Quicken today announced the launch of Quicken 2019, the newest version of its popular finance and budgeting software for PC and Mac.

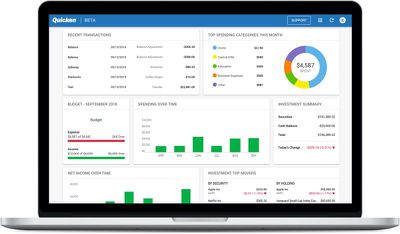

Quicken 2019 introduces web access for the first time, designed to allow Quicken customers to manage their finances online using Chrome, Safari, and other web browsers.

Users are able to check their balances, monitor transactions, view budgets, check spending trends, view past expenses, and access info on their accounts and investment holdings at any time.

A customizable web dashboard created for the web access experience lets customers customize their personal view to see full details on all features Quicken has to offer or a streamlined view with just essential information.

"Millions of people use Quicken to help them manage their financial lives. Because Quicken is important to them, our community of users is incredibly engaged. We prioritize updates primarily based on feedback from these users, and adding web access was the number one requested enhancement," said Eric Dunn, Chief Executive Officer of Quicken. "As an agile, independent company, we've been able to deliver this highly-anticipated feature, among other exciting new customer-inspired updates, on schedule and with great quality. This increased pace of releases and improvements is something our customers can count on and look forward to in the future."

Quicken 2019 also features several enhancements on the desktop, which are designed to offer up an overall faster experience. Quicken for Mac, for example, is up to twice as fast.

The software opens up quicker, charts and graphs load twice as fast, and backing up is four times faster than it was in previous versions of Quicken.

Quicken in 2018 launched a new monthly membership feature so customers who pay for a subscription will get access to Quicken 2019 at no additional cost. There are several plans available for purchase at different price points.

Quicken Starter with budgeting is available for $34.99 for a one-year membership, while Quicken Deluxe is available for $49.99 per year.

Quicken Premiere, with portfolio monitoring functionality and tax advice, is priced at $74.99 per year, while Quicken Home & Business is priced at $99.99.

Top Rated Comments

I had been using 2015 (and Essentials and previous versions) for the Mac, and was perfectly happy with it as my home ledger version of my accounts. As soon as Intuit sold off Quicken Mac and they went subscription only, they not only lost me because of the subscription, but because they actually intentionally "broke" basic functionality of my Quicken 2015 software. I am no longer able to import account files I download (not even directly link) from creditors. They also force nag screens to upgrade at every launch that use "dark" UI patterns in order to dismiss, and you are not able to dismiss permanently. I keep thinking what they did to owners of existing/past software must be illegal in some way. This article reminds me, I need to report them to the BBB (for all the good that'll do).

P.S. I've been researching Quicken alternatives for Mac recently and been curious about Banktivity and a few others that don't require you to store everything in the cloud or lock your data into a subscription. Any recommendations/endorsements?

I actually think Quicken has improved significantly since Intuit sold it to HIG Capital in 2016. I have the 2017 Quicken Mac version and it's great. One time purchase and no subscription. All the useless sales and promotional and extra services fluff has been stripped out and now it's a no-nonsense piece of software. I can download all my transactions from various financial institutions without issue and without additional cost.

I tried Banktivity and it was okay, but to get most of the automatic downloads from my banks, I had to subscribe to their Direct Access subscription service at $45 per year. No thanks.

It handles investments, real estate, loans, etc. fairly well. I do like Quicken's investment presentation a little better, but its certainly good enough with Banktivity. The custom folders and organization of Banktivity is also a huge plus. Quicken force-feeds your accounts in to certain categories, which I hated. I have retirement accounts, accounts for my kids, personal brokerage accounts, etc. that I like to keep organized a particular way.

The 'upcoming transactions' organization did take a little getting used to with several quirks that didn't seem very intuitive. I still make mistakes once in a while setting up recurring transactions. But after you get used to it, again, its not bad at all.

I guess what I'm saying is if you were a fan of Quicken, you'll like Banktivity once you get used to the minor differences.