The iPhone was the best-selling phone in Japan throughout the whole of the last year, the first time the title has ever been taken from a Japanese firm, according to Counterpoint Research's Country Market Share Report (via The Next Web). The number one slot had been held by local firm Sharp for the previous six years.

Apple grabbed 15% of the market, just ahead of local firms Sharp and Fujitsu, at 14% each. Apple had previously taken the number one slot for single quarters as new product launches hit, seen with the 4S launch in 2011, but has never before held its position for an entire year.

Samsung, LG and Huawei all increased their shares, with non-Japanese companies now owning over half the market for the first time. Japan has always been a difficult market for overseas manufacturers, with non-standard networks and an early lead in sophisticated web-enabled feature phones limiting demand for smartphones. Electronista suggests that the shift is in large part due to a carrier battle as Softbank and KDDI challenged market leader NTT Docomo.

Both saw having the iPhone as a strategic advantage over the island nation's largest carrier, NTT Docomo, and promoted the iPhone heavily. Docomo responded with campaigns that emphasized foreign-made Android phones, the first time it had aggressively marketed foreign brands. As a result, the Japanese market had more than 50 percent of the available share split between foreign-owned companies (primarily Apple, Samsung and LG) for the first time.

Counterpoint Research says that the shift in popularity from advanced feature phones to smartphones is likely to be a permanent one.

Japan was once considered to be like a Galapagos Island, an isolated terrain, in terms of mobile technology. It had its own unique digital cellular technology. It was far more advanced than any market in the world and it seemed nearly impossible for any foreign technology company to penetrate the market. Motorola had failed and Nokia had failed. The wave of smartphones has changed the situation now and it looks like the Japanese market is a market that can be transformed after all for better or worse.

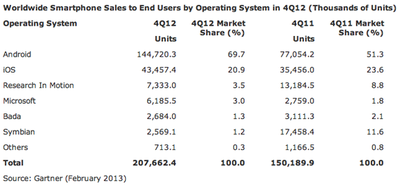

The dominance of Android meant that overall iOS market share fell from 23.6% in Q4 2011 to 20.9% a year later. Android increased its market share in the same period from 51.3% to a commanding 69.7%. The bulk of this growth was at the expense of Symbian and RIM, but some of it was from iOS.

The dominance of Android meant that overall iOS market share fell from 23.6% in Q4 2011 to 20.9% a year later. Android increased its market share in the same period from 51.3% to a commanding 69.7%. The bulk of this growth was at the expense of Symbian and RIM, but some of it was from iOS.

The high-end 15-inch stock configuration now has the twice the amount of RAM that it had previously and the new 13-inch Retina MacBook Pro prices are $200 and $300 cheaper than their predecessor models, respectively. Apple has also lowered pricing on SSD upgrades across the Retina MacBook Pro lineup, with the bump from 256 GB to 512 GB now costing $300 instead of $500 and the additional bump to 768 GB costing $400 instead of $500.

The high-end 15-inch stock configuration now has the twice the amount of RAM that it had previously and the new 13-inch Retina MacBook Pro prices are $200 and $300 cheaper than their predecessor models, respectively. Apple has also lowered pricing on SSD upgrades across the Retina MacBook Pro lineup, with the bump from 256 GB to 512 GB now costing $300 instead of $500 and the additional bump to 768 GB costing $400 instead of $500.

Both

Both  iOS 6.1, which was

iOS 6.1, which was

Apple today released

Apple today released

At today's AllThingsD

At today's AllThingsD

Apple CEO Tim Cook is now

Apple CEO Tim Cook is now  Microsoft yesterday released

Microsoft yesterday released