Chime Banking Now Supports Apple Pay

Chime Banking, a smartphone-based banking company, announced today that it now supports Apple Pay in the U.S. for both in-store and in-app payments.

Chime Visa debit cards can be added to Apple Pay by tapping the "Add Credit or Debit Card" option in the Wallet app on iOS 8.1 or later on compatible iPhones.

Chime Banking is an app that provides over 120,000 customers with FDIC-insured spending and savings accounts that are managed entirely from a smartphone.

The benefits of creating a Chime Banking account include no minimum or monthly fees, no overdrafts, personalized rewards, savings mechanisms, two-factor authentication, and no-fee ATM access at over 24,000 MoneyPass locations.

Chime Banking has no physical locations, so direct deposits and bills can be set up or paid using your Chime card number, by providing your routing and account number to the payee, or by mailing a check from the app.

Chime Banking is free on the App Store [Direct Link] for iPhone and Apple Watch.

Popular Stories

In an all-caps post on Truth Social today, U.S. President Donald Trump said Apple should fully end its diversity, equity, and inclusion (DEI) policies.

Tim Cook meeting with President Trump in 2017

"APPLE SHOULD GET RID OF DEI RULES, NOT JUST MAKE ADJUSTMENTS TO THEM," he wrote.

Trump's post comes one day after Apple held its annual shareholders meeting, during which a majority of...

In a recent press release, Apple confirmed that iOS 18.4 will be released in April.

From the Apple News+ Food announcement:Coming with iOS 18.4 and iPadOS 18.4 in April, Apple News+ subscribers will have access to Apple News+ Food, a new section that will feature tens of thousands of recipes — as well as stories about restaurants, healthy eating, kitchen essentials, and more — from the...

The Apple Watch Ultra 3 is expected to launch later this year, arriving two years after the previous model with a series of improvements.

While no noticeable design changes are expected for the third generation since the company tends to stick with the same Apple Watch design through three generations before changing it, there are a series of internal upgrades on the way.

By the time the ...

Apple is making significant headway on its long-rumored foldable iPhone, with a new report suggesting the company has achieved a major breakthrough by effectively eliminating the screen crease that plagues current foldable devices.

According to Korean publication ETNews, Apple is finalizing its component suppliers for the foldable iPhone, with the selection process expected to be completed...

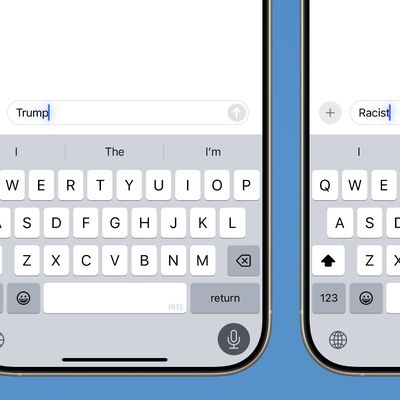

Multiple iPhone owners today noticed a pronunciation processing issue that causes the word "Trump" to momentarily show up when using dictation to send a message with the word "racist."

In some cases, when speaking the word racist through the iPhone's built-in dictation feature, the iPhone briefly interprets the spoken word as "Trump" and "Trump" text shows up in the Messages app before being ...

According to a post on X today from a leaker known as Kosutami, Apple plans to launch AirPods Pro 3 in May or June this year.

The leaker also claimed that an AirTag 2 will launch around the same time.

Kosutami is best known as a collector of prototype Apple hardware, but they have occasionally shared accurate information about Apple's future product plans. For example, they accurately...

Apple plans to launch a second-generation AirTag in May or June this year, according to a post today from a leaker known as Kosutami.

Bloomberg's Mark Gurman previously reported that a new AirTag would be released in mid-2025. May or June would align with that timeframe.

Below, we recap three new features rumored for the AirTag 2:

With a second-generation Ultra Wideband chip, the...

The first beta of iOS 18.4 is now available, and it includes a small but useful change for CarPlay.

As we noted in our list of iOS 18.4 features, CarPlay now shows a third row of icons, up from two rows previously. However, this change is only visible in vehicles with a larger center display. For example, a MacRumors Forums member noticed the change in a Toyota Tundra, which can be equipped...