Apple Promotes New Apple Pay UK Bank Account Balance Feature

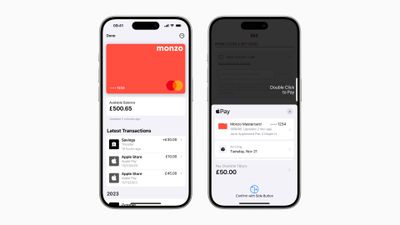

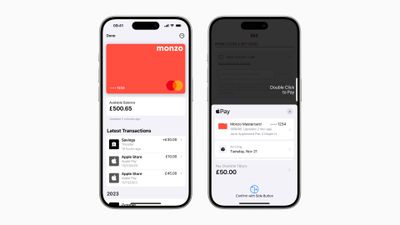

Apple today highlighted the ability in iOS 17.1 for UK users to connect their credit and debit cards in Apple Wallet and easily access information like account balance, spending history, and more.

Users can view their up-to-date bank card balance, payments, deposits, and withdrawals in Wallet and when they're checking out with Apple Pay online or in-apps. Apple says the new feature "empowers users to make more informed purchases, increases their confidence when making a transaction, and allows them to simply view frequent information so that they have more control when it comes to their finances."

From Apple's press release:

"By enabling users to conveniently access their most useful account information within Wallet and at the time of their purchase, they can make informed financial decisions and better understand and manage their spend," said Jennifer Bailey, Apple's vice president of Apple Pay and Apple Wallet. "We look forward to working with U.K. partners under the Open Banking initiative to help users better their financial health, and provide more ways in which banks can deepen their relationships with customers."

Apple added the transaction and card balance functionality to the Wallet app in October's iOS 17.1 update as part of its Connected Cards feature, and several banks have since come on board, including Barclays, Barclaycard, First Direct, Halifax, HSBC, Lloyds, M&S Bank, Monzo Bank, NatWest Bank, and Royal Bank of Scotland.

UK banks support the Open Banking API to integrate with the Wallet app, which has made the feature widely available to UK users, while the Connected Cards rollout in the United States has lagged behind.

Popular Stories

Despite being more than two years old, Apple's AirPods Pro 2 still dominate the premium wireless‑earbud space, thanks to a potent mix of top‑tier audio, class‑leading noise cancellation, and Apple's habit of delivering major new features through software updates. With AirPods Pro 3 widely expected to arrive in 2025, prospective buyers now face a familiar dilemma: snap up the proven...

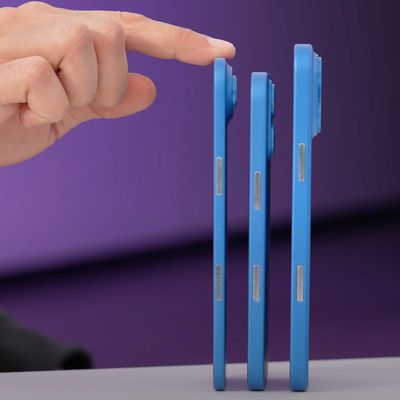

Apple plans to release an all-new super thin iPhone this year, debuting it alongside the iPhone 17, iPhone 17 Pro, and iPhone 17 Pro Max. We've seen pictures of dummy models, cases, and renders with the design, but Lewis Hilsenteger of Unbox Therapy today showed off newer dummy models that give us a better idea of just how thin the "iPhone 17 Air" will be.

The iPhone 17 Air is expected to be ...

If you missed the video showing dummy models of Apple's all-new super thin iPhone 17 Air that's expected later this year, Sonny Dickson this morning shared some further images of the device in close alignment with the other dummy models in the iPhone 17 lineup, indicating just how thin it is likely to be in comparison.

The iPhone 17 Air is expected to be around 5.5mm thick – with a thicker ...

A developer has demonstrated Windows 11 ARM running on an M2 iPad Air using emulation, which has become much easier since the EU's Digital Markets Act (DMA) regulations came into effect.

As spotted by Windows Latest, NTDev shared an instance of the emulation on social media and posted a video on YouTube (embedded below) demonstrating it in action. The achievement relies on new EU regulatory...

While the iPhone 17 Pro and iPhone 17 Pro Max are not expected to launch until September, there are already plenty of rumors about the devices.

Below, we recap key changes rumored for the iPhone 17 Pro models as of April 2025:

Aluminum frame: iPhone 17 Pro models are rumored to have an aluminum frame, whereas the iPhone 15 Pro and iPhone 16 Pro models have a titanium frame, and the iPhone ...

Apple's iPhone development roadmap runs several years into the future and the company is continually working with suppliers on several successive iPhone models simultaneously, which is why we often get rumored features months ahead of launch. The iPhone 17 series is no different, and we already have a good idea of what to expect from Apple's 2025 smartphone lineup.

If you skipped the iPhone...

Apple seeded the third beta of iOS 18.5 to developers today, and so far the software update includes only a few minor changes.

The changes are in the Mail and Settings apps.

In the Mail app, you can now easily turn off contact photos directly within the app, by tapping on the circle with three dots in the top-right corner.

In the Settings app, AppleCare+ coverage information is more...

While the so-called "iPhone 17 Air" is not expected to launch until September, there are already plenty of rumors about the ultra-thin device.

Overall, the iPhone 17 Air sounds like a mixed bag. While the device is expected to have an impressively thin and light design, rumors indicate it will have some compromises compared to iPhone 17 Pro models, including only a single rear camera, a...