Facebook has said measures being taken by Apple on iOS that make it harder for platforms and apps to track users across other apps and websites will cost its business $10 billion in 2022.

Facebook yesterday reported $33.67 billion in revenue, and while higher than expected, earnings per share were shy of analyst expectations. Facebook, renamed to Meta, also offered lower guidance for the first quarter of 2022, saying it would be expecting around $27 to $29 billion in revenue, short of $30 billion expectations (via CNBC).

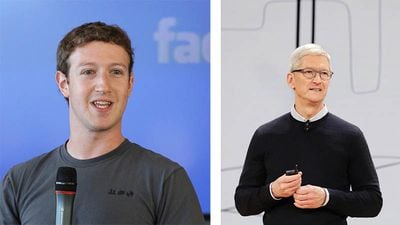

As it has done in the past, Facebook shifted blame for its weaker performance during the past quarter onto steps being taken by Apple to improve user privacy. Most notably, Apple's App Tracking Transparency (ATT) framework, which requires apps to ask users for permission before tracking them across other apps and websites, is negatively impacting Facebook's business, the company's chief operating officer, Sheryl Sandberg, claimed during the earnings call.

First, ads. Like others in our industry, we’ve faced headwinds as a result of Apple’s iOS changes. As we described last quarter, Apple created two challenges for advertisers. One is that the accuracy of our ads targeting decreased, which increased the cost of driving outcomes. The other is that measuring those outcomes became more difficult.

The impacts of Apple's privacy measures will represent more significant challenges to Facebook's business in the next quarter, according to Facebook's chief financial officer, David Wehner. "And we believe the impact of iOS overall as a headwind on our business in 2022 is on the order of $10 billion, so it's a pretty significant headwind for our business," said Wehner.

Wehner also went on to accuse Apple of favoring Google in its privacy policy. Wehner said that ATT exempts browsers from asking users for permission to track them across other apps and websites, therefore allowing browsers like Chrome to be more effective in tracking users for personalized ad purposes.

Wehner accused Apple of favoring Google's Ad Search since "Apple continues to take billions of dollars a year from Google Search ads, [so] incentive clearly exists for this policy discrepancy to continue."

And if you look at it, we believe those restrictions from Apple are designed in a way that carves out browsers from the tracking prompts Apple requires for apps. And so what that means is that search ads could have access to far more third-party data for measurement and optimization purposes than app-based ad platforms like ours.

So when it comes to using data, you can think of it -- that it's not really apples-to apples for us. And as a result, we believe Google's search ads business could have benefited relative to services like ours that face a different set of restrictions from Apple. And given that Apple continues to take billions of dollars a year from Google Search ads, the incentive clearly exists for this policy discrepancy to continue.

Daily active users (DAUs) also took a hit in the past quarter, with Facebook reporting for the first time on record a drop in the number of daily users using its platform. DAUs stood at 1.93 billion in the final quarter of 2021, lower than 1.95 billion from the previous quarter. Still, Wehner said during the company's earnings call that DAUs were up 5% year-over-year.

We estimate that approximately 2.8 billion people used at least one of our Family of Apps on a daily basis in December, and that approximately 3.6 billion people used at least one on a monthly basis. Facebook daily active users were 1.93 billion, up 5% or 84 million compared to last year. DAUs represented approximately 66% of the 2.91 billion monthly active users in December. MAUs grew by 115 million or 4% compared to last year.

Facebook CEO Mark Zuckerberg previously shifted his outlook on Apple's ATT framework, initially saying it would hurt Facebook but later saying it could benefit the company in the long term.