Apple today will release its fiscal third quarter earnings results, reflecting a three-month period that ended in late June, and the consensus among analysts is that the company will report a second consecutive decline in iPhone sales and overall revenue. That same scenario played out last quarter for the first time since 2003.

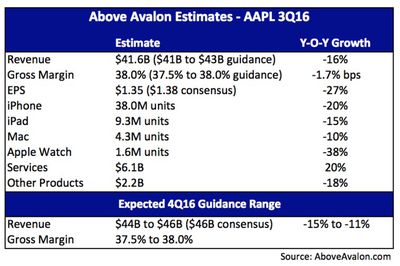

In fact, some analysts have forecasted that iPhone sales may be as low as 38 million to 40 million units, a decline of up to 20 percent compared to the year-ago quarter. If the estimates prove to be accurate, it would mark Apple's worst quarter of iPhone growth ever in the smartphone's nine-year history.

Apple itself provided guidance of between $41 billion and $43 billion in revenue, which would be up to 18 percent lower than the $49.6 billion in revenue it posted in the year-ago quarter. Wall Street expects revenue to be around the $42.1 billion mark, with earnings of $1.39 a share -- one analyst has EPS as low as $1.35.

iPhone accounts for around two-thirds of Apple's revenue, and an even greater portion of its profits, so the device's recent slide is concerning for investors -- reflected in the price of Apple shares, down around 21 percent from a 52-week high of $123.91. The good news for Apple is that many analysts believe it will "bottom out" in the June quarter and return to iPhone and revenue growth by the 2017 fiscal year.

But, until then, the bleeding is expected to continue. iPad sales are forecasted to decline for a tenth consecutive quarter, while market research firm IDC's estimated Apple Watch sales of 1.6 million in the June quarter would be 55 percent lower than the year-ago launch quarter. Mac sales are also projected to decline by up to 10 percent as buyers await a 2016 MacBook Pro and other new models.

As emphasized by Apple CEO Tim Cook, the recent decline in Apple's hardware sales has been offset by growth in the company's expanding services category, including the likes of Apple Music, Apple Pay, AppleCare, and licensing. That trend looks set to continue, as Above Avalon analyst Neil Cybart forecasts service revenue was $6.1 billion in the June quarter for 20 percent year-over-year growth.

Beyond the third quarter, attention has turned to tempered expectations surrounding the upcoming iPhone 7. The consensus among analysts is that a perceived lack of new features coming to the next-generation smartphone could result in a "mega upgrade cycle" for the so-called iPhone 8 rumored for 2017. Next year's model is already rumored to feature a new design with an OLED display and glass casing.

Apple will publish its third quarter earnings report at 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time), and we will share the results shortly thereafter. MacRumors will then provide live coverage of the ensuing conference call with Cook and Apple CFO Luca Maestri at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time).