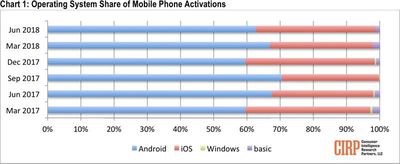

During the second quarter of 2018, spanning from April to June, Apple's iPhones accounted for 36 percent of total U.S. smartphone activations, an improvement over last year's numbers where iPhone activations accounted for just over 30 percent of total activations, according to new numbers shared today by Consumer Intelligence Research Partners [PDF].

More customers are choosing iPhone over Samsung devices this year, and Apple's higher number of activations came at Samsung's expense. During the quarter, Samsung devices were also responsible for 36 percent of new activations, but for Samsung, that's a solid decline from last year.

"Apple improved in part at Samsung's expense, whose share of activations declined relative to both last quarter and last year," said Mike Levin, Partner and Co-Founder of CIRP. "In a quarter without any significant phone launches, Samsung had market share only equal to Apple's. A year ago, Samsung had a considerably greater share of sales."

Apple devices and Samsung devices are the dominant brands, due to ongoing consolidation of the U.S. market. LG and Motorola, for example, have lost ground to Apple and Samsung over the course of the last year.

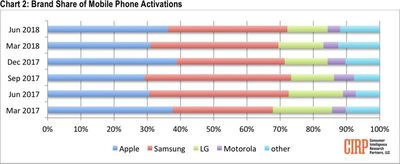

When it comes to operating systems, iOS and Android are, by far, the dominant operating systems in use. iOS accounted for 36 percent of activations during the quarter, while Android, which runs on an array of different smartphones from multiple manufacturers, accounted for 63 percent of U.S. activations.

Compared to last year, iOS's share of activations grew, with CIRP citing increased customer loyalty to their operating system of choice. Given the sheer number of Android devices compared to iOS devices, it's not surprising Android devices are responsible for approximately two thirds of activations.

Consumer Intelligence Research Partners regularly shares these surveys to monitor the state of the smartphone market. Findings are based on a survey of 500 subjects who activated new or used phones during the April to June 2018 period.

Top Rated Comments

Samsung had 42% activations in the Mar QTR - the quarter where they released the S9. Apple had 31% during that QTR. The next QTR when they had nothing new, Sammy lost 6% share of activations while Apple gained 5%. What that tells me is Apple has more stable sales year round. I think both companies know that. Probably why Apple typically has a single Fall intro and Samsung has a Spring and a Fall intro approx 6 mths apart to keep sales from ebbing and flowing too much.

Google's Pixels are akin to Microsoft's Surfaces. High brand awareness, low actual sales. Neither has ever been out of the "Other" categories. Neither probably will be either... at least for a long time. I personally like both brands, but that doesn't change the fact that they are more brand than sales.

tl;dr Samsung and Apple lead. Sammy didn't have it as rough as you seem to think.