Two U.K. banks today updated their mobile apps to support Face ID, the facial authentication feature exclusive to iPhone X, which officially launches on Friday, November 3.

Nationwide and Bank of Scotland became the first mobile banking apps in the U.K. to provide compatibility with Apple's new facial recognition technology, which is set to replace Touch ID fingerprint authentication on all future iPhones and iPads, according to respected KGI Securities analyst Ming-Chi Kuo.

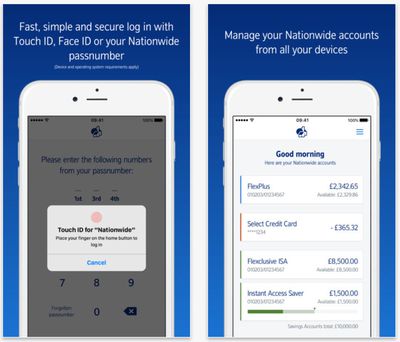

The two banking apps already provide a Touch ID option to authenticate customers when they attempt to log in to their accounts, so the fact that Face ID is being offered as an alternative option shows that the financial sector has full trust in Apple's new security technology, despite tests showing that it can be fooled by identical twins.

Apple has admitted that Face ID may not be able to distinguish between identical twins and in such cases recommends users protect sensitive data with a passcode instead. Otherwise, Apple says the chance that a random person in the population could look at your iPhone X and unlock it with their face is about one in a million (compared to one in 50,000 for Touch ID).

Face ID has proved to be reliable in early iPhone X reviews and first impressions, and it's also considered easy to set up and use, but Apple likely still has some work to do to convince the general public that facial authentication is the future. According to a research conducted by Top10VPN.com in October, over half (60 percent) of British consumers remain unconvinced by facial recognition. Only two in five (40 percent) consumers believing Face ID is a good idea, while 79 percent of Brits prefer to unlock their devices with a fingerprint or passcodes. (Poll sample size: 2,048 adults.)

Top Rated Comments