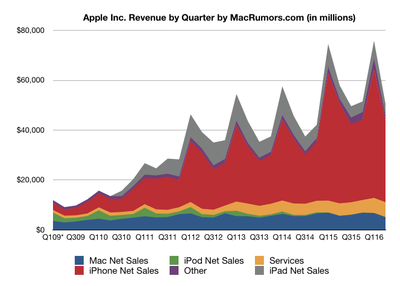

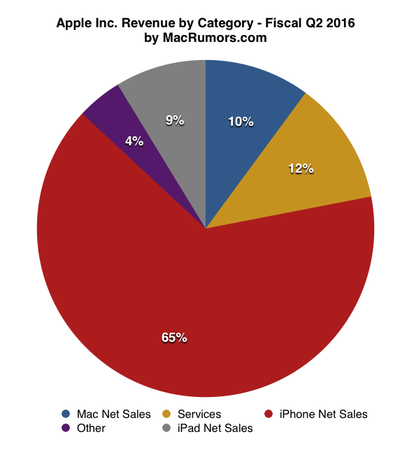

Apple today announced financial results for the second fiscal quarter (first calendar quarter) of 2016. For the quarter, Apple posted revenue of $50.6 billion and net quarterly profit of $10.5 billion, or $1.90 per diluted share, compared to revenue of $58 billion and net quarterly profit of $13.6 billion, or $2.33 per diluted share, in the year-ago quarter. As expected, the year-over-year decline in quarterly revenue was the first for Apple since 2003.

Gross margin for the quarter was 39.4 percent compared to 40.8 percent in the year-ago quarter, with international sales accounting for 67 percent of revenue. Apple also declared an increased quarterly dividend payment of $0.57 per share, up from $0.52. The dividend is payable on May 12 to shareholders of record as of May 9. The company currently holds $233 billion in cash and marketable securities, partially offset by $77 billion in long-term debt.

In addition to the increase in the dividend payment, Apple says it will once again expand its share repurchase authorization by an additional $35 billion to $175 billion and the company says it expects to spend over $250 billion in cash under its capital return program by the end of March 2018.

Apple sold 51.1 million iPhones during the quarter, down from 61.2 million a year earlier, while Mac sales were 4.03 million units, down from from 4.56 million units in the year-ago quarter. iPad sales were also down once again, falling to 10.25 million from 12.6 million.

“Our team executed extremely well in the face of strong macroeconomic headwinds,” said Tim Cook, Apple’s CEO. “We are very happy with the continued strong growth in revenue from Services, thanks to the incredible strength of the Apple ecosystem and our growing base of over one billion active devices.”

Apple's guidance for the third quarter of fiscal 2016 includes expected revenue of $41–43 billion and gross margin between 37.5 and 38 percent.

Apple will provide live streaming of its fiscal Q2 2016 financial results conference call at 2:00 PM Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Conference Call and Q&A Highlights are available in reverse chronological order after the jump.

3:02 pm: Call has ended.

3:01 pm: Cook: Only thing I'll add is we're seeing increasing numbers of people in both parties look toward tax reform, so we're optimistic it will happen.

3:01 pm: Maestri: We're still looking at these, but at first glance, not a material impact. We don't expect any issue there. We are the largest U.S. taxpayer by a large margin, and we pay all of the required tax on our U.S. sales. Tim pay want to talk more about tax reform, but I'll say we've long been a strong proponent of tax reform, and we're optimistic we'll see that point where reform happens. And at that point, hopefully we can be more flexible with our capital.

2:59 pm: Hall: Looking at tax situation and new regulations...what's the impact?

2:59 pm: Cook: We did not contemplate we were going to make a $2 billion channel reduction this quarter. If you look at true demand, you'll find a more reasonable comparison.

2:58 pm: Rod Hall: As you think about how things have changed over this quarter, what are top 2 or 3 three things that changed?

2:57 pm: Cook: It depends on what you compare it to. Compared to 5s, what we're seeing today is slightly higher in terms of rate. But compared to 6, you'd clearly arrive at opposite conclusion. So it depends on reference point. We're trying to be clear and transparent about what we're seeing. Everybody intuitively thought 6 upgrade was accelerated, and they clearly were.

2:56 pm: Milunovich: On upgrades, you pulled forward some upgrade, but in the U.S. at least, carriers have talked about lengthening upgrade cycles. What are you seeing?

2:55 pm: Cook: Most important thing is that we want a great customer experience. So overwhelming we embark on services that help that and become part of ecosystem. In doing so, we've developed a large and profitable business in services. We felt last quarter and working up to that, we should pull back the curtain so investors can see scale and growth of it. It's huge.

2:54 pm: Steve Milunovich: How do you view services? Primary driver of earnings, or supporter of ecosystem and hardware?

2:53 pm: Maestri: You see different dynamics. Continued investment in R&D as the future of the company. We do much more in-house tech development than we used to, which is a great investment. So we continue to invest in the business. SG&A was down slightly, and that was because we look at revenue trend and make changes accordingly. We're being very tight and disciplined there.

2:51 pm: Cross: Asking about cost containment and other operating expenses and leverage.

2:51 pm: Cook: Greater China, which includes Taiwan and Hong Kong, the vast majority of weakness sits in Hong Kong. Combination of HK dollar pegged to US dollar. That strength has driven down tourism and spending there. In mainland China, we're down 11% revenue, but only 7% in constant currency. In sell-through, we're down 5% on a comp that was up 81% a year ago. So from the larger picture, so China is not as weak as has been talked about. We may not have the wind at our backs that we once did, but it's more stable than the common view of it. I'm optimistic. Opened seven new stores and will open five more stores this quarter to hit 40.

2:49 pm: Shannon Cross: Tim, can you talk about China? Trends you're seeing there, and how it's playing out. SE adoption?

2:48 pm: Cook: I don't recall saying what you said I said about 6 upgrade cycle. But I'll say for 6s, slightly better than 5s two years ago, but lower than iPhone 6, a lot lower. If we would have the same rate on 6s that we did 6, it would be time for a huge party. It would be a huge difference. The good news is we're strategically positioned well. With the SE, we're attracting customers. And this tough compare eventually isn't the compare. Installed base is up 80%.

2:46 pm: Sacconaghi: On iPhone 6 cycle, you said upgrade cycle was not materially different. Maybe a little faster in U.S., but not much elsewhere. So what are we really seeing?

2:45 pm: Cook: Channel inventory reduction, vast majority will be in iPhone. On iPhone SE, we're thrilled with response. Demand is much beyond what we thought, and that's why we have the constraint. Will it be like the iPad mini where there was a one-time spike? No. Replacement cycle of tablets and smartphones is very different. Life cycle on iPad is much longer, and we're very optimistic there. iPhone has a very different cycle.

2:43 pm: Toni Sacconaghi: Talked about channel inventory changes, seasonality looks to be about the same or slightly lower in iPhone unit sales than usual. But with iPhone SE coming on, shouldn't we be seeing above average seasonality?

2:42 pm: From an India point of view, each country has a different story, but what's held us back in part is LTE rollout really just beginning. Really good networks going to come on and that will unleash power and capability of the iPhone there. Second part is building the channel out. Unlike U.S. where carriers dominate phone sales, in India the carriers sell virtually no phones. Retail small shops are the source, and we've been working with great energy over the last 18 months on that, and I'm encouraged by the results. India is already third largest smartphone market, but most are low-end. India is where China was 7-10 years ago. Great opportunity there.

2:39 pm: Cook: On developed markets, installed base as grown 80% in last two years. So when you look at upgrade cycles, I think there's still really really good business in developed markets. I wouldn't want to write those off. It's our job to come up with great products.

2:38 pm: Huberty: For Tim...with developed market saturation, growth needs to come from developing countries. What needs to happen for that growth to come.

2:38 pm: Maestri: Commodity projections are still good. Coming out of March quarter, we'll have loss of leverage. And the other factor is the product mix, particularly with iPhone. A couple of things there are affecting ASPs and margins with channel inventory reduction at high end at iPhone SE at low end.

2:37 pm: Katy Huberty: Worst gross margin guidance in a year and a half. Are some of the earlier tailwinds winding down, or is guidedown related to channel inventory?

2:36 pm: Maestri: We're going to be down sequentially...combination of SE entering the mix and also channel inventory reduction, coming from higher end models. As far as services, it's growing very well across the board. The biggest part is App Store at 35%. Music business that had been declining has now hit an inflection point, and we believe this will be the bottom and we'll grow from there over time. Other services are doing very well. iCloud is growing very well...faster than App Store, but from a smaller base. Apple Pay doesn't provide a revenue source, but over the long term could be interesting. From profitability standpoint, similar to company average.

2:33 pm: Cook: SE is attracting customers who wanted a more compact package, and also those who couldn't quite stretch to the previous entry price. Both markets are very important to us. We are currently supply constrained, but we'll work our way out of it.

2:32 pm: Gene Munster: Talking about iPhone ASP. Is the SE the solution for emerging markets, or are there other strategies?

2:31 pm: Your other questions about mergers and acquisitions...we're always looking for ways to accelerate development or enable us to enter a new area more quickly. We would do larger buys than we've done in the past if it was right.

2:31 pm: Maestri: Last year's inventory reduction was about $800 million. Cook: Smartphone market is not growing. Partly an overhang of macroeconomic conditions. We're optimistic that this will pass and we will grow again. Look at three sources of iPhone sales...we compare favorably to 5s upgrade cycle. Lower than 6, but that was an extraordinary cycle that accelerated upgrades from 2016 into 2015. With switchers, we're excited to set a record there. And with emerging markets, we grew 56% in India. So we're in good shape in areas with disproportionate growth. iPhone SE will draw new customers in at a new price point with the latest technology. So we're optimistic there. Also looking at our pipeline, and we're very excited there.

2:28 pm: $2 billion channel inventory..how does that compare to last year. And is Apple still a growth company, or a mature tech company? And effect on mergers?

2:27 pm: Q&A starting

2:27 pm: Gross margins expected between 37.5-38%. Increased efficiencies offset by lower leverage from lower volumes, as well as product mix.

2:26 pm: iPhone ASPs will decline sequentially as we get farther from iPhone 6s launch and iPhone SE contributes.

2:26 pm: Expect revenue of $41-43 billion for June quarter. This is another decline due to tough year-over-year comparisons and macroeconomic conditions. Projections include effects from reducing channel inventories as we will be prudent about these level in current conditions.

2:24 pm: Plan to continue financing capital return program through U.S. cash, U.S. cash flows, and debt.

2:24 pm: Dividend is very important, and we're raising it for the fourth time. Moving from 52 cents to 57 cents, and increase of almost 10 percent. Continue to plan for annual increases going forward. At $12 billion annually, we're one of the largest dividend payers in the world.

2:23 pm: $232.9 billion in cash and marketable securities. $15.5 billion in U.S. denominated notes, including green bonds. Exited quarter with $72 billion in term debt. Returned $10 billion to investors. Over $163 billion in capital returned total. Now increasing total to $250 billion, majority for share purchases.

2:21 pm: In enterprise, continued broad adoption of iOS apps to improve productivity.

2:20 pm: Other Products revenue up 30% thanks to Apple Watch. Customers very happy with Apple Watch, 94% customer satisfaction.

2:20 pm: 97% customer satisfaction for iPad Air 2, and 59% of those looking to buy were planning to buy an iPad, more than three times next highest brand.

2:19 pm: Reduced channel inventory of iPad. Continue to be highly successful in markets we compete in. 72% of commercial U.S. tablet market.

2:19 pm: 4 million Mac sold, down 12%. Challenging for the overall market, but we believe we increased share. Just last week, updated MacBook. Ended quarter within 4-5 week inventory target range for Macs.

2:18 pm: $6 billion in services revenue, up 20%. Continued strong performance of App Store, revenue up 35%. Generated 90% more revenue than Google Play. Average spending per customer set a new all-time record.

2:17 pm: 51.2 million iPhones sold, down 16%. Challenging comparison to record quarter last year. Reduced channel inventory 450,000 this year, while last year increased by 1 million. iPhone ASP was $642, compared to $659...result of currency issues and attractiveness of lower-end models.

2:16 pm: Inventory channel reductions and currency issues hurt financial results in China, so performance was stronger than it seemed. Remain committed to these markets.

2:15 pm: Maestri now speaking. Revenue was within guidance range, down 13%. Comparisons influenced by strength of U.S. dollar. In constant currency, revenue was down 9%.

2:14 pm: Expanding capital return program again. Adding four quarters and expanding to $250 billion.

2:13 pm: 15 acquisitions in the last 4 quarters, and we're always on the lookout.

2:13 pm: Planning to lower channel inventories during this quarter in light of macroeconomic situation, which will impact financials.

2:12 pm: Promoting renewable energy and revolutionizing recycling. We're unwavering in protecting user privacy, and we're promoting diversity and inclusion.

2:12 pm: CareKit framework for health. Very excited in the ways iPhone and Apple Watch are helping people lead healthier lives.

2:11 pm: 9.7" iPad Pro also seeing a great response. In June quarter, we expected best iPad unit comparison in over two years.

2:11 pm: iPhone SE not included in these results, as it launched after the end of the quarter, but demand has been very strong. Demand exceeds supply, but we're working hard to meet demand. iPhone SE puts us in strategic plan to attract new customers.

2:10 pm: Really excited about the first year of Apple Watch, and it has an exciting future.

2:09 pm: Apple Watch sales met expectations. We expected seasonality to be similar to iPod, which generated 40% of sell-through in holiday quarter. Unit sales of Apple Watch exceeded that of iPhone in their first years.

2:08 pm: On Mac, met sell-in expectations while reducing inventory. Over half of buyers were new to Mac, and in some countries, it's even higher...in China it's over 80%.

2:08 pm: 1 billion active devices is a source of recurring services revenue independent of device sales. Apple Pay reach continues to expand with China and Singapore. More than 5X transaction volume of a year ago. More than 10 million contactless locations in Apple Pay countries, including 2.5 million in U.S.

2:07 pm: Services revenue was highest ever, up 20% to $6 billion. App Store setting new records, Apple Music up to 13 million paying customers. Music revenue has hit an inflection point after many quarters of decline.

2:06 pm: Added more switchers in first half of this year than any other six month period. With 42% smartphone penetration, Apple is still attracting new customers.

2:05 pm: iPhone sales come from upgrades, switchers, and new smartphone owners. Business is healthy from all three. Upgrade rate for 6s has been slightly higher than 5s cycle two years ago, but lower than 6 cycle last year. Customers are also incredibly loyal. 95% loyalty rate, highest for any smartphone.

2:04 pm: Cook: Good afternoon. Very busy and challenging quarter, and announcing an update to capital return program. Revenue was within guidance. Despite decline, execution was excellent in challenging conditions including foreign exchange. Installed base of over 1 billion active devices continued to grow strongly. Huge number of Android switchers and new Mac users.

2:02 pm: CEO Tim Cook to speak first, followed by CFO Luca Maestri.

2:01 pm: Conference call getting started.

1:47 pm: WSJ story: http://on.wsj.com/1qR77w1

1:47 pm: "In an interview with The Wall Street Journal, Apple Chief Executive Tim Cook said it was “a challenging quarter” for the company. It struggled with tough comparisons on iPhone sales compared with a year earlier, when demand for the iPhone 6 and iPhone 6 Plus was booming. What’s more, demand for those models prompted some consumers to upgrade sooner than usual, and sapped interest in the latest phones, he said."

1:44 pm: Apple shares are down nearly 6% in after-hours trading following the earnings release.

('https://buyersguide.macrumors.com/#Mac')

('https://buyersguide.macrumors.com/#Mac')