Apple will report its fiscal third quarter earnings results tomorrow, and both the company and analysts project a year-over-year decline in iPhone sales and overall revenue for a second consecutive quarter.

Apple expects third quarter revenue of between $41 billion and $43 billion, which would be up to 18 percent lower than the $49.6 billion in revenue it posted in the year-ago quarter. The consensus among analysts is around $42.1 billion in revenue, which is essentially the midpoint of Apple's guidance.

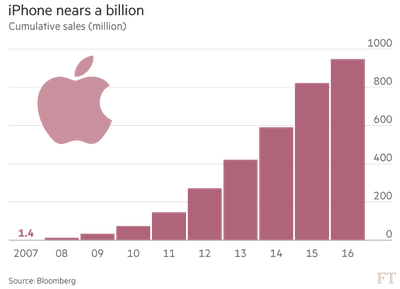

Analysts estimate that Apple sold at least another 40 million iPhones during the June quarter, raising lifetime sales of the smartphone to some 987 million. Applying that sales rate to July -- just over 13 million iPhones per month -- it is likely that Apple will have sold its billionth iPhone between now and the end of this month.

The milestone comes at a time when iPhone sales are on the decline for the first time since the smartphone launched in 2007, an arguably inevitable lull following the smash-hit success of the larger-screened iPhone 6 series. The decline has affected Apple shares, which are down around 21 percent from a 52-week high of $123.91.

Nevertheless, many Wall Street firms expect iPhone growth to resume in 2017. The good news could extend to Apple's stock, as The Wall Street Journal yesterday reported that its "shares have been punished more than enough" and are due for a rally. It said the decline in iPhone sales "appears priced in."

Still, Apple has been punished more than enough. The iPhone slump appears priced in. And while the next iPhone, expected later this year, likely won’t be a significant upgrade, there is optimism that sales growth will soon bounce back. Analysts forecast iPhone unit sales will rise 5% for fiscal 2017, which ends next September.

After briefly touching the $100 mark last week for the first time since early June, Apple shares are currently trading around the $98 mark, a price that some analysts feel undervalues the company.

Apple analyst Brian White of Drexel Hamilton reiterated his "buy" rating for AAPL today, based on a projected price target of $185. UBS analyst Steven Milunovich also issued a "buy" rating today with a 12-month price target of $115.

Apple is expected to introduce a wide range of new products in the second half of 2016 that could further raise its stock price, including the iPhone 7, Apple Watch 2, and long-awaited 2016 MacBook Pro.

Apple's third quarter earnings results will be released at 1:30 p.m. Pacific Time, followed by a conference call with CEO Tim Cook and CFO Luca Maestri at 2:00 p.m. Pacific Time. MacRumors will be providing live coverage of the news.

Update: BGC analyst Collin Gillis has, to the contrary, downgraded AAPL to a "sell" with a lower price target of $85. Apple shares are down nearly 1 percent in intraday trading, now hovering closer to the $97 mark.