Apple has announced it will be holding a special event on Tuesday, March 8, under the tagline "Peek Performance," where it is expected to announce a new iPhone SE, iPad Air, and at least one new Mac.

Apple is thought to have a busy year of product announcements in store for 2022, including multiple new Macs, at least three new Apple Watches, new iPhones, and more. Next week's event is the first of the year, but it'll only check off a few rumored product announcements from the list for 2022. To help set expectations ahead of the event, we've compiled a list of products Apple is unlikely to announce during its event tomorrow, but rather later on in the year or in 2023.

Larger Apple Silicon iMac

Apple is expected to announce at least one new Mac at its event next week, but that's unlikely to be a larger Apple silicon iMac. Apple last updated the iMac with the 24-inch design powered by the M1 chip.

The other iMac in the lineup, the 27-inch iMac, continues to feature an almost 10-year old design, but Apple is rumored to be working on a new model expected to launch sometime in the summer. The larger Apple silicon iMac is rumored to be powered by the M1 Pro and M1 Max chips, features a mini-LED, ProMotion display, and a design similar to the 24-inch desktop.

Second-Generation AirPods Pro

The second-generation AirPods Pro will launch this year if rumors pan out, but it won't be at the upcoming event on Tuesday, March 8. The AirPods Pro have not been updated since 2019 when they first launched, other than the addition of a MagSafe case last October. The second generation of Apple's high-end earphones is expected to feature a new, more compact design, support for Lossless audio, a new charging case, and possibly some health-tracking features.

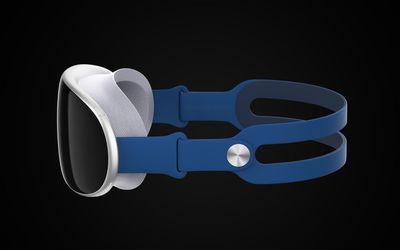

Apple's AR/VR Headset

Apple's rumored AR/VR headset launch might be the biggest announcement from the company this year, but it'll have to wait a little longer to take place. While Apple has been working on the headset for a considerable amount of time, rumors suggest this event won't be the time we'll hear about it.

Apple was initially planning an unveil for the headset in June, around WWDC, but recent reports of development issues have cast doubt on such a timeline, suggesting a launch in 2023 could be more likely.

iPhone 14 and New Apple Watches

Apple always releases its flagship iPhones and Apple Watches in the fall, sometime around September or October. Don't expect to hear about the iPhone 14 or the Apple Watch Series 8 next week; instead, expect updates to the low-end iPhone SE but no Apple Watch announcements.

Conclusion

On the surface, Apple's event next week seems subdued, but it'll still likely include some discussion about the company's services and could offer some dates on the public release of iOS and iPadOS 15.4, alongside macOS Monterey 12.3, which enables Universal Control. Apple's second event of the year is likely to be the Worldwide Developers Conference in June, but no details have so far been shared about it.

Note: MacRumors is an affiliate partner with some of these vendors. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.

Note: MacRumors is an affiliate partner with some of these vendors. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.

Note: MacRumors is an affiliate partner with some of these vendors. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.

Note: MacRumors is an affiliate partner with some of these vendors. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.

Apple Car

Apple Car

Apple CEO

Apple CEO  Note: MacRumors is an affiliate partner with some of these vendors. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.

Note: MacRumors is an affiliate partner with some of these vendors. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.