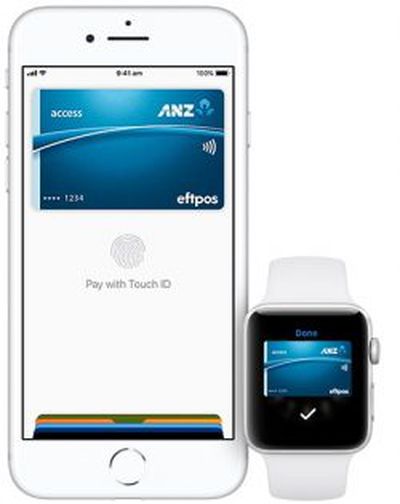

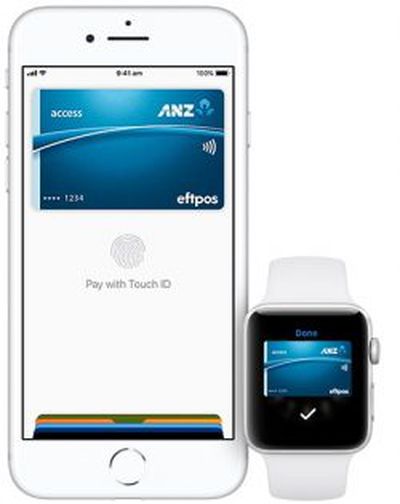

ANZ Eftpos Access Cards Now Support Apple Pay in Australia

Eftpos, a debit payments network in Australia, today announced that ANZ eftpos Access cards now feature support for Apple Pay.

Eftpos, a debit payments network in Australia, today announced that ANZ eftpos Access cards now feature support for Apple Pay.

ANZ is the first bank in Australia to make in-store eftpos mobile payments available to 1.6 million ANZ eftpos Access cardholders through Apple Pay.

Visa, American Express, and MasterCard credit and debit cards issued in Australia by participating banks already supported Apple Pay, but the addition of eftpos is notable as it's widely used in the country.

"Today marks a significant milestone for eftpos as we move from our traditional card based payment method into mobile, enabling consumers with an iPhone or Apple Watch to choose the eftpos account they wish their mobile payment to be made from, being either their eftpos CHQ/SAV account. Customers can set their account preference out of CHQ/SAV and then save themselves entering their account each time they pay. After providing trusted, secure card-based payments for 30 years, eftpos can now also be used to make mobile payments," Mr Jennings said.

"About 1.6 million ANZ eftpos Access cardholders now have the opportunity to make payments on an iPhone or Apple Watch, many of whom may not have had the opportunity to make in store mobile payments before. As Australia's most used debit card network, we are thrilled to be providing ANZ eftpos Access customers with more payment choice, with added benefits of enhanced security and comfort."

As Business Insider points out, support for eftpos reduces fees for both customers and retailers compared to other payment methods.

Support for eftpos is now listed on Apple's Australian Apple Pay website and Apple Pay is available to ANZ Access card customers in Australia immediately.

Popular Stories

Apple's next-generation iPhone 17 Pro and iPhone 17 Pro Max are less than three months away, and there are plenty of rumors about the devices.

Apple is expected to launch the iPhone 17, iPhone 17 Air, iPhone 17 Pro, and iPhone 17 Pro Max in September this year.

Below, we recap key changes rumored for the iPhone 17 Pro models:Aluminum frame: iPhone 17 Pro models are rumored to have an...

Apple is developing a MacBook with the A18 Pro chip, according to findings in backend code uncovered by MacRumors.

Earlier today, Apple analyst Ming-Chi Kuo reported that Apple is planning to launch a low-cost MacBook powered by an iPhone chip. The machine is expected to feature a 13-inch display, the A18 Pro chip, and color options that include silver, blue, pink, and yellow.

MacRumors...

In 2020, Apple added a digital car key feature to its Wallet app, allowing users to lock, unlock, and start a compatible vehicle with an iPhone or Apple Watch. The feature is currently offered by select automakers, including Audi, BMW, Hyundai, Kia, Genesis, Mercedes-Benz, Volvo, and a handful of others, and it is set to expand further.

During its WWDC 2025 keynote, Apple said that 13...

Apple hasn't updated the AirPods Pro since 2022, and the earbuds are due for a refresh. We're counting on a new model this year, and we've seen several hints of new AirPods tucked away in Apple's code. Rumors suggest that Apple has some exciting new features planned that will make it worthwhile to upgrade to the latest model.

Subscribe to the MacRumors YouTube channel for more videos.

Heal...

Apple is planning to launch a low-cost MacBook powered by an iPhone chip, according to Apple analyst Ming-Chi Kuo.

In an article published on X, Kuo explained that the device will feature a 13-inch display and the A18 Pro chip, making it the first Mac powered by an iPhone chip. The A18 Pro chip debuted in the iPhone 16 Pro last year. To date, all Apple silicon Macs have contained M-series...

Popular accessory maker Anker this month launched two separate recalls for its power banks, some of which may be a fire risk.

The first recall affects Anker PowerCore 10000 Power Banks sold between June 1, 2016 and December 31, 2022 in the United States. Anker says that these power banks have a "potential issue" with the battery inside, which can lead to overheating, melting of plastic...

Chase this week announced a series of new perks for its premium Sapphire Reserve credit card, and one of them is for a pair of Apple services.

Specifically, the credit card now offers complimentary annual subscriptions to Apple TV+ and Apple Music, a value of up to $250 per year.

If you are already paying for Apple TV+ and/or Apple Music directly through Apple, those subscriptions will...

As part of its 10-year celebrations of Apple Music, Apple today released an all-new personalized playlist that collates your entire listening history.

The playlist, called "Replay All Time," expands on Apple Music's existing Replay features. Previously, users could only see their top songs for each individual calendar year that they've been subscribed to Apple Music, but now, Replay All...

Eftpos, a debit payments network in Australia, today announced that ANZ eftpos Access cards now feature support for Apple Pay.

Eftpos, a debit payments network in Australia, today announced that ANZ eftpos Access cards now feature support for Apple Pay.