Consumer spending on the top 100 non-game subscription-based apps across mobile platforms grew 34% year-on-year from $9.7 billion in 2019 to $13 billion in 2020, according to a new report by analytics firm Sensor Tower.

According to the data, revenue from subscription apps purchased on the App Store and the Google Play Store represented around 11.7% of the $111 billion that consumers spent on in-app purchases last year, the same share as in 2019. In the fourth quarter of 2020, however, 86 of the top 100 earning non-game apps worldwide offered subscriptions, which is actually down slightly from 89 in the same quarter of 2019.

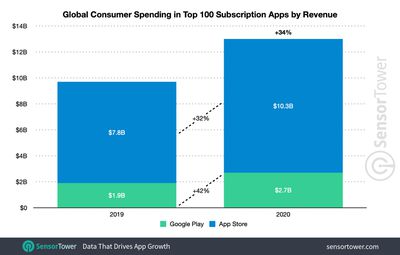

Reflecting a wider historical trend, spending on subscription-based apps in Apple's App Store was vastly more than in the Google Play Store:

Consumers have historically spent more on the App Store than on Google's marketplace, and the same holds true for subscription apps. Globally, the top 100 subscription apps on the App Store generated $10.3 billion in 2020, up 32 percent from $7.8 billion the previous year. The cohort of 100 top earners on Google Play saw $2.7 billion last year, up 42 percent Y/Y from $1.9 billion in 2019.

The only performance indicator in which the Google Play Store beat the App Store was in terms of year-on-year growth for U.S. user spending on subscription apps.

Looking at the U.S. App Store, consumers spent $4.5 billion in 2020 on the top 100 earning non-game apps offering subscriptions, up 25 percent from approximately $3.6 billion in 2019. While the top 100 earning subscription apps on Google Play did not generate as much revenue, they did see greater Y/Y growth. In 2020, the top Google Play subscription apps in the U.S. saw $1.4 billion spent, up 40 percent Y/Y from $1 billion.

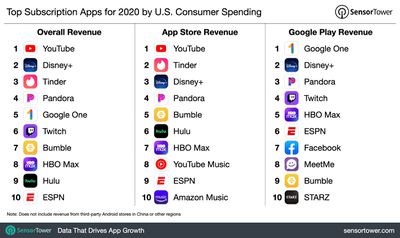

Google was the big winner this year in terms of subscription app spending, both globally and in the U.S. YouTube was the subscription app leader across both stores, earning $991.7 million in gross revenue globally and $562 million in the U.S. It was also the top earning subscription app on the App Store.

Despite the numbers, the subscription apps generally divide App Store users between those for and against the revenue model. Apple began incentivizing developers to sell their apps for a recurring fee instead of a one-time cost when it made changes to its App Store subscription policies in 2016. Usually, Apple takes 30 percent of app revenue, but developers who are able to maintain a subscription with a customer longer than a year see Apple's cut drop down to 15 percent.

In late 2017, Apple began letting developers offer discounted introductory pricing and time-limited free trials on auto-renewable app subscriptions, based on the idea that subscriptions provide a higher likelihood of an engaged audience.