Apple CEO Tim Cook earned over $11 million in salary in 2019 according to the 2019 proxy statement Apple filed with the SEC today.

Apple CEO Tim Cook earned over $11 million in salary in 2019 according to the 2019 proxy statement Apple filed with the SEC today.

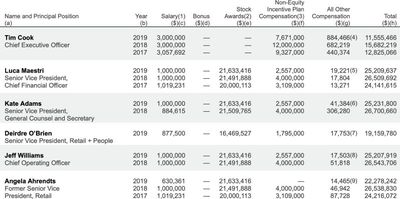

Cook earned a base salary of $3,000,000 in addition to $7.7 million in incentives awarded for performance. Cook also received another $884k in "other compensation" for a total of $11,555,466.

Other compensation includes life term insurance premiums, contributions to a 401k plan, vacation cash out (totaling $92,000), $457,083 in security expenses, and $315,311 for his personal use of private aircraft.

Cook earned more than $4 million less than the $15 million he earned in 2018. The salary listed here does not include stock awards that were received in 2019, with Cook earning over $113 million from shares that vested in 2019.

Most other Apple executives received a base salary of close to $1 million, along with stock and incentives of $20 to $25 million. Luca Maestri, Kate Adams, and Jeff Williams earned over $25 million.

Angela Ahrendts, who left the company early in the year, earned $22 million, while her replacement, Deirdre O'Brien, earned $19 million.

All Apple executives earned significantly more than the median salary at Apple, which was $57,596 because of the large number of retail and support employees that work for Apple. Cook earned 201 times more than the average employee compensation.

The full proxy statement from Apple includes additional salary details, proposals that will be voted on at Apple's upcoming 2020 shareholders meeting set to be held on February 26, 2020.

Top Rated Comments

But I do concur with @I7guy that Tim Cook has earned every penny. Different people are needed at different points in a company history. Jobs was right for his era, but I maintain that he would have been a disaster for the Cook era. Cook is amazing, and has been responsible for most of the achievements of Apple, albeit not the initial innovation and concept that Jobs provided. Rather, what Cook has done is refine Apple's culture and expanded it, and has done as fine a job as any CEO in American history, if not world business history.

Past a certain point, I don't think throwing more money at R&D is going to yield better results. It would simply be throwing good money after bad.

As for lowering prices, Apple's margins have actually decreased in recent years.

And I am going to assume that Apple pays its staff competitive wages.

At the end of the day, Apple's ability to grab monopoly-like share of profits in the respective markets isn’t a result of there being an Apple Tax, but rather borne out of a design-led product strategy that ultimately marginalises entire industries.