Apple was the largest buyer of semiconductor chips after Samsung in the whole of last year, according to new data collected by Gartner. The two companies together consumed $81.8 billion of the chips in 2017, up from more than $20 billion in 2016, and combined they represented 19.5 percent of the total worldwide market (via DigiTimes).

"Samsung Electronics and Apple not only retained their respective No. 1 and No. 2 positions, they also radically increased their share of semiconductor spending through 2017," said Masatsune Yamaji, principal research analyst at Gartner. "These two companies have held on to the top positions since 2011 and they continue to exert significant influence on technology and price trends for the whole semiconductor industry."

Eight of the top 10 companies in 2016 remained in the top 10 in 2017, while the top five chip buyers stayed in the same positions. LG Electronics returned to the top 10, with the only newcomer being Western Digital, which grew its semiconductor spending by US$1.7 billion in 2017, according to Gartner.

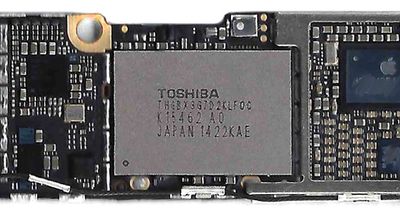

In September, Toshiba agreed to sell its lucrative NAND memory chip unit to a global consortium that includes Apple, in a deal reportedly worth $17.7 billion. Apple is interested in the memory chip unit because NAND flash is an essential component of its iPhones and iPads. Only a handful of companies make the chips and the dominant player is Samsung, Apple's biggest rival in the smartphone industry.

Semiconductor spending by the top 10 OEMs reached 40 percent of the total semiconductor market last year, up from 31 percent 10 years ago. The trend is expected to continue, according to Gartner, which predicts that the top 10 OEMs will account for more than 45 percent of total global semiconductor spending by the year 2021.

Top Rated Comments