Consumer Intelligence Research Partners this afternoon shared analysis comparing data collected from Spotify subscribers in the United States and Spotify subscribers globally, finding some notable differences in habits between the two.

Spotify has a lower percentage of Spotify Premium subscribers in the United States compared to the global share, according to CIRP, which CIRP attributes to the competitive U.S. market that offers many different services from Apple, Google, Amazon, and others.

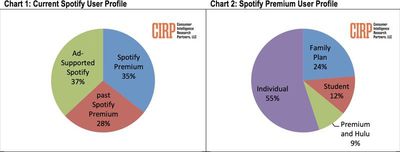

In the United States, 35 percent of Spotify users have signed up for a premium subscription, while the other 65 percent listen to the company's free tier or were previously Spotify Premium subscribers.

Of premium subscribers in the U.S., 55 percent have individual accounts, 24 percent use a family plan, 12 percent have student subscriptions, and 9 percent have a subscription that combines access to Spotify Premium and Hulu.

"In our first survey of Spotify users, we can see differences between the US and the rest of the world," said Josh Lowitz, Partner and Co-Founder of CIRP. "In the US, a somewhat lower percentage of listeners have Spotify Premium compared to the global share.

The US is a competitive market, with a number of options for both free and paid streaming music. And, among these Premium subscribers, over half have the standard Individual membership, while one-quarter have the broader Family Plan, which offers multiple individual accounts for a single higher monthly fee. A significant percentage of Spotify customers have chosen these alternative subscription options."

During the second quarter of 2018, which is when the data was collected, 11 percent of ad-supported Spotify listeners started a trial Premium subscription, while 74 percent of subscribers continued with a paid Premium subscription when a trial ended.

16 percent of Premium subscribers ended a subscription and reverted to the free listening tier or stopped using Spotify all together, a churn rate that CIRP says is higher than Spotify's global churn rate.

"Spotify's financial success depends on creating a robust funnel of users, converting casual listeners that download the app to long-term paid Premium subscribers," said Mike Levin, Partner and Co-Founder of CIRP. "Spotify encourages free Ad-Supported listeners to begin a free or nearly-free trial of a Premium subscription, typically of seven or thirty days. It then seeks to convert that trial to some form of paid Premium, with users paying for the service monthly. The monthly payment plan does allow Premium subscribers to cancel at any time, a situation that Spotify calls 'churn'.

We estimate a US churn rate of 16% for the quarter, higher than what Spotify suggests is the global rate. Again, we attribute this to a competitive US market, with many choices for paid and free streaming music services."

While Spotify and Apple Music both operate in multiple countries around the world, Apple Music has been gaining popularity rapidly in the United States since its 2015 launch.

In early July, an anonymous source from a major U.S.-based distributor told Digital Music News that Apple Music has surpassed Spotify's subscriber count in the United States, something The Wall Street Journal accurately predicted would happen this summer given the subscriber growth rates of the two companies.

Both Apple Music and Spotify are said to have more than 20 million subscribers in the United States, with Apple "a hair ahead" of Spotify. Spotify and Apple Music do not break down their subscriber counts by country, so there's no official confirmation.

Spotify in May announced that it has a total of 75 million paid subscribers worldwide, and Apple during the same month said that it has 50 million paid subscribers and free trial users around the globe. Spotify's total user base continues to be much larger -- 170 million active users - due to the free ad-supported tier that Spotify offers.

Customers in the United States have a lot of choice when it comes to streaming music services. Along with Apple Music and Spotify, Pandora Radio, SoundCloud, Google Play Music, Amazon Music and others offer subscription options.

CIRP's Spotify data for its report was gathered from surveys of 500 U.S. participants who used Spotify from April to June 2018.

Top Rated Comments

It also has much better music suggestions and localised content.

Flame me. I can take it! :)

Think about it. They got the first-mover advantage and they amassed tons of users. Seems great, right?

But as Spotify adds more users... they actually lose more money. So every new customer costs them money.

Oh I hear what you're saying. Apple is the first credible threat to Spotify.

But Spotify has been losing money long before Apple got onto the scene.

I just re-started a trial of Apple Music... I think it was even worse than when I first tried it out at launch.

Spotify all the way, and that's coming from an :apple: fanboy like myself.