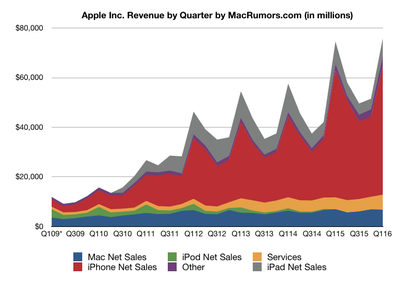

Apple today announced financial results for the first fiscal quarter of 2016, which corresponds to the fourth calendar quarter of 2015. For the quarter, Apple posted revenue of $75.9 billion and net quarterly profit of $18.4 billion, or $3.28 per diluted share, compared to revenue of $74.6 billion and net quarterly profit of $18 billion, or $3.06 per diluted share, in the year-ago quarter. Both revenue and earnings were company records.

Gross margin for the quarter was 40.1 percent compared to 39.9 percent in the year-ago quarter, with international sales accounting for 66 percent of revenue. Apple also declared an upcoming dividend payment of $0.52 per share, payable on February 11 to shareholders of record as of February 8. The company currently holds $215.7 billion in cash and marketable securities, partially offset by $53.2 billion in long-term debt.

Apple sold a record 74.8 million iPhones during the quarter, up slightly from 74.5 million a year earlier, while Mac sales were down slightly to 5.3 million units sold from 5.5 million units in the year-ago quarter. iPad sales were also down once again, falling to 16.1 million from 21.4 million despite the introduction of the iPad Pro during the quarter.

“Our team delivered Apple’s biggest quarter ever, thanks to the world’s most innovative products and all-time record sales of iPhone, Apple Watch and Apple TV,” said Tim Cook, Apple’s CEO. “The growth of our Services business accelerated during the quarter to produce record results, and our installed base recently crossed a major milestone of one billion active devices.”

Apple's guidance for the second quarter of fiscal 2016 includes expected revenue of $50–53 billion and gross margin between 39 and 39.5 percent. Revenue guidance is slightly below analyst expectations.

In supplemental materials, Apple explains that currency headwinds have cost the company 15 percent in earnings over the past 18 months. Using "constant currency" measures, Apple's revenue for the holiday quarter would have been $80.8 billion for an 8 percent increase year-over-year.

Apple will provide live streaming of its fiscal Q1 2016 financial results conference call at 2:00 PM Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Apple will provide live streaming of its fiscal Q1 2016 financial results conference call at 2:00 PM Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Conference Call and Q&A Highlights are available in reverse chronological order after the jump.

2:59 pm: And the call is finished.

2:58 pm: On patent question, this is a one-off item that affected the December quarter. As I said earlier, it's worth 40 basis points so GM would have been 39.7 percent, it would not repeat going forward. Was it included in the guidance? Yes, it was included in development of guidance range, that number was included within the range.

2:58 pm: A: Our strategy is always to make the best products. That, for the smartphone market, we are able to provide several different price points for our customers .Have premium part of line, 6s and 6s Plus, have mid-price point with iPhone 6 and 6 Plus, and we continue to offer the iPhone 5s in the market and it continues to do quite well. We offer all of those and I don't see us deviating from that approach. We always want to offer somebody the, we don't design to a price point, we design a great product and we price it at a great value. Today we're able to offer all three of those different iPhone options.

2:57 pm: Q: With Macro situation changing, many CEOs view their strategies, some change the way they go to market, some change their products. Apple is known for a premium product. Is APple's strategy always a premium product, or is there a need to go to medium market or lower market, growing those services could really grow out long term. On patent litigation, did you have view on guidance that money was coming in or was that post-quarter guidance? Assuming all one-time, bump to gross margin and won't call that to reoccur going forward.

2:55 pm: A: This has nothing to do with moving customers from one person to another, this has to do with wanting to provide customers a very simple way to upgrade because we serve a significant number of customers in the Apple Store who want th iPhone when it's new and when it comes out. we designed ap program to make it simple and easy to do that. I have no idea over time how the percentage of sales will vary between carriers and the Apple Retail Store but that's not our overriding objective.

2:55 pm: Q: Are folks buying with Apple now instead of carriers because of upgrade programs?

2:54 pm: A: We started breaking out services in the beginning of 2015, and as that business has grown and became clear to us that the investors and analysts wanted more visibility into that business, we've now elected to break it out and show the full size, scope, growth and make comments on the profitability of it from a transparency point of view. The assets that we have in this area are huge and I do think it's something the investment community would want to and should focus more on. Wouldn't comment on any particular thing re future plans, but obviously with breaking this out, we wouldn't break it out if it wasn't important to us in the future.

2:53 pm: Q: Overarching message of introducing a little more detail around services, is this to reinforce the power of the franchise or platform at Apple to navigate tougher economic times or is it a stepping stone to more to cloud services for enterprise?

2:52 pm: No doubt that we had an unbelievable year last year. Really strong because of pent-up demand from Q1 to Q2, no doubt about that, however you can tell from the numbers that Luca is talking about from currency side, that's before thinking through effect that price increases can sometimes have on business over a period of time, it is clear that the economic piece is large.

2:51 pm: A: Number of people who had an iPhone prior to iPhone 6 and 6 Plus announcements, September 2014, that have not yet upgraded to a 6, 6s, 6s Plus is now 60%. 40% have upgraded, 60% have not.

2:50 pm: Q: On iPhone business, you talk a lot about macroeconomic sway on units. You've mentioned in recent calls helpfully, the percent of the base when 6 came out that are now on the largest screen phone, last time was in the low 30's?

2:50 pm: On India, it's also incredibly exciting. India's growth as you know is very good, quickly becoming fastest growing BRIC country, third largest smartphone market in the world behind China and the US. Median age is 27. Think of China age being young at 36-37, 27 is unbelievable. Half the people in India are below 25. Demographics there are also incredibly great for a consumer brand and people who really want the best products. We've been putting more energy in India. India revenue in Q1 was up 38%. Currency issues, constant currency growth was 48%. Very rapidly expanding country and I think the government there is very interested in economic reforms and so forth and I think they all speak to a really good business environment for the future.

2:48 pm: A: LTE penetration in China is in mid-20's. Enormous upgrade cycle there for people who are still running on 3G handsets. Also, it's easy to lose perspective but the middle class in China was less than 50 million people in 2010 and by 2020 it is projected to be half a billion. An enormous people moving into middle class and this provides us a great opportunity to win over some of those customers into the Apple ecosystem. Demographics are great, continue to invest in retail stores, Angela and her team are on aggressive rollout plan. 28 stores in Greater China and on target to hit 40 by this summer. Continuing on distribution, product things in mind, are crafting products and services with China heavily in mind. Remain very bullish on China. Don't subscribe to the doom and gloom kind of predictions frankly.

2:47 pm: Q: Investing in India? A billion mobile subscribers. And China?

2:46 pm: We are not retrenching. We don't believe in that. We are fortunately are strong enough to continue investing and we think it's in Apple's long term interest to do so. Downside of economic stress is that some asset prices get cheaper, commodity prices get cheaper and that sort of thing, this is the period that you want to invest. And do so confidently.

2:45 pm: Even in the markets where today, granted it looks fairly bleak, Russia and Brazil and some of the other economies tied to oil based economies, we do believe this too shall pass. These countries will be great places and we want to service customers in there.

2:45 pm: A: R&D, we're continuing to invest without pause. We have great things in the pipeline, very much believe strongly in investing through downturn in terms of SG&A. Investing in new stores, expansion plans in China have not changed. Maintaining our investment profile and plans there. We are also continuing to invest in markets where we believe that are great places for Apple for the long term like India.

2:43 pm: Q: Talk a bit about leverage within the model? I know you said you want to invest while there's opportunity, but given some of the pressures you're seeing, how do you think about spending that R&D dollar and how should we think about that? Running $6 billion per quarter.

2:43 pm: By far the largest impact on margins for quarter is loss of leverage from seasonal pattern. Which gets offset by favorable commodity environment that we've seen for a number of quarters. It's the other side of the coin of FX.

2:43 pm: A: Q1, IP licensing, the patent dispute that was resolved. It was included in gross margin, worth 40 basis points. 40.1 that we included. Puts and takes are actually quite simple, from FX standpoint, the negative impact on sequential basis from December is 50 basis points.

2:42 pm: Q: About gross margins, 39-39.5 in your margins, includes hedging. Curious about puts and takes. Quarter and IP licensing contribution, any color on this quarter and the March quarter.

2:41 pm: To question around channel inventory, we grew channel inventory by 3.3 million units during December quarter, we started in a position where we were below our target range. Significantly short at beginning of the quarter.

2:41 pm: From a purchase value standpoint, in December quarter we grew 24%, for fiscal 2015 we grew at 23%. Grew at very healthy levels. To reconfirm, growth of installed base was over 25%.

2:40 pm: A: Reason why we added this, Page 3 of supplemental, is to try to explain a couple of steps. First, of services that we report, a portion, about 85% of all services, is directly tied to installed base. Smaller portion of services business that is not related to installed base, related to when we sell a device like AppleCare. On that portion of installed base drive services, there is a part that is related to where we recognize revenue in terms of the full transaction value and transactions like app store sales where a portion of the transaction does not get recognized by Apple but it goes to the developer.

2:39 pm: Q: Clarification... Luca, you talked about channel inventory increasing. 18.4 million for iPhone last quarter, how many more do you have this quarter? And not sure if I misheard, but you said your total installed base grew 25% year over year? If services grew at 13% and installed base grew at 25%, it implies penetration of your installed base is going down.

2:39 pm: A: We don't spend a lot of time predicting the market. If we make a great product and have a great experience, we should be able to convince enough people to move over. Talk to broader umbrella point about saturation, the metrics I see would strongly suggest otherwise. Almost half of the iPhones that we sold in China last quarter were to people buying their first iPhone. Certainly if you go outside China into other emerging markets, our share is much lower and the LTE penetration is so low that in some cases it's zero. It indicates to me that there's still a lot of people, a tremendous number of people in the world who will buy smartphones and we should be able to win over our fair share of those.

2:38 pm: Q: Speak to points around expectations around smartphone market? Has replacement cycle changed?

2:37 pm: At this point, we see Q2 is the toughest compare. We believe it's the toughest compare because the year ago quarter also had catch up in it from Q1. If you recall, we were heavily supply constrained through Q1 so some demand moved to Q2. We're in an environment that's dramatically different from a macroeconomic POV, from currency, level of which we've had to adjust pricing in several of these markets. Overall melees in virtually every country in the world.

2:36 pm: A: We do think iPhone units will decline in the quarter. We don't think they'll decline to levels you'll talk about. Aren't projecting beyond the quarter.

2:36 pm: Q: Or is it tough to gain share in market where it's moving to lower price points? Likely to be a decline in lower iPhone units, how do we put that in context given healthy data around switches?

2:35 pm: Q: On iPhone, it looks like the guidance implies about a 15-20% unit decline for fiscal Q2, unless you really see a change in demand profile in the second half suggests iPhone units will decline year over year for Fiscal 16. I'd like you to address that question because the obvious follow up is "do you believe the smartphone market won't grow? Or Apple won't be reaching saturation in the market?"

2:35 pm: A: That is kind of the ranking, it starts always for us as a tooling and manufacturing equipment, that is up a bit year over year. Data centers are a growing expenditure for us. Our installed base of customers and devices is growing very significantly. Data center we put in place is to provide services that are tied to the installed base. That type of expenditure goes with installed base. Facilities, nearing completion of our new campus here in Cupertino. This is the year where we get our peak requirements in terms of capital.

2:33 pm: Q: What's driving that growth in CapEx? Given slowdown that you started to see in December, are you comfortable with that level of investment growth?

2:33 pm: Exited the quarter on iPad and Mac well within the range that we want to have.

2:33 pm: We have a very strong mid-tier in the portfolio, but when you look at outcome, it was very very strong. We feel that we have a very strong portfolio for iPhone. Channel inventory, we entered December quarter below target range of 5-7 weeks of iPhone inventory. Built a bit of inventory during course of december quarter but we exited at low end of 5-7 weeks. We feel that we are in good shape there.

2:32 pm: A: Our iPhone ASP was $691 during December quarter, we couldn't be happier with level of ASP that we generate, foreign exchange impact on that number was $49.

2:31 pm: Q: How might consumers might react from ASP perspective, will consumers move down the product line because of macro items?

2:31 pm: In terms of VR, I don't think it's a niche. It's really cool and has some interesting applications.

2:30 pm: Upgrades: Will be meaningful as customers get into different pattern, how much of that plays out in Q1 of 2017 range is difficult to say. Other items are probably more important but I am optimistic about upgrade program as well.

2:30 pm: A: iPhone, the most important thing for us will always be the product and the experience. First and foremost, we were blown away by the level of Android switches that we had. Highest ever by far.

2:29 pm: Q: Talk a little about iPhone upgrade program and the theme of iPhone as a subscription. Will this have impact on December quarter once we anniversary? Rollout outside the US? Can't talk about new products, but thoughts on VR theme? Is this a geeky niche or something that could go mainstream?

2:28 pm: Number of things we're facing: Macro environment is weakening, all of commodity driven economies, Brazil, Russia, Canada, Australia... clearly economy is significantly weaker than a year ago.

2:27 pm: A: In constant currency, look at the March quarter, revenue would be down between 5 and 10 percent. We are looking at 400 basis point impact for FX in March.

2:27 pm: Q: In terms of March quarter, it does imply a double-digit decline at midpoint. What FX headwind is embedded in that? And fundamental underpinning, how much has to do with international markets in terms of weakening demand and comps or response to higher prices in some overseas markets?

2:24 pm: Spent $153 billion in cash return plan, $200 billion authorized. Update coming in April.

2:24 pm: Bought back more shares, paid out more dividends.

2:22 pm: Services generated $6.1 billion in revenue, plus $548 million from a patent infringement dispute.

2:21 pm: Going over standard numbers about corporate intent to buy, customer satisfaction, etc.

2:18 pm: Many of these items were mentioned at the beginning of the liveblog.

2:16 pm: Maestri discussing breakdown of earnings.

2:16 pm: 1 billion devices, up 25% year over year.

2:15 pm: We define active device as one engaged with our services in last 90 days.

2:15 pm: Compares favorably to services companies you might be familiar with. On a purchase value basis, margin is similar to company average.

2:15 pm: Up 23% over FY 2014. In December quarter, services reached $8.9 billion, up 24% YoY.

2:15 pm: Look at purchases in addition to revenue: Purchase value to services tied to install base, it adds up to more than $31 billion.

2:14 pm: Major drivers of growth: Apps, movies and TV shows are tied to installed devices. We recognize some revenue based on transaction value. For some services, like App Store, we only recognize revenue on the portion of revenue we keep.

2:14 pm: Services category includes revenue from iTunes, App Store, iCloud, Apple Pay, licensing and other items.

2:13 pm: Luca joining the call to talk about platform.

2:13 pm: 1 billion active devices, we thought this would be a great opportunity to share more information on the services business.

2:13 pm: Because installed base has grown quickly, we have seen acceleration in services business.

2:13 pm: Installed base reached a major milestone, crossing 1 billion active devices for the first time.

2:13 pm: Purchase apps, content and other services. Likely to buy other Apple products or replace the one that they own. Because of enduring value of the device, replacement is likely to be sold or given away to be used again.

2:12 pm: Growing portion of revenue is directly driven by existing installed base.

2:12 pm: iPhone loyalty rate is almost twice as strong as next-highest brand.

2:12 pm: Customer sat and retention rates are second-to-none. Recent surveys measured 99% customer satisfaction rate for 6s and 6s Plus, and 97% rate for iPad Air 2.

2:11 pm: Investors have been asking for a while about the recurring nature of our business. We believe it is important to appreciate that a significant portion of Apple's revenue recurs over time.

2:11 pm: We have the mother of all balance sheets with almost $216 billion in cash, or $39 per diluted share.

2:10 pm: Cook is going over all the products launched or updated over the past quarter.

2:09 pm: And taking opportunity to invest in other markets.

2:09 pm: Some of the most important breakthrough products in Apple's history were born as a result of investing through the downturn.

2:08 pm: Apple remains incredibly strong. Satisfied and loyal customer base, greater number of switchers from Android to iPhone than ever in Q1, and we are optimistic.

2:08 pm: We remain very confident about long term potential in China, and we are maintaining our investment plans.

2:07 pm: Highest ever quarterly iPhone sales and record App Store performance. Some signs of economic softness in greater china, most notably in Hong Kong.

2:07 pm: Saw incredible momentum for iPhone, Mac and the App Store last summer. December quarter, we produced our best results ever in Greater China. Revenue up 14% over last year, 47% sequentially, and 17% year over year in constant currency.

2:07 pm: Conditions in China have been a source of concern for many investors.

2:07 pm: $100 of non-US dollar revenue in Q414 translated to $85 last quarter due to weakening currencies in International markets. Last quarter, impact was very large. Q1 revenue and growth rates expressed in constant currency translates to $80.8 billion in constant currency revenue, up $5 billion. For perspective, that difference is about the size of the annual revenue of a Fortune 500 company.

2:06 pm: Brazilian Real is down more than 40%, and Russian Ruble is down more than 50%. 2/3 of revenue is generated outside the US, so foreign currency fluctuations have a meaningful impact on our results.

2:05 pm: Euro and British Pound are down double digits, and Canadian dollar, Australian dollar are down 20% or more.

2:05 pm: Results are particularly impressive given challenging global macro environment. Extreme conditions about everywhere we look. Brazil, Russia, Japan, Canada, Southeast Asia, Turkey, Australia and Eurozone are impacted by slowing economic growth and weakening currencies.

2:04 pm: It's an average of 34,000 iPhones per hour, 24/7 for 13 weeks. 50% more than Q1 volume 2 years ago, and 4x volume 5 years ago.

2:04 pm: Constant currency, our growth rate would have been 8 percent. Record revenue and strong operating performance led to all-time quarterly net income of $18.4 billion. 74.4 million iPhones, an all-time high.

2:04 pm: Tim Cook: Today we're reporting Apple's strongest financial results ever. All-time record quarterly revenue and up 2 percent over last year.

2:03 pm: Apple CEO Tim Cook is on the call, along with CFO Luca Maestri.

2:02 pm: The conference call with analysts is beginning.

2:00 pm: Apple's conference call music is... interesting.

2:00 pm: That's offset by $53.204 billion in long term debt.

1:59 pm: Apple has nearly $216 billion in cash and short- and long-term securities.

1:57 pm: Apple doesn't break out the profitability of different segments, however, so it's impossible to know for sure where most of the profit is coming from -- but the iPhone likely remains extremely profitable.

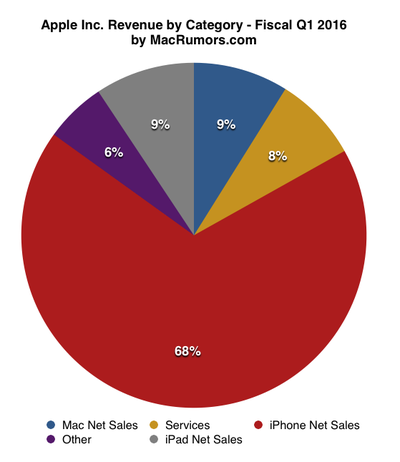

1:56 pm: Apple's iPhone sales remain a massive part of the company, clocking in at 68% of revenue, but Services continues to grow, reaching 8 percent -- that's nearly as large as the Mac and iPad businesses.

1:55 pm: Other products revenue, which includes Apple TV, Apple Watch, Beats and iPods, set a record with $4.351 billion. Previous high was $3.048 billion the prior quarter.

1:55 pm: Services revenue (iTunes and App Store, among other things) was highest ever by more than $1 billion, bringing in $6.056 billion.

1:54 pm: iPhone ASP was strongest ever with the average iPhone costing $691. Previous high was $674 in Q1 2009.

1:53 pm: Third strongest Mac quarter ever with 5.312 million units sold, though the second strongest in terms of revenue on the backs of rising average selling prices. The average Mac cost $1,270 last quarter.

1:53 pm: That is, a strong dollar makes it more difficult for American companies (which report in dollars) to perform when large amounts of their business is overseas.

1:53 pm: Profits $18.361 billion, up from $18.024 last year. Margins remain strong, 40.1% even with significant foreign exchange headwinds.

1:52 pm: The quarter is Apple's strongest ever, $75.872 billion in revenue is a tick up from $74.599 billion in the same quarter last year.

1:52 pm: Apple's earnings call starting in 9 minutes, but some quick analysis...