Apple today announced financial results for the first quarter of fiscal 2009. Apple posted record revenue of $10.17 billion and net quarterly profit of $1.61 billion, or $1.78 per diluted share, compared to revenue of $9.6 billion and net quarterly profit of $1.58 billion, or $1.76 per diluted share, in the year-ago quarter. Gross margin was 34.7 percent, equal to the year-ago quarter, and international sales accounted for 46 percent of the quarter's revenue. Apple also generated $3.6 billion in cash during the quarter. The results constitute the best quarterly revenue and earnings in Apple's history.

Using non-GAAP data, which eliminates subscription-based accounting for the iPhone and Apple TV, Apple would have had $11.8 billion revenue and $2.3 billion of net income.

Apple shipped 2,524,000 Macintosh computers during the quarter, representing 9 percent unit growth over the year-ago quarter. The company also sold 22,727,000 iPods during the quarter, representing 3 percent unit growth over the year-ago quarter and a company record. Quarterly iPhone unit sales reached 4,363,000 up 88 percent from the year-ago-quarter.

"Even in these economically challenging times, we are incredibly pleased to report our best quarterly revenue and earnings in Apple history - surpassing $10 billion in quarterly revenue for the first time ever," said Steve Jobs, Apple's CEO.

Apple's guidance for the second quarter of fiscal 2009 includes expected revenue of $7.6 billion to $8.0 billion and earnings per diluted share of $0.90 to $1.00.

Apple will provide live streaming of its Q1 2009 financial results conference call at 2:00 PM Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Conference Call Notes of Interest:

- Extremely pleased with record results: first time surpassing $10 billion revenue, new iPod sales record

- Very proud of how quickly iPhone has gained traction

- Very proud of performance and very excited about product pipeline

- Snow Leopard: We're very excited about it, but we are not prepared to announce a launch date at this time.

- iPhone competitors: We view iPhone as primarily a software platform, which is different from our competitors. We don't mind competition, but if others rip off our intellectual property, we will go after them.

More Highlights...- Extremely pleased with record results: first time surpassing $10 billion revenue, new iPod sales record

- Operating margin higher than expected

- 2.5 million+ Macs, representing 9% growth over year-ago quarter

- 34% growth in portables, 25% decline in desktops

- Mix of portables/desktops affected by huge sales in the year-ago quarter due to iMac release; also a general shift in consumer buying habits

- Record 22.7 million iPods sold

- >70% share of MP3 players in December in the US, UK, Australia, >60% in Japan, and >50% in Canada

- Biggest iTunes sales quarter ever

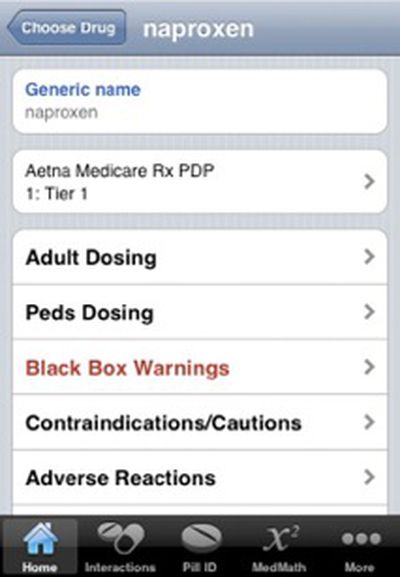

- Over 15,000 App Store applications available and over 500 million downloads

- iPhone sales reached 13.7 million total for the year, surpassing goal of 10 million

- Very proud of how quickly iPhone has gained traction

- Apple retail stores - revenue of $1.74 billion up 2% year-over-year

- Difficult economic conditions led to decline in average sales per store, but pleased with how well they are holding up

- 251 stores in 10 countries

- Cash and short-term securities rose to $28.1 billion - a reclassification in how securities are classified resulted in an adjustment to numbers, and previous results have been update to reflect new classification

- Economic situation is uncertain, so providing broad guidance for next quarter

- Very proud of performance and very excited about product pipeline

Q&A:

Q: How is Steve? How will things be different under Tim? Would Tim remain in charge if Steve does not return?

A: Steve remains CEO and will be involved in strategic decisions going forward. Tim is COO and will be overseeing day-to-day operations. We are pleased with the depth of talent in our team, and that isn't changing. We don't settle for less than excellence in all departments, so regardless of who is in charge, our values will allow us to succeed.

Q: Are you scaling back retail expansion?

A: Plan to open about 25 stores in fiscal 2009, half international. Continuing to be very selective with sites. We're confident in our stores and happy with how they are performing in a difficult environment.

Q: Is iPhone segment elastic and would price reductions make sense in the future?

A: You've seen us reduce prices over time. In the US, $599 down to $399 down to $199 saw big jumps at each level. But we believe that $199 is a solid price point, with nothing able to offer a comparable experience at that level.

Q: Will gross margins be around 30% for fiscal 2009 as guided previously?

A: We are benefiting from some factors that are giving us slightly better margins in the first half of 2009, but expect closer to 30% in second half.

Q: Your guidance for March quarter is a bit narrower than for this past quarter. Is this due to stability from subscription-based accounting?

A: We consider a $400 million range pretty wide for us. Last quarter's guidance was given around the time when banks were failing left and right and there was a lot of uncertainty. While the economy is still bad, many things that affect us appear to have stabilized a bit.

Q: How is the market for component pricing?

A: We expect a favorable market in aggregate for NAND, DRAM, LCDs. Not huge prices decreases, but favorable.

Q: Are there iPhone markets where your pricing is too high? Will you address that?

A: Yes, there are markets, such as India, that don't have subsidized prices. We recognize the low penetration in these markets and their potential and will respond accordingly going forward. We will not do low-end though; we'll leave that to others.

Q: What about the netbook (<$500) segment?

A: We're watching it, but we don't feel that they offer good products...underpowered, poor software, cramped keyboards, etc. We've got some ideas, but we will not provide the inferior experience that we believe other companies are providing.

Q: What about Apple TV?

A: Still a hobby for us, but movie rentals are increasing popularity. We will continue to invest in it, because we believe there is something there.

Q: How are the pro and education segments?

A: Businesses are cutting back. Education down 6% year-over-year in total, K-12 down 10%. Very significant funding uncertainty due to state budget shortfalls. We don't see this picking up very quickly.

Q: Any comments on Snow Leopard?

A: No comment. We're very excited about it, but we are not prepared to announce a launch date at this time.

Q: Anything to say about inventories for iPhone?

A: Difficult to say due to number of countries we're in and uncertain seasonal variations at this point.

Q: Where is iPod growth coming from?

A: US sales actually declined, so growth is coming from international markets. Huge spike in the final week of the quarter accounted for all of our growth.

Q: How did product mix affect gross margins?

A: We don't talk a lot about year-over-year changes in margins due to a number of complicating factors contributing to the data. All we can say that it was flat compared to the year-ago quarter.

Q: Thoughts on operating expenses?

A: We're confident in our business and we're going to invest our way through this downturn. We're investing in engineering, marketing, customer service.

Q: Any plans for your cash?

A: We have no new updates on this.

Q: Can you speak to details of guidance for March quarter?

A: We can't go into that. We're shipping great products and our customers are responding.

Q: Can you talk about adding Wal-Mart as iPhone distribution point?

A: We just started with them at the very end of December, so we don't have enough data to draw any conclusions on performance. Wal-Mart gives us a much broader reach beyond what we and AT&T can provide. They were already selling iPods, and we were pleased with that relationship.

Q: Can you talk about linearity in Mac and iPhone sales?

A: Mac sales second-highest in history. New portable announcement drove huge sales and resulted in the stunning 34% growth in that segment given the overall market. Overall, international performance better than US. iPhone doesn't have much history, so hard to say, but we're pleased with the performance.

Q: Is there a different retail store philosophy for international vs. domestic?

A: International retail performance was a bit stronger than in US. We think the retail stores help us in each of our locations. We just want to be sure that the Macs and iPhones have a great place for customers to experience them.

Q: How have dynamics of discounting to third-party retailers like Best Buy and Wal-Mart affected you?

A: Retailers are free to do what they want. Around the holidays we saw some attaching promos like gift cards to purchases, and that's fine with us.

Q: There are other iPhone competitors coming to the market: Android, Palm Pre. How do you think about sustaining leadership in the face of these competitors?

A: It's difficult to compare to products that are not yet in the market. iPhone has seen terrific rating from customers. Software is the key ingredient, and we believe that we are years ahead of our competitors. Having different screen sizes, different input methods, and different hardware makes things difficult for developers. We view iPhone as primarily a software platform, which is different from our competitors. We don't mind competition, but if others rip off our intellectual property, we will go after them.

Q: The Palm device seems to directly emulate the iPhone's innovative interface. Is that what you're referring to?

A: We don't want to refer to any specific companies, so that was a general statement. We like competition because it makes us better, but we will not stand for companies infringing on our IP.

Q: How many One-to-One sessions did you have at retail stores this quarter?

A: We don't have that number here, but we did set a record.

Q: How many of your 500 million App Store downloads were paid and how many were free?

A: That's not something we're prepared to disclose.

Q: Will you eventually separate out App Store sales results from iTunes Store sales?

A: The App Store is part of iTunes, and we have no plans to separate them.

-End of Call-