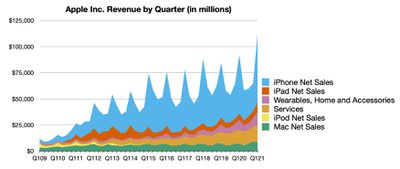

Apple today announced financial results for its first fiscal quarter of 2021, which corresponds to the fourth calendar quarter of 2020.

For the quarter, Apple posted revenue of $111.4 billion and net quarterly profit of $28.8 billion, or $1.68 per diluted share, compared to revenue of $91.8 billion and net quarterly profit of $22.2 billion, or $1.25 per diluted share, in the year-ago quarter.

As expected thanks largely to the later launch of the iPhone 12 series that pushed it entirely into the first fiscal quarter rather than the traditional end of the fourth quarter, this was the best quarter in Apple's history in terms of revenue and profit, topping the first fiscal quarter of 2020 and easily breaking through the $100 billion mark in revenue.

Gross margin for the quarter was 39.8 percent, compared to 38.4 percent in the year-ago quarter, with international sales accounting for 64 percent of revenue. Apple also declared an upcoming dividend payment of $0.205 per share, payable February 11 to shareholders of record as of February 8.

“This quarter for Apple wouldn’t have been possible without the tireless and innovative work of every Apple team member worldwide,” said Tim Cook, Apple’s CEO. “We’re gratified by the enthusiastic customer response to the unmatched line of cutting-edge products that we delivered across a historic holiday season. We are also focused on how we can help the communities we’re a part of build back strongly and equitably, through efforts like our Racial Equity and Justice Initiative as well as our multi-year commitment to invest $350 billion throughout the United States.”

As has been the case for the past several quarters, Apple is once again not issuing guidance for the current quarter ending in March, as considerable uncertainty surrounding the global health situation's impact remains.

Apple will provide live streaming of its fiscal Q1 2021 financial results conference call at 2:00 p.m. Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Apple earnings call recap ahead...

1:38 pm: Apple's stock is currently down about 1% in after-hours trading, following a nearly 1% drop in regular trading today amid broader market declines.

1:44 pm: Apple CFO Luca Maestri: "Our December quarter business performance was fueled by double-digit growth in each product category, which drove all-time revenue records in each of our geographic segments and an all-time high for our installed base of active devices. These results helped us generate record operating cash flow of $38.8 billion. We also returned over $30 billion to shareholders during the quarter as we maintain our target of reaching a net cash neutral position over time."

1:59 pm: The Q1 earnings call will likely take about an hour, opening with remarks from Apple CEO Tim Cook and CFO Luca Maestri. Then a question-and-answer session with market analysts.

2:02 pm: The call is beginning with standard disclosures about forward-looking statements.

2:04 pm: Tim starts by thanking the employees of Apple for working so hard, and is noting the all-time revenue records across numerous categories and geographies. "This result caps off the most challenging year any of us can remember."

2:05 pm: "We are doubly aware that the work ahead of all of us to navigate the end of this pandemic and to restore life... and to build back, with a sense of justice, is profound and urgent."

2:05 pm: Why we outperformed our expectations: We hit a new high watermark for installed devices at 1.6 billion devices worldwide.

2:06 pm: iPhone grew by 17 percent year over year, driven by strong demand for the iPhone 12 family. Active installed base of iPhone is more than 1 billion.

2:06 pm: Response has been enthusiastic even in light of COVID impact at retail locations. iPad and Mac grew by 41 and 21 percent respectively.

2:06 pm: Availability began for both iPad Air and first-gen M1 Apple Silicon Macs. Demand has been very strong.

2:07 pm: Efforts to bring latest iPads and professional support to educators, students and parents. Educational districts and governments worldwide are continuing major deployments.

2:07 pm: Wearables, Home and Accessories grew by 30% including demand for Apple Watch and AirPods lineup, and HomePod mini. Records for each subgroup.

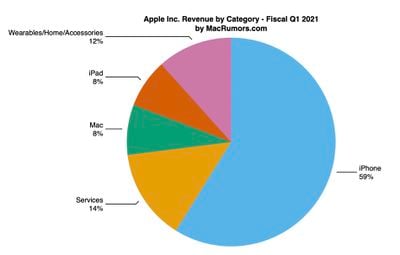

2:09 pm: Touting Fitness+, and the deep integration of hardware, software, and services. Delivered all-time quarterly services record of $15.8 billion. First quarter of Apple One bundle. Optimistic about where we're headed. App Store ecosystem is so important as individuals, families and businesses evolve and adapt to the COVID-19 pandemic. This quarter, we took a significant new step to help smaller developers continue to experiment, innovate and scale the latest great app ideas. Latest program reduces commission on goods and services to 15%.

2:10 pm: Tomorrow is international privacy day. We set new standards to users' right to privacy, not just for our products but to be the ripple in the pond to move the industry forward. The winter holiday season is always a busy time for us and our products. We had a record number of device activations during the last week of the quarter. We saw the highest volume of FaceTime calls ever this Christmas. As always, we could not have made so many holidays special without our talented Retail team. Set new Retail records driven by high performance at our online store.

2:11 pm: We are focused on how to help in a moment of great national need. Hope for healing, unity and progress begins with and depends on addressing the things that continue to wound us. In our communities, we see how every burden... falls heaviest on those who have always faced structural barriers to equality and opportunity. New commitments through $100 million racial equity and justice initiative.

2:12 pm: Will help support next generation of leaders in ML, app development to entrepreneurship and design. Apple Developer Academy in downtown Detroit. We want to accelerate the potential of the app economy here, knowing there is no shortage of good ideas here.

2:12 pm: Since inception of Apple Giving program, Apple employees have donated more than $600 million and volunteered 1.6 million hours.

2:13 pm: Ahead of schedule on multi-year commitment to invest $350 billion throughout the American economy. Much more to be done.

2:14 pm: It will take a society-wide effort across public and private sectors, as individuals and communities, every one of us, to determine that what's ahead of us is not just the end of a disease. At Apple we have every intention to be partners in this effort and we look forward to working with communities around the world to make this possible.

2:14 pm: Luca coming on now.

2:14 pm: Started Fiscal 2021 with exceptional business and financial performance.

2:15 pm: "We are thrilled with the ways our teams innovate and execute." $111.4 billion in revenue, up $20 billion or 21% from a year ago. Grew strong double-digits in each product categories with records in iPhone, Wearables/Home/Accessories, and Services, and Mac.

2:16 pm: Products revenue was $95.7 billion, up 21%. Unmatched loyalty of customers led 1.65 billion active devices.

2:16 pm: Services set record. New all-time records in most services categories and geographies.

2:16 pm: Company gross margin was 39.8%, up 160 bp sequentially. Leverage from higher sales and strong mix. Product gross margin was 31.5%. Services was 68.4 percent. Net income, diluted earnings per share and cash flow were all all-time records.

2:17 pm: iPhone revenue was up 17% year over year, with demand for iPhone 12 very strong.

2:17 pm: Active installed base of iPhones reached all-time high and surpassed 1 billion devices.

2:18 pm: Latest survey from 451 research indicates iPhone customer sat of 98% for iPhone 12 family.

2:18 pm: All-time revenue record for services, with all-time records in App Store, cloud services, music, AppleCare and payment services.

2:18 pm: TV+, Arcade, News+, Card, Fitness+, Apple One bundle are also contributing to services growth and add users content and features.

2:19 pm: Installed base growth has accelerated and is at all-time high across every category. Transacting and paid accounts on digital content stores reached all-time high, with paid accounts increasing double digits across each geographic segment. Paid subs continue to grow nicely. Exceeded 600 million paid subs before end of calendar 2020. December quarter, we added 35 million sequentially and have more than 620 million paid subs, up 140 million from year ago.

2:19 pm: Improve breadth and quality of services offerings, and adding new services that we think customers will love. Apple Music released biggest product update ever. Listen Now, all-new search, personal radio stations, and autoplay.

2:20 pm: Payment services, we expand coverage with 90% of stores accepting ApplePay.

2:20 pm: Wearables, Home and Accessories: wearables business is now size of Fortune 120 company. Apple Watch continues to extend its reach with nearly 75% of customers purchasing Apple Watch being new to the product.

2:21 pm: Mac December quarter record. Strong double-digit growth in each geographic segment.

2:21 pm: Strong demand for new MacBook Air, MacBook Pro and Mac mini, powered by M1 chip.

2:21 pm: iPad performance impressive, up 41%. Strong double digits in every geographic segment including all-time record in Japan.

2:21 pm: Both Mac and iPad are incredibly relevant products for customers in current working and learning environments.

2:22 pm: 93% customer sat for Mac and 94% for iPad.

2:22 pm: Half of those customers in the quarter were new to the product.

2:22 pm: Enterprise, seeing many businesses shifting technology in response to COVID. Businesses handing in hundreds of millions of desk phones.

2:23 pm: To cash position: Ended quarter with $196 billion in cash plus marketable securities. Retired $1 billion in maturing debt. Total debt of $112 billion. $84 billion in net cash. $30 billion returned to shareholders. $24 billion through open market repurchases of 200 million Apple shares.

2:25 pm: March quarter: Given continued uncertainty around the world, we will not be guiding to a specific revenue range. Some directional insights, assuming covid-related impacts do not worsen from our current assumptions. We believe growth will accelerate on a year-over-year basis and in aggregate follow typical seasonality on a sequential basis. Product category level... during March quarter last year, we saw elevated activity in digital services as lockdowns grew. Tougher year over year comparison there. Year over year growth in wearables will decelerate in Q1. Chasing demand on AirPods last year from Q1 to Q2. This year, we plan to decrease AirPods channel inventory as is typical after holiday quarter.

2:25 pm: OpEx between $10.7 and $10.9 billion. Tax rate around 17%. Board of directors declared cash dividend of $0.205 cents per share.

2:25 pm: Q&A beginning.

2:28 pm: Katy Huberty w Morgan Stanley: Congratulations on a really strong quarter. Gross margin was particularly strong vs outlook, can you talk about whether you recognize the full impact of weaker dollar given typical currency hedges and how are you thinking about headwinds and tailwinds on GM?

Luca: GM was strong, better than anticipated. Reason for that was strong leverage from higher sales and mix was strong. Both mix within products and services. That was only partially offset by cost. Launched many new products during the fall and that comes with new cost structures. FX standpoint, really at the GM level, FX didn't play a role. Neither sequentially nor year-over-year for December quarter. Partially because of hedges but also because some currencies are still weaker against the dollar than a year ago, specifically in emerging markets in Latin America, Russia, turkey, and so on. If dollar weakens, that can become a tailwind for us. At current rates we expect some level of benefit around 60-70bp for the March quarter.

2:30 pm: Q: Challenges with valuing Apple is limited visibility into the roadmap and any new categories that you might enter over time. Without commenting on given opportunities, can you talk about the framework that you use internally to evaluate new markets and what you believe will determine your success as you look to enter new markets?

A: Thanks for the question and not asking any specifics. The framework that we use is around "is this a product that we would want to use?" That's a pretty high bar. Is it a big enough market to be in? Unless it's an adjacency product then it's about customer experience. There's no set way that we're looking at it. No formula. But we're taking into account all of those things. The kind of things we love to work on are those where there's a requirement for hardware, software and service to come together. We believe that the magic really occurs at that intersection. I think that we have some really good opportunities out there and if you look at our current portfolio of products, we still have relatively low share in a number of cases in very big markets. We feel that we have really good upside there and really good upside in services area too, that we've been working on for quite some time. With 4-5 new services just coming online in the last year plus.

2:32 pm: Q: iPhone growth exceeded expectations even with late launch. You referenced strong mix, how does this change your view on March quarter, can you share some color?

A: iPhone was one of the major factors why we exceeded internal expectations, we had a fantastic product lineup and we knew that and it's been fantastic to see customer response to the four new models particularly the pro models, Pro and Pro Max. Done well on units and pricing because of strong mix, and we've had some level of supply constraint particularly on Pro and Pro Max. As you said, we launched these products in the middle of the quarter, two after two weeks and two after seven weeks. Steep ramp that went very well. Products are doing very well around the world, particularly in China. Phenomenal customer response. Also some level of pent-up demand for 5G iPhones given that the market is moving very quickly to 5G. Look ahead, very optimistic. We believe we can be in supply-demand balance for all the models during the quarter. And the product is doing very well all around the world.

2:33 pm: Q: Strength of installed base performance, can you help us think through switcher vs upgrader activity across recent quarters?

A: Look at this past quarter, this is early going but we saw both switchers and upgraders increase on a year-over-year basis and in fact we saw the largest number of upgraders that we've ever seen in a quarter. We were very thrilled about that.

2:36 pm: Q: Shannon Cross w Cross Research: What are you seeing in China, significant sequential growth but from iPhone and other categories, what are you seeing and how back to normal is the Chinese market?

A: China was more than an iPhone story. iPhone did do very well there and sort of like the world if you look at switchers and upgraders, we were up year over year in China and a record number of upgraders there in a quarter. Probably some portion of this was that people probably delayed purchasing in the previous quarter as rumors started appearing about an iPhone. 5G in China is well-established and the overwhelming majority of phones are 5G phones, so there was some level of anticipation for us delivering an iPhone with 5G. iPhone did extremely well. The other products did as well, we could not have turned in a performance like we did with only iPhone. iPad did extremely well, far beyond the company average. Mac was above the company average, wearables, so if you really look at it, we did really well across the board there. In terms of COVID, I think they're for last quarter, beyond COVID. In the recovery stage. This quarter there are different reports about cases in some places, and lockdowns occurring, but we have not seen that in our businesses yet. Those cases are much smaller than ones in other countries.

2:38 pm: Q: Services... this is one of the first times that you talked about Apple TV+, Arcade, the smaller services moving the needle. You had stores closed during the quarter and that typically affects AppleCare revenue but that was a record.

A: Two businesses during covid that have been impacted negatively, one is AppleCare. When stores are closed, it's tougher for customers to have that interaction with us and advertising which is in line with overall level of economic activity. For December, in-store traffic improved and AppleCare we grew — not as much as company average, but we grew in AppleCare. Set all-time record there in spite of the fact that we started closing stores in US and Western Europe. In total we were able to support more customers than past quarters. But sequential growth in advertising, too. Clearly the strength was in digital services. App Store, cloud, music. Those were the services that really delivered very strong performance and that's something that we've seen happen during the covid environment.

2:41 pm: Q: Can we probe a little bit more into iPhone? You talked about a drawdown in channel inventory last quarter. Are iPhones at normal levels exiting Q1 and should we be thinking about above-seasonal growth with fewer selling days in Q1 and should we be thinking about above seasonal growth looking into Q2?

A: On the December performance, this was a very different cycle because we launched at a different time than usual. Initial part of the quarter without the new phones and then with the new phones, we had channel fill that typically happens in the September quarter. At the end of the quarter, demand is very strong and we've been constrained. At end of December, we had level of iPhone channel inventory which is slightly below a year ago. We still had a level of supply constraint that we believe we'll solve during the March quarter. In terms of sequential change that we talked about during prepared remark, we talked about company average and we expect that sequential progression to be similar to typical seasonality that you've seen in past years. Last year was not typical because of COVID, but go back to 17/18/19, that's our typical progression. We mentioned a few categories where we have slightly more difficult compare. Draw your conclusions around the iPhone though.

2:45 pm: Q: Comment on growth and sources for growth, well over $300 billion in revenue. Do you still feel confident that Apple has organic growth opportunities and that you don't believe acquisitions are an important source of growth? As you look over the next five years, what is a realistic revenue growth rate for Apple going forward?

A: As you know, we give some color on current quarter but not beyond that. In terms of growth rates, so I'll punt that part of your question. If you look at the ingredients that we have at this point, we have the strongest hardware portfolio that we've ever had. We have a great product pipeline for both product and services. We're still attracting a fair number of switchers and upgraders. We just set all-time services record, and we have that install base to compound that with added services over the past year. As they grow and mature and will contribute even more to services. On wearables, we've brought this thing from $0 to Fortune 120 company which was no small feat. But I feel that we're in the early stages of those products. Look at our share in other products, iPhone or Mac or iPad, you find that the share numbers leave a fair amount of headroom for market share expansion and this is particularly the case in some of the emerging markets where we're proud of how we've done but there's a lot more headroom in those markets. India as an example, we doubled our business last quarter compared to year-ago quarter. But absolute level of business there is still quite low given the size of the opportunity. Other markets like that as well. The other thing from a market point of view, we've been on a multi-year effort in enterprise and have gained quite a bit of traction there. Some of the things in Luca's comments and we comment some on it each quarter. We're very optimistic on what we can do in that space. New things that we're not going to talk about that we think will contribute to the company as well just like other new things have contributed nicely in the past. We see lots of opportunity.

2:47 pm: Q: GM discussion... we haven't seen GM at this level since 2016. Can you step back, what has enabled this shift higher? What has enabled you to get there? Commodities, sourcing components, wondering about durability of GM at these levels?

A: When you grow like we grew, 21%, we have a certain level of fixed cost in product structure. High level of sales helps margin expansion. Probably the biggest factor to be honest. Across the board, in services, in every product category, we had a very strong mix of products. The iPhone, Pro and Pro Max, that's pretty much the case in every product category. Mix has been very good. Commodity environment is fairly benign. One thing not affecting us is FX. It hasn't been a tailwind yet, but at the same time it hasn't been a negative. FX for us has been a negative for 5-6 years, almost every quarter. That has changed and that obviously makes a difference.

2:49 pm: Q: Growth rates for Mac and iPad, how much of this is replacement cycle vs new folks coming into the ecosystem? What growth is more durable or predictable?

A: Look at switchers, new to Mac and new to iPad, these numbers are still worldwide about half of purchases. Install base is still expanding with new customers in it. That's true on both iPad and Mac. If you look on Mac, M1 gives us a new growth trajectory that we haven't had in the past. If Q1 is a good proxy, there's a lot of excitement to M1 based Macs. A lot more to do there, early days of two-year transition but we're excited with what we see so far. Best iPad lineup we've ever had. Others are using them as complementary to desktop rather than laptop replacement. 41% growth is phenomenal. Part is work from home and part is distance learning, but wouldn't underestimate how much of that is the product itself in iPad and Mac. Share in Mac is quite low, for the total personal computer market, so lots of headroom there.

2:51 pm: Q: iPhone sales in general, China and North America have more robust 5G infrastructure. What do you see for customer engagement and velocity for 5G in Europe where they haven't rolled up robust 5G? Is that impacting customer interest in the latest lineup?

A: Look at 5G rollout in Europe, it's true that Europe is not in the place of or nowhere close to China or the US. But there are other regions that 5G is very good including Korea as an example. The world I would describe is more of a patchwork quilt. There are places where there's excellent coverage, and places within a country that are very good but not from a nationwide point of view. Then there are places where it hasn't gotten started yet. Latin America is closer to the last one, lots of opportunity ahead of us there. Europe has 5G implementations but most of that growth is in front of us there.

2:52 pm: Q: Apple One has been around for a couple of months. Any metrics for conversion rates or services in the bundle that are driving adoption?

A: It's really too early to answer some of those questions. Just got started into the quarter in Q1 so less than a quarter on this right now. What we wanted to accomplish was making our service very easy to subscribe to. Customers told us they wanted to subscribe to several services or all of our services so we've made that very simple. It's clear from the early going that it's working but we've just gotten started on it.

2:53 pm: Q: Talk about search and advertising business. What do you think about long-term growth opportunities there and are there applications in the fundamental search tech that can be used elsewhere?

A: Search advertising is going well. There's lots of intent from search and we do it in a very private kind of manner, observing great privacy policies and so forth. I think people see that and are willing to try it out. We're growing nicely in that area, it's a part of the advertising area that Luca spoke of earlier.

2:55 pm: Q: In the March quarter, you typically see a bump due to gaming downloads during Chinese New Year. Will we see that this year?

A: Typically in China, March is strongest quarter for services because of Chinese New Year. Last year we saw more activity because the whole country went into lockdown for several weeks so that propensity for playing games continued more than a previous cycle. Expect to have a great quarter in China, but need to keep in mind the compare is going to be particularly challenging because of what happened a year ago.

2:57 pm: Q: Asking about iPhone ASP. Are you confident that you can continue to improve mix on iPhone going forward?

A: iPhone revenue grew 17%. That came from unit sales and mix in the December quarter. It's very early because we launched the new product only a few weeks ago, but what we've seen so far is a high level of interest for Pro models and we've worked very hard to ramp up supply. We've had some supply constraints in the December quarter and we think we can solve them during the March quarter. Mix has been very strong on iPhone.

2:58 pm: Q: Benefits to carrier actions with aggressive trade-ins on units or mix? What would be level of permanence to those actions to see if those subsidies were removed to be a headwind?

A: Subsidies always help. Anything that reduces the price to the customer is good for the customer and obviously good for the carrier and good for us as well. It's a win across the board. I believe that at least based on what I see right now that there will be continued to have competition in the market if you're talking about the US for customers as carriers work to get more customers to move to 5G. In outside the US, the subsidies are not used in all geographies and it really varies greatly by country. Some of them separate completely the handset and service, and in those areas we don't have subsidies.

3:01 pm: Q: Amazing how your company has pivoted and progressed through this uncertainty time in society. A lot of pushback we get on our view of Apple, everyone we know has an iPhone and the market seems saturated. But in India for example, you are much below. How should we think about your moves in India and you don't have full market share everywhere equally around the world.

A: Several markets, including India, where our share is quite low. It did improve from the year-ago quarter. Business roughly doubled over that period of time. We feel good about the trajectory. We have the online store there and the last quarter was the full quarter of the online store. That has gotten a great reaction to it and helped us achieve results that we got last quarter. Going in with retail in the future and we look to that to be another great initiative where we continue to develop the channel. Lots of things, not only in India, but several other markets that you might name where our share is lower than we'd like.

I would also say, even in the developed markets, when you look at our share, definitely not everybody has an iPhone. Not even close. We really don't have a significant share in any market. There's headroom left even in developed markets where you might hear that.

3:01 pm: The call is concluded.