Apple today announced financial results for the second fiscal quarter of 2024, which corresponds to the first calendar quarter of the year.

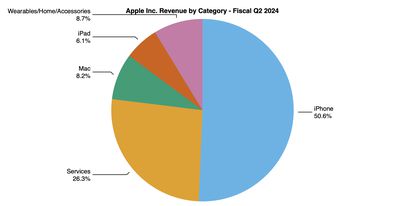

For the quarter, Apple posted revenue of $90.8 billion and net quarterly profit of $23.6 billion, or $1.53 per diluted share, compared to revenue of $94.8 billion and net quarterly profit of $24.1 billion, or $1.52 per diluted share, in the year-ago quarter. Apple set an all-time quarterly record for Services revenue at $23.9 billion, but iPhone revenue dropped by over $5 billion compared to the year-ago quarter.

Gross margin for the quarter was 46.6 percent, compared to 44.3 percent in the year-ago quarter. Apple's board of directors also authorized an additional $110 billion for share repurchases and declared an increased dividend payment of $0.25 per share, up from $0.24 per share. The dividend is payable May 16 to shareholders of record as of May 13.

"Today Apple is reporting revenue of $90.8 billion for the March quarter, including an all-time revenue record in Services," said Tim Cook, Apple's CEO. "During the quarter, we were thrilled to launch Apple Vision Pro and to show the world the potential that spatial computing unlocks. We're also looking forward to an exciting product announcement next week and an incredible Worldwide Developers Conference next month. As always, we are focused on providing the very best products and services for our customers, and doing so while living up to the core values that drive us."

As has been the case for over four years now, Apple is once again not issuing guidance for the current quarter ending in June.

Apple will provide live streaming of its fiscal Q2 2024 financial results conference call at 2:00 pm Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Conference call recap ahead...

1:40 pm: After closing up over 2% in regular trading today, Apple's share price is up another 6% in after-hours trading following the earnings release.

1:43 pm: Services and Mac were Apple's only segments that saw year-over-year growth, with Services increasing by almost $3 billion and Mac increasing by around $300 million. But with iPhone dropping by over $5 billion, iPad dropping by $1.1 billion, and Wearables dropping by $800 million, Apple's overall revenue declined by roughly $4 billion. Increased gross margin meant, however, that Apple's net income declined by only around $500 million, and with Apple's share count continuing to decline as it buys back shares, earnings per share actually increased by a penny year-over-year.

2:01 pm: The call is beginning with the usual caveats about forward-looking statements. On the call is Apple CEO Tim Cook and CFO Luca Maestri.

2:02 pm: Tim is on the call, reporting revenue of $90.9 billion and an earnings per share record of $1.53 for the March quarter.

2:03 pm: He is touting revenue records in a number of countries and regions, including March quarter records in Latin America, the Middle East, Canada, India, Spain and Turkey.

2:03 pm: He notes that in the year-ago quarter, iPhone demand was increased because of supply disruptions and a refill of channel inventory — "We estimate this one time impact added close to $5 billion to the March quarter revenue last year. If we remove this from last year's results, our March quarter total company revenue this year would have grown."

2:04 pm: Now talking up Apple Vision Pro, revealing that half of Fortune 100 companies have bought Apple Vision Pro units and are exploring ways to use them for business. "An exciting product announcement" next week "that we think our customers will love."

2:05 pm: Mentions WWDC in June, and says: "We continue to feel very bullish about our opportunity in generative AI. we are making significant investments and we're looking forward to sharing some very exciting things with our customers soon. We believe in the transformative power and promise of AI and we believe we have advantages that will differentiate us in this new era, including Apple's unique combination of seamless hardware, software and services integration, groundbreaking Apple silicon, with our industry-leading neural engines, and our unwavering focus on privacy, which underpins everything we create."

2:06 pm: Now going over iPhone revenue, $46 billion, down 10% year over year, but notes growth in mainland China and that the iPhone 15 and 15 Pro Max were the best-selling smartphones in Urban China.

2:06 pm: Reveals that he visited China, Vietnam, Indonesia and Singapore and that customers and communities have a great affinity for Apple and it's one of the many reasons he is so optimistic about the future.

2:07 pm: Moving to Mac, revenue $7.5 billion, up 4% year over year. Launched the new 13- and 15-inch MacBook Air with M3.

2:07 pm: iPad, $5.6 billion, down 17% year over year following M2 iPad Pro and 10th-gen iPad last fiscal year.

2:08 pm: Wearables, Home and Accessories revenue was $7.9 billion, down 10% thanks to a difficult compare on Apple Watch and AirPods. He notes that Apple is harnessing AI and machine learning to power fall detection and heart rhythm notifications.

2:09 pm: Services appear to the the most successful category in the quarter, at $23.9 billion, up 14% year over year with all-time revenue records across several categories and geographic segments.

2:09 pm: Mentions Apple Sports iPhone app.

2:10 pm: Now to Retail, mentions the new Shanghai store and that the "energy and enthusiasm from our customers was something to behold." Vision Pro demos have delighted customers and given the profound and emotional experience of using it for the very first time.

2:10 pm: Apple wants to enrich user lives, with making Apple Podcasts more accessible with the new transcript feature, new encryption protections in iMessage, and environmental work towards making products carbon neutral.

2:12 pm: Apple is investing in new solar and wind power, working with partners in India and the US to replenish water usage, and has committed $200 million to nature-based carbon removal projects.

2:12 pm: He calls this a year of unprecedented innovation.

2:12 pm: CFO Luca Maestri is coming on to discuss results in more detail.

2:13 pm: Revenue was $90.8 billion, down 4% year over year. Foreign exchange had a negative impact of 140 basis points.

Products was $66.9 billion, down 10% year over year, thanks to a challenging compare on iPhone, partially offset by Mac.

2:14 pm: Gross margin was 46.6%, up 70 basis points sequentially, driven by cost savings, favorable mix to service, partially offset by leverage. Products gross margin was 36.6%, down 180 basis points sequentially. Services gross marging was 74.6%, up 180 basis points from last quarter. OpEx was $14.4 billion, midpoint of guidance range and up 5% year over year. $23.6 billion net income, diluted EPS was $1.53, a March quarter record. Operating cashflow was $22.7 billion.

2:15 pm: Adjusting for one-time iPhone impact, iPhone revenue would be roughly flat to last year. iPhone active installed base grew to a new all-time high, in total and across every geographic segment. In March quarter, iPhone was the top selling model in the US, China, Australia, UK, France, Germany, and Japan. iPhone 15 continues to be very popular with customers, with 99% customer satisfaction in the US.

2:16 pm: Mac Revenue was $7.5 billion, up 4% year over year, driven by the strength of the new MacBook Air with M3 chip. Mac installed base reached a new all-time high, with half of MacBook Air buyers being new to the customer. Mac customer satisfaction was 96%.

2:16 pm: iPad made $5.6 billion, down 17% year over year. Half of buyers are new to the product, 96% customer satisfaction.

2:17 pm: Wearables, Home and Accessories was $7.9 billion, down 10% year over year, had launch of AirPods Pro 2nd gen last year, plus Watch SE and the Apple Watch Ultra. Apple Watch install base went to a new all-time high, with two-thirds of customers being new to the product. Customer satisfaction at 95%.

2:18 pm: Services reached $23.9 billion, up 14% year over year. The installed base of active devices continued to grow. Transacting and paid accounts reached a new all-time high, with paid accounts growing double digits year over year. More than 1 billion paid subscriptions, more than double the number of four years ago.

2:18 pm: Mentions new games on Apple Arcade and new shows on Apple TV+.

2:18 pm: In the enterprise, customers keep embracing the Mac. In healthcare, Epic recently launched its native app for the Mac, allowing hospitals to transition to the Mac for clinical use.

2:19 pm: KLM is using Apple Vision Pro to train aircraft engine mechanics and Lowes is using it for immersive kitchen design.

2:20 pm: Apple revenue was roughly flat in the first half of the fiscal year, in spite of having one less week of sales and FX headwinds. There were first-half revenue records in Latin America, the Middle East, India, Indonesia, the Philippines and Turkey. First half diluted EPS record of $3.71/share was up 9% from last year.

2:21 pm: Ended quarter with $162 billion in cash and marketable securities. $105 billion in debt, with $58 billion in net cash. $27 billion returned to shareholders, with $3.7 billion in dividends and $23.5 billion through open market repurchases of 130 million shares. $110 billion for share repurchases was approved by the board, plus an increase of the dividend by 4% to $0.25/share.

2:22 pm: Expects June revenue to grow low single digits year over year, despite 2.5% of FX headwinds. Services to grow low double digits, similar to what was reported in the first half of the year. iPad to grow double digits. Gross margin between 45.5 and 46.5. OpEx of $14.3 to $14.5 billion. Tax rate to be around 16%.

2:22 pm: Q&A with analysts is beginning.

2:24 pm: Q: Re the June quarter guidance, revenue outlook for low single digit growth, can you go through product assumptions, iPhone, what gives you confidence around that? What was better than expected in Services?

A: We expect to grow low single digits for the company, and expect services to grow double digits at a rate similar to the first half of the fiscal year. iPad should grow double digits. This is the color that we're providing for the June quarter.

In services, we see a very strong performance across the board, records in several categories and geographic segments. It's very broad-based. Subscription business is going well. Transacting and paid accounts are growing double digits. Seeing strong performance in both developed and emerging markets.

2:26 pm: Q: Should we expect changes to historical capex cadence with changes to AI, changes to how we've thought about the split between tooling, data centers and facilities?

A: We are excited about the opportunity, pushing hard on innovation on every front and we've been doing that for many years. We've spent more than $100 billion on R&D in the last five years. On CapEx, we have a hybrid model where we make some investments ourselves and share some with suppliers and partners, we purchase some of the tools and manufacturing equipment, and some of our suppliers buy things. Same with data centers. It's a model that has worked for us historically and we plan to continue on the same lines going forward.

2:27 pm: Q: What are the changes and implications to Apple from the EU third-party app stores, can hurt user experience but also result in lower revenue for Apple. What are developers and consumers doing?

A: It's too early to answer the question, just implemented in March in the EU. We're focused on complying while mitigating the impacts to user privacy and security. That's our focus.

2:28 pm: Q: On product gross margin, you noted mix and leverage... are people mixing down across product lines? Trying to get some color on customer behavior.

A: On a sequential basis, we were down, it's primarily the fact that we had a slightly different mix of products than the previous one. Leverage plays a big role as we move from the holiday quarter into a more typical quarter. Primarily leverage and a different mix of products. We haven't seen anything particuluar.

2:29 pm: Q: Mentioned excitement around GenAI a couple of times. There have been a few different ways to monetize and historically Apple hasn't made a lot of revenue from software upgrade cycles, any color you can share on that?

A: Don't want to get in front of our announcements. We see generative AI as a key opportunity across our products, and we believe we have advantages that set us apart and we'll be talking more about it as we go through the weeks ahead.

2:31 pm: Q: A broad concern about headwinds at rising commodity costs having a hit on your gross margins. Thinking of all commodities that go into products collectively, are they rising or falling and what tools do you have to mitigate?

A: During the last quarter, commodity and component costs behaved favorably to us. On the memory front, prices are starting to go up. They've gone up slightly during the March quarter. It's been a period, not only during this quarter but the last several that commodities have behaved well to us. They go in cycles, so always that possiblity — we are starting from a very high level of gross margin — 46.6% is something we haven't seen in decades, starting from a good point. We try to buy ahead when the cycles are favorable to us, so we will try to mitigate if there are headwinds but particularly for this cycle, we are in good shape.

2:33 pm: Q: Any more color from your visit to China, I know you continue to be confident there in the long term, but any color as to when the tide turns?

A: If you look at our results in Q2, for Greater China we were down 8%, an acceleration from Q1. The primary driver was iPhone, and if you look at iPhone within mainland China, we grew on a reported basis, before any kind of normalization for supply disruptions. If you look at the top-selling smartphones, the top two in urban China were iPhones. While I was there, it was a great visit and we opened a new store in Shanghai, and the reception was very warm and highly energetic. I left there having a fantastic trip and enjoyed being there. I maintain a great view of China in the long term, I don't know how each quarter and week goes, but over the long haul I have a very positive viewpoint.

2:34 pm: Q: There's a fear out there that you may lose some traffic acquisition revenue, and I'm wondering if you thought AI, from a big picture, on a long term basis, is AI an opportunity for you to continue to monetize mobile real estate from a big picture. Is there a big picture color you can give and how to monetize that?

A: I think AI, generative AI and AI, both are big opportunities for us across our products. We'll talk more about it in the coming weeks, but I think there are numerous ways there that are great for us. We think that we're well positioned.

2:36 pm: Q: Last quarter you spoke about getting traction in enterprise, is your AI going to be both consumer and enterprise?

A: Our focus on enterprise has been, through the quarter and the quarters that preceded it, have been on selling iPhones and iPads and Macs and recently added Vision Pro to that. We're thrilled with what we see there in terms of interest and big companies buying some to explore ways they can use it. I see enormous opportunity in enterprise. I wouldn't want to cabin that to AI only. I think there's a great opportunity for us around the world in enterprise.

2:37 pm: Q: Seen a bias towards Pro model, seen growth in Services but weakness in product?

A: Customers want to purchase the best product we offer in each category, we've done what we can to make it easier for customers through financing and other programs. Customers want to buy at the top of the range, but in developing markets where affordability issues are more pronounced, we have seen a trend where this is more sustainable.

2:39 pm: Q: On Capital Allocation, $58 billion of net cash, as you get closer to net cash neutral, would you ever take leverage on the balance sheet or once you get to neutral, how do you feel about leverage or returning free cash to shareholders?

A: I would say one step at a time. We put out the target to get to net cash neutral, we've worked hard to get there, our cash flow generation has been very strong. We've increased our allocation to the buyback, let's get there first, it's going to take a while still. We'll reassess what the optimal capital structure for the company when we get there.

2:41 pm: Q: On China discussion, could you step back, these numbers are still declining on a year over year basis. What are you seeing from a macro basis in China, do you think this is macro or micro driven over there?

A: I can only tell you what we're seeing, I don't want to present myself as an economist so I'll steer clear of that. What we saw was an acceleration from Q1 and it was driven by iPhone and iPhone in Mainland China before we adjust for this $5 billion impact did grow. Other products didn't fare as well, so we clearly have work to do there. I think it has been and is through last quarter the most competitive market in the world. I wouldn't say anything other than that, I've said that before, I think it was last quarter as well.

If you step back from the 90-day cycle, what I see is a lot of people moving into the middle class, we've tried to serve customers very well there and have a lot of happy customers and you can kind of see that in the latest store opening over there. I continue to feel very optimistic.

2:44 pm: Q: How are you thinking of the competitive landscape outside of China, what's the consumer demand and receptivity to new devices? Is this an AI thing or are there other drivers?

A: There's a big opportunity with generative AI across all our devices, that's not within the next quarter and we don't guide at the product level, but I'm extremely optimistic. That's kind of how I view it. If you step back on iPhone and you make this adjustment from the previous year, our Q2 results would be flat-ish on iPhone. That's how we performed in Q2.

On outlook, I'll repeat what we said before, the color for the quarter, we expect to grow in total, expect services to grow, iPad to grow, for the rest I'll let you make assumptions and then we'll report 3 months from now.

2:46 pm: Q: Services growth accelerated, what parts of services did you see that, and why isn't it more sustainable as you're guiding a little lower?

A: Number of things on services, first of all, the overall performance was very strong. As I said earlier, all-time records in both developed and emerging markets, so Services do well across the world. Records in many of our services categories, there are some growing very fast because they're relatively small in the scheme of services, Cloud, Video, Payments. Those set all-time revenue records. We feel very good about the progress that we're making in services. As we go forward, if you look at our growth rates at year ago, they improved during the course of our fiscal year last year. The comps become more challenging as we go through the year but we expect to grow double digits in the June quarter at a rate that's similar for the first half.

2:48 pm: Q: For this India market, how much of the momentum you're seeing would you associate with retail expansion strategy versus supply chain or manufacturing changes and strategies?

A: We did grow strong double-digits so we were very pleased about it, it was a new March revenue record for us. As I said before, I see it as an incredibly exciting market and it's a major focus for us. In terms of the operational side, we are producing there. From a pragmatic point of view, you need to produce there to be competitive. Yes, the two things are linked from that point of view, but we have both operational things going on and we have go-to-market initiatives going on. We opened a couple stores last year and we see enormous opportunity there. We're continuing to expand our channels and also working on developer ecosystem as well. We've been very pleased that there's a rapidly growing base of developers there and so we're working all of the entire ecosystem from developer to the market to operations, the whole thing. I could not be more excited and enthusiastic about it.

2:49 pm: Q: At a high level, when we look at the data points reported through the quarter, what are people missing in Apple's iPhone traction in the iPhone market, given data points from the last quarter?

A: I can't address the data points, I can only address what our results are. We did accelerate last quarter and the iPhone grew in mainland China so that's what the results were. I can't bridge to numbers we didn't come up with.

2:50 pm: Q: How would you characterize channel inventory dynamics for iPhone?

A: We decreased inventory during the quarter, which we usually do during Q2 so that's not unusual. We're very comfortable with overall channel inventory.

2:52 pm: Q: Is Apple approaching a point where all emerging markets might become bigger than current Greater China segment?

A: I think you're asking a really interesting question. We were looking at something similar recently. Obviously China is by far the largest emerging market we have, but when we start looking at India, Saudi, Mexico, Turkey, Brazil, Indonesia, the numbers are getting large. We're very happy because these are markets where our market share is low, the populations are large and growing, and our products are really making a lot of progress in those markets. The level of excitement for the brand was very high. It's very good for us and certainly the numbers are getting larger all the time, the gap to China is reducing and hopefully that trajectory continues for a long time.

2:54 pm: Q: Do you see ways to deploy capital more to spur replacement demand either with greater device financing, more investment in marketing, more promotions, do you need to produce those sorts of margins or more important to spur growth with replacements?

A: Innovation spurs the upgrade cycle. There's economic factors as well that play in there but what kind of offerings from our carrier partners and so forth, but we work all of those. We price our products for the value that we're delivering. That's how we look at it.

One of the things, at the long arc of time that maybe isn't fully understood, we've gone through a long period of very strong dollar and what that means, given that our company sells 60% of revenue outside the US, the demand for our products in the US is stronger than the results that we report just because of the translation of local currency into dollars. That is something to keep in mind as you look at our results. Innovation, obviously, financing solutions, trade in programs, and we will continue to make all those investments.

2:56 pm: Q: For enterprise, what are some of the top two or three cases for Vision Pro, what are you hearing about?

A: I wouldn't say one emerges at the top right now, the most impressive is the way people use the Mac is the way they use it for everything. People are using it for everything, field service, training, healthcare things like preparing a doctor for surgery or advanced imaging. Command and control centers, it's an enormous number of different verticals and our focus is on growing that ecosystem and getting more apps and more enterprises engaged. The event that we had recently, can't overstate the enthusiasm in the room. It was extraordinary. We're off to a good start with enterprise.

2:57 pm: Q: March quarter, commodity pricing was favorable, for memory and such for June and the full year?

A: We just provide guidance for the current quarter. We are guiding to a very high level of gross margin, 45.5-46.5, within that guidance we expect memory to be a slight headwind (not a very large one), and the same applies for foreign exchange. Negative impact sequentially of about 30 basis points.

2:57 pm: That's the end of the call.