The music industry is facing a "fragile recovery" at the hands of popular streaming services like Apple Music and Spotify, according to new data collected by the Recording Industry Association of America (via Bloomberg). In total, the music industry in the United States is on track to grow for the second year in a row, which would mark "the first back-to-back growth since 1998-1999."

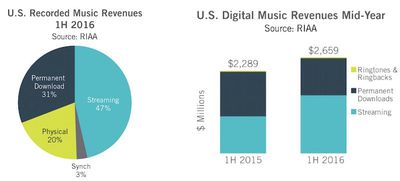

RIAA's data showed that streaming revenue in the U.S. grew 57 percent in the first half of 2016, reaching $1.6 billion, and accounted for almost half of industry sales, while subscriptions totaled $1.01 billion. Altogether, the industry grew 8.1 percent to $3.4 billion in the first half of 2016, which is on track to best the $7 billion yearly average of the last six years.

Apple Music and Spotify remain the biggest forces in the streaming market, and a few label executives noted that "most of the users for Apple Music are people new to paying music, not former Spotify customers." At the last recorded subscriber count, Spotify had 40 million paid subscribers worldwide, while Apple music had 17 million.

Nor is this the first time new technology has come along to get people to pay online. Apple Inc. co-founder Steve Jobs convinced record labels that iTunes would save the industry from piracy, only to vaporize album sales by selling singles instead.

Yet Apple is no longer the only player in the market for digital music. Spotify operates a larger paid subscription service and has showed no signs of slowing down since Apple Music began competing in that market. Most of the users for Apple Music are people new to paying music, not former Spotify customers, according to label executives.

Understandably, retail spending on physical media isn't accounting for any of the overall industry growth. Physical music sales dropped 14 percent in RIAA's data of the first half of 2016, while paid downloads -- like those offered in the traditional iTunes store -- "also shrank by a double digit percentage." Free streaming grew 24 percent in the same data, to $195 million, but "those services aren’t doing enough to convince people to pay for music," nor are they making enough money off free users to continue staying afloat.

That could potentially be why popular free music platforms, like Pandora, are gearing up to introduce new paid listening tiers for users. Amazon is planning to do the same, and both services are predicted to match Apple Music's $9.99 per month cost, while offering similar on-demand singles, albums, radio, and playlists for listeners.