Apple has received trademark approval for Apple Cash and Apple Card from the Government of Canada, suggesting the services might one day launch in the country.

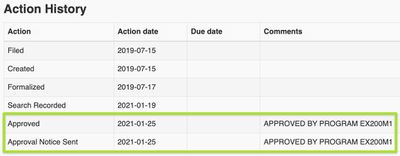

According to trademark database notes discovered by the tech website iPhone in Canada, Apple applied for the trademarks in July 2019, and recent action history shows that both were approved on January 25, 2021.

Apple released Apple Card in the United States in August 2019, but it remains the only country in which the service is available. The credit card is linked to Apple Pay and built right into the Wallet app. Apple partnered with Goldman Sachs for the card, which is optimized for Apple Pay but still works like a traditional credit card for transactions.

In 2017, Apple enabled person-to-person Apple Pay payments through the Messages app on the iPhone and Apple Watch. Using Apple Cash, users can send money to friends or family – but again, only in the United States.

It's uncertain whether the trademark approvals point to an imminent launch in Canada, since the services are likely to face several financial regulatory hurdles that diverge from country to country, but they at least offer a positive sign that it could happen one day. Apple has also already been granted trademarks on the terms in numerous other countries where it has yet to launch.

In related news, code recently discovered in iOS 14.5 suggests that Apple is planning to introduce a new Apple Card feature that will allow for multiple people to use the same Apple Card account.

Currently, Apple Card usage is tied to an individual and there is no option to share an account with another person. In future, Apple Card account holders should be able to invite family members to use their Apple Card account, with family spending available for viewing in the Wallet app.