ChangeWave Research today released a new study based on a survey of 4,000 professionals and early-adopter consumers showing considerable enthusiasm for the iPhone 4 ahead of its launch, much of it coming at the expense of Research in Motion's BlackBerry line.

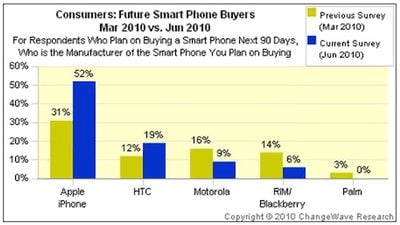

Survey data collected in the 10 days leading up to the iPhone 4's launched showed that 52% of surveyed customers planning to purchase a smartphone in the next 90 days were targeting the iPhone, up from only 31% in the prior quarter's survey. The jump was not terribly surprising considering the excitement surrounding the iPhone 4 launch, and the increase was similar in size to that seen prior to previous iPhone launches.

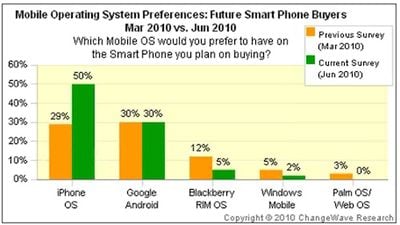

Perhaps more interesting is the effect of Apple's jump on its competitors, with Android impressively able to hold steady under the weight of the Apple tsunami as HTC saw a significant boost due to its new handsets such as the EVO and offset declines by Motorola as its Droid line is still waiting for the impact of the forthcoming Droid X launch. But Research in Motion, Windows Mobile, and Palm were the big losers in Apple's surge, with the percentage of planned purchasers opting for BlackBerry and Windows Mobile devices falling by more than 50% and Palm falling off the map completely from a previous level of 3% in the wake of its acquisition by HP.

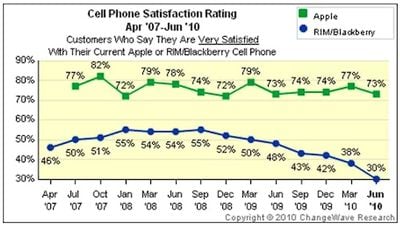

Also of note regarding Research in Motion is the degree to which consumers are no longer being satisfied by the aging hardware and software lineup from the company. While Apple has been holding strong in the 70-80% range as far as the percentage of users registering as "very satisfied" with their device, Research in Motion has sunk over the past two years from the mid-50% range to only 30%, with seven consecutive quarters of decline in user satisfaction.

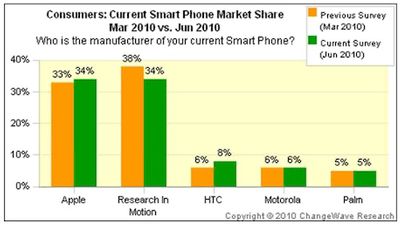

Apple has also finally caught up with RIM in smartphone ownership among ChangeWave's survey group, with the two companies knotted at 34% as Apple closed a five percentage point gap from the previous quarter.

Research in Motion has long been the market leader among smartphones and thus Apple's primary competitor as it seeks to gain market share. And while Google's Android platform has seen tremendous growth over the past 1-2 years, RIM's BlackBerry line remains a high-profile competitor, especially among business users.