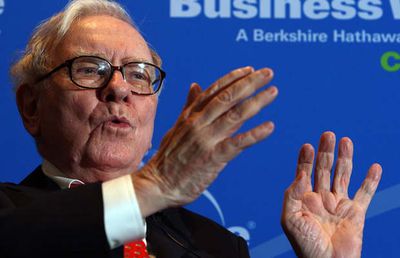

A regulatory filing by multinational conglomerate Berkshire Hathaway -- which is run by Warren Buffett -- today revealed that as of March 31, the company owned 9,811,747 shares in Apple stock (via Bloomberg). Berkshire Hathaway's shares were valued at over $1 billion at the end of the first quarter of 2016, but given Apple's recent dip in stock value, it has subsequently declined to nearly $900 million.

Berkshire Hathaway's stake in Apple appears to be a bet that the Cupertino company's stock will rebound, following its first ever year-over-year revenue drop in 13 years. The slump comes after Apple's April earnings call where it announced the first ever drop in iPhone sales in the 9 years that the smartphone has been on the market. Last week, shares of the company fell below $90 for the first time in nearly two years, but after Berkshire Hathaway's disclosure, Apple's stock price rose 2.2 percent to $92.50 in early trading Monday morning.

Earlier in April, Apple investor Carl Icahn decided to sell his stake in the company, explaining that he did so due to concern over China's attitude towards Apple's encroaching presence in the country. A second Apple investor, David Tepper, also dumped his shares of the company as its value continued to lessen. Tepper had 1.26 million shares that were valued at around $133 million.

Top Rated Comments

The two guys in the other story are traders. Berkshire is an investor. Long term.

It was Warren's lieutenants, Ted Weschler or Todd Combs that made the trade. Imagine if you can buying that many shares and not appreciably impacting the stock price upwards. Can you say limit orders from several terminals? Their average price? $93.

According to their SEC 13F filings, they added Apple, increased IBM, Phillips 66 and Visa, decreased WalMart, Procter and Gamble (99%), and MasterCard. They dumped AT&T.

They have a policy of buying back any Berkshire A shares at +20% if any investor wants to exit. Virtually none do. Last price: $212,140 per share.

Apple needs to get off its high horse and cuts those profit margins in half