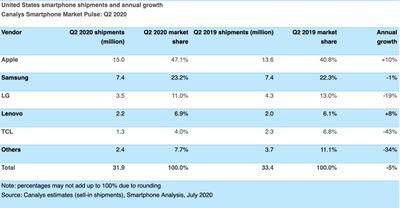

Apple shipped approximately 15 million iPhones in the United States in the second quarter of 2020, according to a new report shared by Canalys, setting a new domestic record.

Apple shipped 15 percent more iPhone 11 devices than last year's equivalent, iPhone XR. Most strikingly, iPhone SE was responsible for growing Apple's quarterly market share to 47 percent. Overall, Apple shipped 10 percent more devices compared to the same quarter of last year.

Vendors shipped 31.9 million smartphones in the United States in total. This represents a 5 percent year-on-year decline, but an 11 percent quarter-on-quarter increase. The reopening of manufacturing facilities in China at the end of March and retail stores reopening in May and June were key contributors to growth. Around 70 percent of smartphones shipped in the U.S. in the second quarter of 2020 were made in China, up 60 percent from the last quarter.

5G adoption was low in the second quarter of 2020, but is expected to increase as more 5G-connected devices come to market in the coming months. Apple is expected to contribute to this drive for 5G adoption with the release of 5G-enabled iPhones this fall.

"As the coronavirus pandemic forced consumers to stay at home, 5G adoption in the U.S. failed to take off. Store closures and virus fears limited interaction with demonstration models, tight consumer budgets further constrained spending power, and with scarce 5G network coverage in American suburbia, consumers saw plenty of reasons to buy a 4G device instead," Canalys Analyst Vincent Thielke said. "Despite the lackluster 5G roll-out so far, strong carrier marketing in coming quarters will be instrumental in catalyzing a multi-year transition period from LTE to 5G."

Canalys also noted the "perpetual state of uncertainty" hanging over smartphone vendors due to an escalation of tensions between the U.S. and China, but explained that this largely does not affect Samsung and LG.

"The worsening relationship has resulted in extreme instability that has global onlookers eagerly awaiting November's presidential election. This may guide the U.S.-China trade war into a new phase of détente – or reignite flare-ups," Thielke explained.

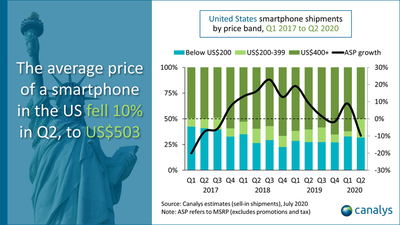

Apple and Samsung together account for seven out of every 10 devices sold. The average price of a smartphone in the U.S. dropped 10 percent compared to last year, down to $503. Canalys found that distributors are increasing orders for ultra-low-end Android smartphones from lesser-known brands, such as Unimax and Wiko. Google and other Android brands are increasing their exposure to the low-end and mid-range segments, and in addition to the success of iPhone SE, it appears that the sub-$400 segment is poised to gain more prominence.