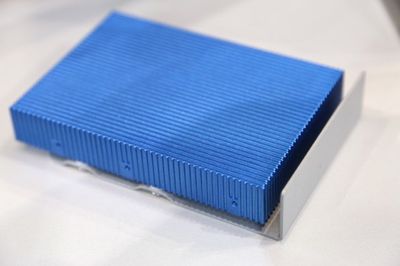

Later this year, Other World Computing plans to release a 3.5" SSD drive meant for tower-style PCs like the Mac Pro. The drive, called the "Mercury Viper", will allow OWC to build an SSD with capacities as large as 2TB, as well as transfer rates over 600MB/s over a SATA 3 connection.

Currently, OWC makes 2.5" SSD's that can be installed in a laptop or desktop via a bracket, but the extra space in a 3.5" drive allow for four times the capacity as their current drives -- at a significant cost. A OWC spokesperson told Ars Technica that the drive was designed "performance and capacity, not price".

That's in stark contrast to where the rest of the market is headed, typically driving costs down and making the most of 2.5" and mSATA form factors used in notebooks and Ultrabooks. But workstation may care less about budget and more about getting work done. "We think the price will be right for the kind of user that spends $6,000 on a computer," Dahlke said. "And you can't get this kind of capacity anywhere else."

Pricing and availability details are expected in March.

(Image courtesy Ars Technica/Chris Foresman)

Former Apple employee Don Melton has been sharing a unique look

Former Apple employee Don Melton has been sharing a unique look

Yesterday, a

Yesterday, a

As part of an

As part of an

Apple today pushed out a new EFI Firmware Update 2.6 for the mid–2012 MacBook Air, which comes with several bug fixes for the MacBook Airs that were released in June alongside the 15-inch Retina MacBook Pro.

Apple today pushed out a new EFI Firmware Update 2.6 for the mid–2012 MacBook Air, which comes with several bug fixes for the MacBook Airs that were released in June alongside the 15-inch Retina MacBook Pro. Thunderbolt cables remain relatively expensive due to the electronics included inside the cables to manage the multiple protocols supported by the standard. The complexity and expense has both slowed deployment of Thunderbolt peripherals and limited support mostly to high-end devices capable of absorbing the high cost premium.

Thunderbolt cables remain relatively expensive due to the electronics included inside the cables to manage the multiple protocols supported by the standard. The complexity and expense has both slowed deployment of Thunderbolt peripherals and limited support mostly to high-end devices capable of absorbing the high cost premium.