Apple Card Customer Agreement Updated for 'Upcoming' Savings Account Feature

Goldman Sachs this week updated its Apple Card customer agreement to reflect the credit card's upcoming Daily Cash savings account feature, which was expected to launch with iOS 16.1 but appears to have been delayed.

"To enable new ways to use Daily Cash like the upcoming Savings account feature, we are updating the Daily Cash Program section of your Apple Card Customer Agreement," reads an email sent to Apple Card holders this week.

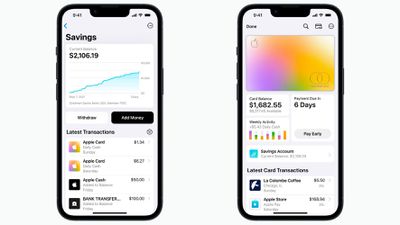

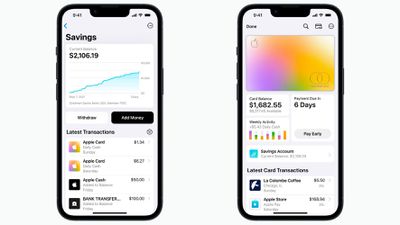

In October, Apple announced that Apple Card users would soon be able to open a new high-yield savings account from Goldman Sachs and have their Daily Cash cashback rewards automatically deposited into it, with no fees, no minimum deposits, and no minimum balance requirements. The account will be managed through the Wallet app on the iPhone.

The savings account was listed in the release notes for the iOS 16.1 Release Candidate, but it did not end up launching with that update. The savings account has not been present in any iOS 16.2 betas, so it's unclear when it will become available, but Goldman Sachs evidently continues to lay the groundwork for the feature's launch.

Once the account is set up, all Daily Cash received from that point on will be automatically deposited into it and start earning interest, unless a user opts to continue having Daily Cash added to their Apple Cash balance. Apple Card provides 2-3% Daily Cash on purchases made with Apple Pay and 1% on purchases made with the physical card.

Launched in 2019, Apple's credit card remains exclusive to the United States. Customers who sign up for an Apple Card and use it to purchase Apple products through December 25 will receive 5% Daily Cash as part of a limited-time promotion.

Popular Stories

While the iPhone 17 Pro and iPhone 17 Pro Max are not expected to launch until September, there are already plenty of rumors about the devices.

Below, we recap key changes rumored for the iPhone 17 Pro models as of April 2025:

Aluminum frame: iPhone 17 Pro models are rumored to have an aluminum frame, whereas the iPhone 15 Pro and iPhone 16 Pro models have a titanium frame, and the iPhone ...

Apple may have updated several iPads and Macs late last year and early this year, but there are still multiple new devices that we're looking forward to seeing in 2025. Most will come in September or October, but there could be a few surprises before then.

We've rounded up a list of everything that we're still waiting to see from Apple in 2025.

iPhone 17, 17 Air, and 17 Pro - We get...

A common complaint about the iPad Pro is that the iPadOS software platform fails to fully take advantage of the device's powerful hardware.

That could soon change.

Bloomberg's Mark Gurman today said that iPadOS 19 will be "more like macOS."

Gurman said that iPadOS 19 will be "more like a Mac" in three ways:Improved productivity

Improved multitasking

Improved app window management...

Apple's upcoming foldable iPhone (or "iPhone Fold") will feature two screens as part of its book-style design, and a Chinese leaker claims to know the resolutions for both of them.

According to the Weibo-based account Digital Chat Station, the inner display, which is approximately 7.76 inches, will use a 2,713 x 1,920 resolution and feature "under-screen camera technology." Meanwhile, the...

Apple in October 2024 overhauled its 14-inch and 16-inch MacBook Pro models, adding M4, M4 Pro, and M4 Max chips, Thunderbolt 5 ports on higher-end models, display changes, and more. That's quite a lot of updates in one go, but if you think this means a further major refresh for the MacBook Pro is now several years away, think again.

Bloomberg's Mark Gurman has said he expects only a small...

Apple is working on a new version of the Vision Pro with two key advantages over the current model, according to Bloomberg's Mark Gurman.

Specifically, in his Power On newsletter today, Gurman said Apple is developing a new headset that is both lighter and less expensive than the current Vision Pro, which starts at $3,499 in the U.S. and weighs up to 1.5 pounds.

Gurman said Apple is also...

On this week's episode of The MacRumors Show, we catch up on the latest iOS 19 and watchOS 12 rumors, upcoming devices, and more.

Subscribe to The MacRumors Show YouTube channel for more videos

Detailed new renders from leaker Jon Prosser claim to provide the best look yet at the complete redesign rumored to arrive in iOS 19, showing more rounded elements, lighting effects, translucency, and...

It was a big week for leaks and rumors in the Apple world, with fresh claims about iOS 19, the iPhone 17 Pro, and even the 20th anniversary iPhone coming a couple of years from now.

Sources also spilled the tea on the inner turmoil at Apple around the Apple Intelligence-driven Siri revamp that has seen significant delays, so read on below for all the details on these stories and more!

iOS ...

Apple and other electronics manufacturers have received a break from Trump's reciprocal tariffs, with the U.S. Customs and Border Protection agency sharing a long list of products excluded from the levies last night.

iPhones, Macs, iPads, Apple Watch, and other Apple devices will not be subject to the 125 percent tariffs that have been put in place on imported Chinese goods, nor will Apple...