Apple today announced financial results for the third calendar quarter and fourth fiscal quarter of 2018.

Apple today announced financial results for the third calendar quarter and fourth fiscal quarter of 2018.

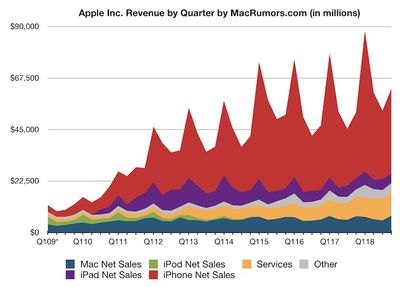

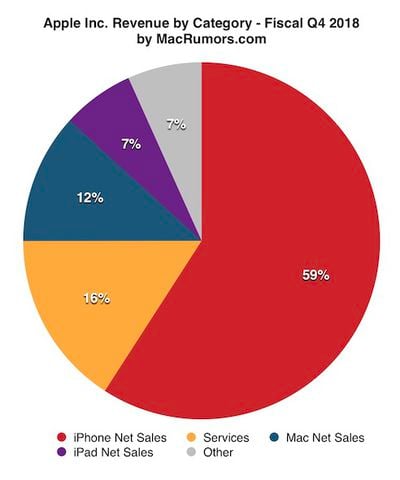

For the quarter, Apple posted revenue of $62.9 billion and net quarterly profit of $14.1 billion, or $2.91 per diluted share, compared to revenue of $52.6 billion and net quarterly profit of $10.7 billion, or $2.07 per diluted share, in the year-ago quarter. Revenue, profit, and EPS were all-time records for the September quarter.

Gross margin for the quarter was 38.3 percent, compared to 37.9 percent in the year-ago quarter, with international sales accounting for 61 percent of revenue. Apple also declared an upcoming dividend payment of $0.73 per share, payable November 15 to shareholders of record as of November 12.

For the quarter, Apple sold 46.9 million iPhones, up slightly from 46.7 million in the year-ago quarter. iPad sales fell to 9.7 million from 10.3 million in the fourth quarter of 2017, while Mac sales dipped to 5.3 million from 5.4 million.

For the full fiscal year, Apple generated $265.6 billion in sales with $59.5 billion in net income, up from $229.2 billion in sales and $48.4 billion in net income for fiscal 2017. Both figures are also all-time company records, exceeding standards of $233.7 billion in sales and $53.4 billion in net income set in fiscal 2015.

“We’re thrilled to report another record-breaking quarter that caps a tremendous fiscal 2018, the year in which we shipped our 2 billionth iOS device, celebrated the 10th anniversary of the App Store and achieved the strongest revenue and earnings in Apple’s history,” said Tim Cook, Apple’s CEO. “Over the past two months, we’ve delivered huge advancements for our customers through new versions of iPhone, Apple Watch, iPad and Mac as well as our four operating systems, and we enter the holiday season with our strongest lineup of products and services ever.”

Apple's guidance for the first quarter of fiscal 2019 includes expected revenue of $89-93 billion and gross margin between 38 and 38.5 percent.

Apple will provide live streaming of its fiscal Q4 2018 financial results conference call at 2:00 PM Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Conference call recap ahead…

1:55 pm: AAPL's stock is down 4% in after-hours trading, despite the record-breaking revenue. iPhone sales were relatively flat and fell slightly below Wall Street expectations.

1:58 pm: Luca Maestri, Apple CFO: "We concluded a record year with our best September quarter ever, growing double digits in every geographic segment. We set September quarter revenue records for iPhone and Wearables and all-time quarterly records for Services and Mac. We generated $19.5 billion in operating cash flow and returned over $23 billion to shareholders in dividends and share repurchases in the September quarter, bringing total capital returned in fiscal 2018 to almost $90 billion."

1:59 pm: That was a prepared statement from Luca. The conference call begins momentarily.

2:02 pm: Opening remarks from Apple's Senior Director of Investor Relations, Nancy Paxton.

2:04 pm: Tim Cook says he just got back from Brooklyn... capping off a great fiscal year with a record-breaking September quarter.

2:04 pm: Record Q4 earnings. 41% YoY growth in EPS. Record results from iPhones, Services, and Wearables drove momentum. Strong double-digit growth in all of Apple's geographic segments.

2:05 pm: iPhone revenue was up 29% in Q4 vs year-ago quarter, fueled by continued demand for iPhone 8, iPhone 8 Plus, iPhone X, and the launch of iPhone XS and iPhone XS Max.

2:06 pm: Cook says Apple isn't finished yet. iPhone XR reviews have been overwhelmingly positive.

2:07 pm: Cook is recapping iOS 12 features.

2:08 pm: Cook says new iPad Pro is unrivaled in its versatility and performance. Beautifully refined Apple Pencil. iPad Pro will extend its lead as the ultimate creativity and productivity device.

2:08 pm: Best quarter for services ever. $10B. 27% growth in this category YoY if one-time favorable adjustment from year-ago quarter is excluded.

2:09 pm: Exceptional performance of Apple Pay. By far the #1 mobile contactless payments service worldwide. Transaction volume tripled YoY. Apple Pay generated significantly more transactions than even PayPal Mobile. Costco has completed rollout to over 500 US warehouses. 60% of all US retail locations support Apple Pay.

2:09 pm: Apple Pay Cash is highest-rated peer-to-peer payment service by Consumer Reports.

2:10 pm: Quarterly record for Mac revenue thanks to 2018 MacBook Pro and Back to School season.

2:10 pm: Cook recapping macOS Mojave features.

2:11 pm: Cook highlights launch of new MacBook Air with Retina display, Touch ID, latest 8th Gen Intel Core processors, and even more portable design. New Mac mini, also with faster 8th Gen processors. An "amazing" 5x faster performance vs. previous model (editor's note: from 2014, of course!)

2:11 pm: Later this year, ECG app will be available to Apple Watch Series 4 customers in the US.

2:12 pm: Unprecedented and potentially life-saving feature.

2:12 pm: We are proud to bring HomePod to more customers. I was in Spain last week as HomePod became available there and in Mexico. Highest-fidelity audio quality. Over 50 million songs from Apple Music.

2:14 pm: Our retail team posted record Q4 results to post best fiscal year ever. Today at Apple sessions... over 250,000 of them hosted this quarter. Apple Stores hosted 74,000 kids at Apple Camp over summer. Relationship that Apple has with customers is about more than making a purchase, with recent addition of beautiful new stores in Italy, Japan, and in just a few weeks Thailand...

2:15 pm: I'd like to touch on two items integral to Apple's mission and making the world a better place. More than 5,000 colleges/community colleges/technical institutions using Apple's free Everyone Can Code curriculum. Potential not limited by ZIP code or country. Over 350 schools working with Everyone Can Create... collection of free tools and project guides to unleash students' creativity with help of iPad.

2:15 pm: Next, environment. 100% of global operations powered by renewable energy. Made progress in doing the same with our supply chain. 100% recycled aluminum in MacBook Air and Mac mini. Alloy designed by Apple.

2:16 pm: "Unimaginable innovation." I'd like to thank all of our employees, customers, business partners for helping us deliver fantastic results across our 2018 fiscal year. Heading into holiday season with our strongest lineup of products ever... we could not be more bullish about Apple's future.

2:16 pm: Apple CFO Luca Maestri has taken over the call. Reviewing financial results.

2:17 pm: New revenue records in almost every market Apple tracks, especially strong growth in Germany, Italy, Switzerland, Sweden, Japan, South Korea... 25% or higher in each.

2:17 pm: All-time quarterly revenue records for Services and Mac.

2:18 pm: New September quarter records for net income, EPS ($2.91, up 41%), and cash flow from operations ($19.5 billion, up $3.8 billion YoY). iPhone revenue grew 29% YoY. $793 iPhone ASP.

2:18 pm: 46.9 million iPhones sold. Growth of 20% or more in several markets, including Japan, Australia, New Zealand, Norway, Chile, Vietnam...

2:19 pm: iPhone customer satisfaction at 98% for iPhone X + 8 + 8 Plus combined per 451 Research.

2:19 pm: Services: best quarter ever. Revenue of $10B. A year ago, we had a one-time $640M favorable impact to Services revenue due to accounting adjustment, taking that into account, YoY growth of 27%. Well on our way to doubling our Fiscal 2016 services revenue by Fiscal 2020.

2:20 pm: 30,000 third-party subscription apps available on App Store today.

2:21 pm: Mac: great response to our new MacBook Pro models launched in July. Strong double-digit revenue growth driving all-time quarterly revenue record. Especially in emerging markets, Latin America, India, Middle East, Central and Eastern Europe, Africa... active install base of Macs at all-time high.

2:22 pm: 9.7M iPad sales. Gaining share in nearly every market we track, based on latest estimates from IDC. Latin America, India, Japan, etc... Active installed base reached new all-time high. NPD indicates iPad has 68% share of US tablet market in September quarter, up from 54% share YoY. 451 Research has iPad customer satisfaction rate of 96% for iPad + iPad Pro.

2:22 pm: "Wearables growth of over 50%. Strong performance of Apple TV."

2:23 pm: 47 of top 50 airlines around the world have adopted iOS to fly safer and provide better customer experiences.

2:24 pm: Apple's call cut out there for a second... we're back!

2:25 pm: Cash position: $237.1B in cash at start of quarter. $102.5B in term debt. $12B commercial paper outstanding. $122.6B net cash. Our plan is to reach net cash neutral position over time.

2:26 pm: Returned almost $90B to investors during year.

2:27 pm: Apple is implementing new changes to its fiscal reporting to provide additional transparency starting in the December quarter.

2:28 pm: Apple will no longer be providing unit sales for iPhone, iPad, and Mac starting in December quarter. (Wow!)

2:29 pm: Unit sales in 90-day period isn't necessarily an indicator of underlying strength of our business.

2:29 pm: "Other Products" category will be renamed "Wearables, Home, and Accessories" starting in December quarter. This will still include Apple Watch, Apple TV, HomePod, AirPods, Beats, iPod touch, accessories, etc…

2:31 pm: Q&A time!

2:32 pm: Wamsi Mohan, Bank of America asks a question about emerging markets and apps trying to bypass subscription system in App Store.

2:35 pm: Tim Cook says Apple has raised prices in certain markets due to currency fluctuations, resulting in those markets not growing the way Apple would like to see... in India, for example, business in Q4 in India was flat, obviously we'd like to see that be a huge growth, Brazil was down somewhat compared to the previous year... I see these as each one of the emerging markets has a bit of a different story... I don't see it as some sort of issue that is common between those for the most part... in relation to China specifically, I would not put China in that category. Our business in China was very strong last quarter... we grew 16%... iPhone in particular was very strong. Very strong double-digit growth there. Our "Other Products" category was also stronger -- a bit stronger than the overall company number. App Store in China, we have seen a slowdown or moratorium to be more accurate on new game approvals... new regulatory setup in China, things are not moving the way they were moving previously... we did see a few games approved recently, but very far below the historic pace. You've probably seen some of the larger companies there that are public have talked about this as they announce their earnings as well... We don't know exactly when these approvals will return to a normal pace.

2:37 pm: AAPL is now down over 7% following Apple's admission that it will no longer be reporting iPhone, iPad, and Mac unit sales starting in the December quarter. Big news.

2:39 pm: Mohan asks a follow-up question about Apple's impact on healthcare.

2:40 pm: Tim Cook: I think Apple has a huge opportunity in health. You can see from our past several years that we have an intense interest in the space and are adding products and services, non-monetized services, so far to that. I don't want to talk about the future, because I don't want to give away what we're doing, but this is an area of major interest to us. Thank you.

2:40 pm: Shannon Cross, Cross Research: Given $4B range in revenue guidance for next quarter, can you maybe give some details about what went into this? What were the puts and takes? Geopolitical impacts?

2:43 pm: Luca Maestri: At the revenue level, we are very, very excited about the lineup of products and services we have entering holiday shopping season. Strongest lineup we've ever had. Our guidance also represents an all-time Q1 revenue record... first consideration is launch timing of new iPhones is essentially reverse-order vs. last year. Had an effect on Q4 and will have an effect on Q1. Top-end (iPhone X) in Q1 2018, and iPhone 8 and iPhone 8 Plus in Q4 2017 last year... this year, high-end iPhone XS and iPhone XS Max launched in Q4 2017, iPhone XR in Q1 2018... Foreign exchange/currency headwinds also have an impact... to the tune of $2B in USD revenue. Finally, last point... some level of uncertainty at macro economic level in emerging markets where consumer confidence isn't as high...

2:44 pm: Cross asks a follow-up question about Apple's upcoming financial reporting changes/qualitative commentary...

2:46 pm: Maestri: Unit sales are not necessarily representative of underlying strength of our business. Revenue and net income, stock price, etc, over past 3 years, no correlation to unit sales in any given period... As you know well, our product ranges for all the major product categories have become wider over time... therefore, a unit of sale is less relevant for us at this point compared to the past because we have a much wider lineup... as I know that you're aware, our top competitors in smartphones and tablets and computers do not provide quarterly unit sales either... nevertheless, we know this is something of interest, and we believe when providing qualitative commentary is necessary, we will.

2:46 pm: Tim Cook: We will continue to provide revenue guidance at the company level... it's the actual report that changes.

2:47 pm: Mike Olson, Piper Jaffray: With the staggered iPhone launch, were you able to discern any impact on customers potentially waiting for iPhone XR?

2:47 pm: Tim Cook: iPhone XS and iPhone XS Max got off to a really great start... iPhone XR only out there for five days or so at this point... We have very little data there. Usually there is some amount of wait until another product shows up and look. In looking at the sales data for iPhone XS and iPhone XS Max, not obvious evidence of that in the data as I see it.

2:48 pm: Olson: record services revenue, if growth is to continue at this pace, what will be strong drivers in this category?

2:50 pm: Luca Maestri: Apple Music, cloud services, AppleCare, etc, all set records... we have a very large and growing installed base across all major product categories. Opportunity for us to monetize our services business continues to grow over time. We're also improving the quality of the services we provide... over last 3 years, we've added Apple Pay, Apple Music, advertising business on App Store... clearly we want to continue offering new services over time (editor's note: streaming TV service!)... We're very confident about the future in services space.

2:51 pm: Tim Cook: As far as AR, a year ago we came out with ARKit, 6 months later ARKit 1.5, then recently ARKit 2. Number of things you can do are growing significantly. Number of devs working on things growing tremendously. Lots of interest out there. Number of categories growing too -- shopping, gaming, art, historical education... I'm seeing it sort of everywhere I go now. We are in the early days and will keep getting better and better. I'm really happy with where things are at the moment.

2:52 pm: Katy Huberty, Morgan Stanley: Given current trade negotiations and broader geopolitical risk, have you considered diversifying the supply chain? Would that have significant impacts on the business/profitability?

2:54 pm: Tim Cook: Our products are really manufactured everywhere. We have significant content from the US market, from Japan to Korea, many countries. Great content from China as well. Many hands in the products -- vast majority or almost all R&D is in the US, as well as a lot of the support organizations... I think that that basic model where you look around the world and find the best in different areas, I don't expect that model to go out of style so to speak... I think there's a reason why things have developed in that way. I think it's great for all countries and citizens of countries involved in that... I'm still of the mindset... I feel very optimistic and positive that the discussions that are going will be fruitful. These trade relationships are big and complex, and they clearly do need a level of focus and updating and modernization. I'm optimistic that the countries, the US and China, and the US and Europe, and so forth, can work these things out for the benefit of everyone.

2:54 pm: Huberty: Why aren't we seeing the drop in NAND memory prices reflected in wider profit margins for December quarter?

2:55 pm: Luca Maestri: You're correct. We're going to be getting some benefits from commodities -- memory, etc. -- on a sequential basis. On the other hand, currencies have weakened against the US dollar and the impact that we expect at the gross margin level is a 90-basis point headwind sequentially. At this point, we also have higher cost structures, because we've launched so many products in the past 6 weeks…

2:58 pm: Tim Cook on question about India: We have great discussions with Indian government. I fully expect at some point they'll allow us to bring our stores into the country. We've been in discussions with them and they're going quite well. There are import duties in some or most of the product categories that we're in... in some cases, they compound... this is an area that we're giving lots of feedback on. We do manufacture some of the entry iPhones in India, and that project has gone well. I am a big believer in India. I am very bullish on the country and the people and our ability to do well there. The currency weakness has been part of our challenge there, as you can tell just by looking at currency trends... The long term there is very, very strong... large number of people who will soon move into middle class... government has made some bold moves, and sort of can't wait for the future there.

3:01 pm: Luca Maestri on Apple's decision to stop reporting iPhone, iPad, and Mac unit sales going forward: in terms of reporting results, one of the things we are doing is it's new and in addition to the information we provide to investors, because we've heard some significant level of interest is this, is starting with the December quarter we're going to be providing info about revenue and cost of sales, and therefore gross margins, for both products and services... important metric for our investors to follow... we do not believe that providing unit sales is particularly relevant for our company at this point, I can assure you it is our goal to build our unit sales for every product category still... but unit sales are less relevant for our company now... we will provide qualitative commentary when it is important... but at the end of the day we make our decisions to try to optimize our revenue…

3:01 pm: Tim Cook: Our installed base is growing double-digits... that's probably a much more significant metric for us from an ecosystem point of view, customer loyalty, etc... second thing, this is sort of like when you go to the market, and you go up to the cashier, and she, or he, says, how many units do you have in there? It doesn't really matter how many units are there, as opposed to the overall value of the cart.

3:02 pm: The Q&A session and Apple's earnings call has concluded. Stay tuned to MacRumors for continued coverage.

3:02 pm: A replay will be available by approximately 5:00 p.m. Pacific Time on Apple's Investor Relations website today.