During today's earnings call for the third fiscal quarter of 2019, Apple CEO Tim Cook confirmed that Apple plans to launch its Apple Card credit card in August.

Thousands of employees are currently testing the card, and Apple will be ready to debut it soon. Cook did not provide a specific date in August for the launch, so it could come at any time.

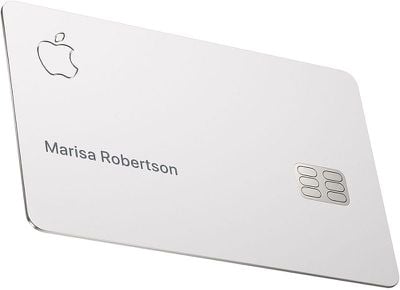

Created in partnership with Goldman Sachs, the Apple Card is deeply integrated with Apple Pay and the Wallet app, though there is also a physical titanium card that can be used for in-person purchases.

Apple Card can be used for both standard purchases and Apple Pay purchases, with Apple providing rewards for both. Customers will get 3 percent cash back for purchases made at an Apple Store, 2 percent cash back for all Apple Pay purchases, and 1 percent cash back for all other purchases.

Cash back is provided in the form of "Daily Cash" that, as the name suggests, is paid out to customers on a daily basis. Daily Cash is added to the Apple Cash card in Wallet and can be used for purchases, sent to friends, or transferred to a bank account.

In the Wallet app, Apple will offer spend tracking and other budgeting tools. Color-coded categories will give users an idea of how much money they're spending on food, activities, shopping, health care, entertainment, and more.

Apple Card will be limited to the United States at launch, but may expand to additional countries in the future. For more details on the Apple Card, make sure to check out our Apple Card guide.