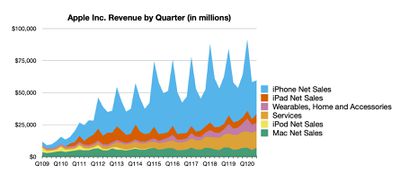

Apple today announced financial results for the third fiscal quarter of 2020, which corresponds to the second calendar quarter of the year.

For the quarter, Apple posted revenue of $59.7 billion and net quarterly profit of $11.25 billion, or $2.58 per diluted share, compared to revenue of $53.8 billion and net quarterly profit of $10.0 billion, or $2.18 per diluted share, in the year-ago quarter. Both revenue and earnings per share were June quarter records.

Gross margin for the quarter was 38.0 percent, compared to 37.6 percent in the year-ago quarter, with international sales accounting for 60 percent of revenue. Apple also declared a quarterly dividend payment of $0.82 per share, payable on August 13 to shareholders of record as of August 10.

Apple is also announcing a four-for-one stock split that will take effect for shareholders of record as of August 24, with split-adjusted trading to begin on August 31.

Apple's results were obviously significantly affected by the global health crisis, and the company did not issue financial guidance for the quarter in its previous earnings release on April 30, but results were generally ahead of Wall Street expectations.

“Apple’s record June quarter was driven by double-digit growth in both Products and Services and growth in each of our geographic segments,” said Tim Cook, Apple’s CEO. “In uncertain times, this performance is a testament to the important role our products play in our customers’ lives and to Apple’s relentless innovation. This is a challenging moment for our communities, and, from Apple’s new $100 million Racial Equity and Justice Initiative to a new commitment to be carbon neutral by 2030, we’re living the principle that what we make and do should create opportunity and leave the world better than we found it.”

Apple is once again not issuing guidance for the current quarter ending in September, as considerable uncertainty surrounding the health situation's impact remains.

Apple will provide live streaming of its fiscal Q3 2020 financial results conference call at 2:00 PM Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Apple earnings call recap ahead...

1:40 pm: Apple's stock price is up nearly 5% in after-hours trading, pushing through the $400 mark.

1:48 pm: Mac and iPad sales were especially strong, which should be unsurprising given the shift to work-from-home setups and some product updates.

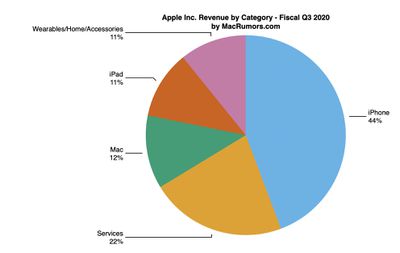

1:51 pm: At just 44% of overall revenue, the iPhone's share of Apple's business was remarkably low. That's a combination of the late-stage lifecycle of the current flagship models, strong performance in Mac and iPad, and continued growth in Services.

1:53 pm: Apple's four-for-one stock split next month should bring the share price down to around the $100 range, depending on its performance between now and the split date. It's Apple's first stock split since a seven-for-one split in 2014.

1:56 pm: The hold music on Apple's financial results conference call is terrible.

2:02 pm: The earnings conference call is starting.

2:02 pm: On the call is Apple CEO Tim Cook and Apple CFO Luca Maestri.

2:03 pm: Forward-looking statements, projections, etc etc. Tim coming on now.

2:04 pm: Starting with kind words about Congressman John Lewis. "I was humbled and fortunate to know him, and as an Alabama native... He inspires me still."

2:04 pm: Throughout the call, I'll speak in greater detail about Apple's support for equity and justice.

2:04 pm: In an uncertain environment, Apple saw a quarter of historic results.

2:04 pm: June Quarter record with revenue of $59.7b, up 11% YoY. Products and services grew double digits, and revenue grew in each geographic segment.

2:05 pm: What makes us proud is not merely what we did but how we did it. We committed $100 million to launch Racial Equity and Justice initiative.

2:06 pm: More context on quarter's results: Due to uncertain and ongoing impacts of Covid-19, we did not provide typical guidance last quarter but we did provide some color on how we expected the June quarter to play out. Across our product categories, beginning with iPhone: Up 2%, expected YoY performance to worsen but saw better than expected demand in May and June. Strong iPhone SE launch, continued economic stimulus, and potentially some benefit from shelter-in-place restrictions lifting around the world.

2:07 pm: iPad and Mac growth to accelerate, saw double-digit growth this quarter. In spite of supply constraints on both products. Working hard to get more iPads and Macs into customers' hands, recognizing how integral they are to working and learning from home.

2:07 pm: Wearables growth decelerated as we expected, but grew by double-digits and set revenue records for non-holiday quarter.

2:08 pm: Installed base of active devices grew to new active records across all categories. Services generated $13.2 billion, up 15% YoY.

2:08 pm: Two distinct trends we were seeing and they played out as we thought. Results for Ads and AppleCare were impacted by reduced levels of economic activity. Had strong performance in digital services with all-time records in App Store and Apple Music, Video and Cloud Services. Elevated engagement on iMessage, Siri and FaceTime.

2:09 pm: Apple TV+ just hit history-making 95 awards nominations and 25 wins and accolades.

2:09 pm: Proud to announce that we have achieved our goal of doubling our Fiscal 2016 services revenue 6 months ahead of schedule.

2:10 pm: Results stand in stark relief in a time of real economic adversity. We do not have a zero-sum approach to prosperity. Focus on growing the pie, and make sure our success isn't just our success. Want to create opportunities for others. App Store is an example. Independent economists found the App Store facilities more than $500 billion in commerce globally in 2019.

2:10 pm: Can measure economic resilience in ways App Store helps with remote ordering for restaurants and other opportunities and more.

2:11 pm: Allocated $400 million of multi-year $2.5 billion commitment to new buyer construction and affordable housing projects.

2:12 pm: Thanking AppleCare and Retail employees for adapting to reopening and reclosing challenges.

2:12 pm: Re WWDC: Though we could not be together in person, we set new standards for what an all-virtual event could be. 22 million viewers across all Apple's streams. 72 hours of video content, with more than 200 direct to video engineering and design sessions, and 4,500 person-to-person appointments across 227 virtual labs.

2:13 pm: Touting iOS 14, macOS Big Sur, Apple Silicon and other releases.

2:14 pm: Looking forward, we are profoundly optimistic about Apple's future. With this success comes a real responsibility to lead with our values. We are just as proud of our announcement this month that Apple will be fully carbon neutral by 2030 across our entire supply chain, and including the energy use of every device we make, as we are of any hardware innovation. We want to leave the world better than we found it.

2:14 pm: Stand with those marching for their lives and dignity through the Racial and Ethnic Justice initiative.

2:15 pm: Discussing the obligations of Apple to stand with the communities where employees live and work.

2:15 pm: Handing off to Luca Maestri.

2:15 pm: June quarter was a testament to Apple's ability to innovate and execute in challenging times.

2:16 pm: New June quarter revenue record, up 11%, despite 300bp headwind from FX.

2:16 pm: Results were very strong all around the world. Grew in all geographic segments.

2:17 pm: $46.5 billion product revenue. iPhone returned to growth, and saw double-digit growth from iPad, Mac, and wearables. Lockdowns and point of sale closures were widespread in April, but saw demand for all products improve significantly in May and June.

2:17 pm: Unmatched loyalty of customers led to all-time high in all geographic segments across all product categories.

2:17 pm: 38% gross margin, down 40bp sequentially.

2:19 pm: iPhone revenue grew 2% to $26.4 billion, with customer demand improving as the quarter progressed. COVID was most impactful during the first 3 weeks of April. Improvement in May and June around the world.

2:19 pm: Latest surveys of consumers in the US, indicates iPhone customer satisfaction of 98%.

2:20 pm: Apple TV+, Apple Arcade, Apple News+ are contributing to overall services growth, and add users, content and features. Customer engagement in the ecosystem continues to grow at a fast pace.

2:20 pm: More than 35 million new paid subscriptions.

2:21 pm: Wearables business is size of Fortune 140 company.

2:21 pm: 70% of Apple Watch buyers are new to the product.

2:22 pm: Both Mac and iPad are extremely relevant products in the current climate. Customer satisfaction at 96% for Mac and 97% for iPad. Half of customers purchasing Mac or iPad were new to that product. New all-time high for both products.

2:22 pm: Retail set records thanks to performance of online store.

2:23 pm: Touting the growth of Telehealth services.

2:25 pm: Total debt of $113 billion. Net cash is $81 billion at end of quarter. Continue to reach net cash neutral position over time. Returned $21 billion to shareholders. $3.7 billion in dividends and equivalents, and $10 billion in open market repurchases.

2:26 pm: Move to September quarter, will provide some color on what they're seeing. Similar to last quarter, given uncertainty in near term, will not be giving revenue and margin guidance for the coming quarter. But additional insight on expectations for September quarter for product categories: On iPhone, expect to see recent performance continue including strong customer response for iPhone SE. Started selling iPhones in late September. We project supply to be available a few weeks later.

2:27 pm: For services, expect same trends in June quarter except for AppleCare. We expect difficult comp for AppleCare considering COVID-related point of sale closures.

2:28 pm: Opening the call to questions:

2:29 pm: Q: Katy Huberty with Morgan Stanley: In light of economic adversity, can you walk us through how Apple's leveraging finance and trade-in programs to make technology more affordable and accessible? How might these expand over time?

A: As Luca mentioned, in June we rolled out the ability to do interest-free financing in our stores with payments and that's in addition to trade-in which is becoming a more-common trend now which is terrific because it's great for the environment and acts as a subsidy against the phone. Compound these with financing and trade-in, it makes the product super affordable. We're happy with what we're seeing in that regard.

2:31 pm: Q: Specifically to iPhone, the category returned to growth, installed base is larger today, replacement cycle is elongated and affordability element. Does all of that combine to build confidence that we're entering a longer period of iPhone revenue growth after six quarters of decline?

A: Very pleased with how we did on iPhone, better than we thought. May and June were much better. iPhone in totality, the things that get me very optimistic is the size of the active installed base, major geographies like US we had the top two selling smartphones. Three of four in the UK, five of six in Australia, top four in Japan, Urban China iPhone 11 was top-selling smartphone in the country. These are very different geographies with different competitive situations and we're doing fairly well. iPhone SE, it's clear, that from early data we're seeing a higher switcher number than we did in previous year that we feel very good about. Seemed to appeal to some people that were holding on to the device for a little longer because they wanted a smaller form factor phone. Combination of smaller form factor and affordable price made iPhone SE very popular. iPhone 11 is still most popular but iPhone SE definitely helped our results and as Luca said in his outlook, we do see that continuing into this quarter currently.

2:33 pm: Q: Services business and in terms of TV content production, how did movement restrictions affect content production?

A: Working to get it restarted because we shut down in March and yet to really restart in a significant way, particularly for those shot in the LA area. Given the current status of the virus.

2:35 pm: Q: With strong sales in Mac, do you think back-to-school season got pulled forward by a quarter?

A: For providing commentary for September, we expect all the non-iPhone product categories to have strong year-over-year performance. Back-to-school season is clearly this one and we're very excited not only for Mac but for iPad. Fantastic lineup of products and we know that these products are incredibly relevant especially given current circumstances. Performance that we've seen for Mac in June quarter to continue.

2:36 pm: Q: Shannon Cross, Cross Research: Talk a bit about what you're seeing in China? Revenue up 2% plus record iPads, but given their 5G is a bit ahead, how are you seeing market play out?

A: Growth that we see, we did see growth, currency affected China a bit more than other places, affected 400bp. In constant currency we would have grown at 6%. iPhone 11 has been our best selling phone and has been number one in Urban China. iPad was helped in June quarter there by the work from home and distance learning as it was in other geographies. Mac also grew strong double-digit during the quarter. And services set a new June quarter record there. We also continue to see extremely high new customer rates on Mac and iPad there. Perspective... Three out of four customer buying Mac are new, 2/3 buying iPad are new. These are numbers that we are super proud of.

2:37 pm: Q: Decision to bring Apple Silicon in-house and benefits you're expecting to see from vertical integration and intel modem business integration?

A: What we'll wind up with is common architecture across all of our products, which gives us some interesting things we can do and products that unleashes another round of innovation. Don't want to say a lot about it other than we're extremely excited about it. It's something that we've worked on quite a while to get to this point and we're looking forward to shipping the first Mac with Apple Silicon later in the year.

2:39 pm: Q: If I think about the strength with iPhone, where is this trend coming from? Replacement cycles or new iOS customers? Clearly these growth rates seem impressive in context of pandemic.

A: It's a combination of a strong launch of iPhone SE, and some pickup thanks to economic stimulus in different countries, and some of the reopening that took place across the quarter. We've been having a strong cycle with the iPhone 11 and 11 Pro, so when you combine a strong cycle plus iPhone SE launch, plus reopening of stores etc, I think there are a lot of things that were going in the right direction there.

2:41 pm: Q: Perspective on how we think about 38% gross margin? What are levers to improve this going forward and in that context, do you see a point where product gross margin stabilizes because it's been trending lower.

A: We were at 38%, down slightly sequentially but up the same amount YoY. Really, the big negative impact that we felt for several quarters has been the strength of the US dollar. FX impact on sequential basis was 90bp, YoY was 130bp. That is something to keep in mind. Other aspect to keep in mind is that we sell many different products, they have different margin profiles, and different mix can have an impact on the aggregate of product gross margin. We're very pleased to see performance of Mac, iPad and wearables, but it's a different mix. Going forward, the variables are always the same. FX will continue to have an impact, the mix of products that we sell, the commodities market has been relatively benign and we'll see how that plays out over time. As you know, for several years, we've been managing gross margin fairly well in spite of some difficult situations like the one with the strength of the dollar and we plan to make good trade-off decisions between revenue and units and margins.

2:43 pm: Q: Survey on smartphones in China, large portion of install base is on 6/7/8 device. Trade-in programs etc, what are you doing to get those customers into latest technology?

A: Customers upgrade at different pace, but I don't have exact install base from China but much like in other geographies, the upgrades have extended some. Extended some during the depths of the pandemic in China and the rest of the world and probably to the rest of the world and is happening still at this point. The key thing that we can do is keep innovating, deliver a product that people can't imagine going through life without, and obviously keep rolling out these programs that make the front end purchase be much less and this is the financing and trade-in programs. I do feel like those are going quite good in a number of geographies.

2:45 pm: Q: Should we think about how much iPad and Mac sales are pull-forward or earlier future upgrades?

A: The install base is growing and new customer numbers that Luca went over in the aggregate are still very high, close to 50% kind of range. That to me bodes well for the future. There's clearly some amount of work from home and remote learning that do affect the results of Mac and iPad positively. They probably affect wearables and iPhone the other direction. But on Mac and iPad, these are productivity tools that people are using to stay engaged with their work or stay engaged with schoolwork. We believe we're going to have a strong back-to-school season, sitting here today it certainly looks like that.

2:46 pm: Q: Can you share a bit about channel inventory, talked about tightness for Mac and iPad in June quarter, in terms of where you think inventory is across product categories?

A: We usually have gotten away from talking about channel inventory, but sitting here looking at it, iPhone is slightly less than a year ago and that's at quarter-end point at end of Q3. Obviously, iPad and Mac are constrained so both of those are less than year-ago quarter.

2:48 pm: Q: Color you can share about impact COVID had on OpEx, work from home stipends, less travel, employee support costs. What's longer term opportunity of employees working remotely, maybe permanently?

A: On OpEx front, there have been certain things that have been affected in terms of cost reductions, travel is a perfect example, meetings we have internally, but we've also invested heavily in initiatives with a program where we match employee donations, we've made donations directly, on a net basis the costs outweighed the savings both in March and June quarter but we think it's the right thing to do. From employee perspective, what we said so far is that here in the US in most of our population will continue to work from home through the end of the year. Try to understand how the virus is evolving over time, taken a cautious approach both with corporate facilities and with retail stores. Retail stores you've seen we've reopened in a number of geographies around the world, reopened here in the US, we've had to reclose here in the US as the number of cases has gone up and we'll continue to track how the virus is doing. Hoping for vaccine or cure and so we'll make those decisions as we get more information.

2:50 pm: Q: Focus on the gross margin expansion within services line, all-time record for the quarter. Curious whether you think that was a theme, within services there's a pretty wide margin within businesses and should that continue to improve?

A: Sequential expansion for services and that was driven primarily by mix. Very broad portfolio and defending which does better, we have an impact on services gross margin. We like services business because it is a recurring type of revenue and is accretive to company margin. 67% this quarter and we want to offer competitive services across the board and the same comments on products, what matters to us is to be successful with everything we do and provide great products and services to our customers. The relative success of products and services in marketplace will drive what our margins are. Margins are a byproduct of success in the marketplace.

2:52 pm: Q: On wearables, you're categorizing wearables as being a little bit impacted by pandemic. First time that wearables haven't had that growth. Is there pent up demand as we get to normalized environment?

A: On Watch in particular, like the iPhone, more affected by store closures. Because some people want to try on the Watch and see what it looks like, look at different band choices and those sorts of things. As stores closed, it puts more pressure on that. We did come out last quarter and we knew things would decelerate because of the closures. We ended up being pleased with how we did, but store closers affect the wearables and iPhone.

2:54 pm: Q: Coronavirus the company did a fantastic job at overcoming the hurdles. As you look forward to Christmas/Holiday shopping season, given the economic challenges and coronavirus, give commentary how you expect to see differences from past Christmas cycles? But Apple is showing a lot more strength coming into Christmas than past years.

A: We take it one quarter at a time. We'll give color on December quarter in October. Generally speaking, we need to see a vaccine or therapeutic or both. There's some optimism around that in that particular time frame. No particular information that isn't publicly available there. That would boost consumer confidence quite a bit if it began to happen, and I think that any kind of consumer company would benefit from that.

Q: Quick comment Luca, about iPhone coming out a few weeks later — was that for iPhone, iPhone chips, product launches, can you expound on that?

A: On iPhone, I said in my remarks that we launched a year ago, the new iPhone in late September so I was referring to the new product. I said that this year, the supply of the new product will be a few weeks later than that.

2:56 pm: Q: Can you comment on penetration of Apple Card users in iOS install base, and have you seen any changes in Card users in terms of spending on Apple products?

A: Changes in consumer spending as shutdowns occurred and store closures occurred. Saw that across the card, it affected the categories that you would guess the most — travel, entertainment, etc. Pull the lens out on Apple Card, we're happy with the number of people who have the Apple Card. We think it's the fastest rollout in the history of credit cards so we feel very good about that.

2:56 pm: Q: Now that Apple has Apple Silicon for Macs, would you consider this monetizing this as merchant silicon or is this forever for Apple use?

A: I would never say "forever." We're a product company and we love making the whole thing, and if we can own the user experience with the goal of delighting the user, that's the reason we're using Apple Silicon is we can envision some products that we can achieve that we couldn't achieve otherwise.

2:57 pm: The call has ended. Replays are available on apple.com/investor.