In a new study performed by InfoScout, nearly half as many possible Apple Pay customers used the mobile payments system on Black Friday in 2015 as they did in 2014 on the same sales-laden holiday (via Quartz). The study polled a total of 300,000 people to gather the information, discerning the time around March 2015 as Apple Pay's peak, with another understandable resurgence in the fall surrounding the launch of the iPhone 6s and iPhone 6s Plus.

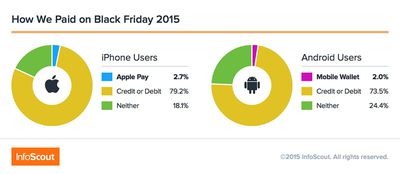

The research organization found that Apple Pay was used for only 2.7 percent of total possible Apple Pay-eligible transactions on Black Friday this year. This is opposed to 2014, where new iPhone 6 and 6 Plus customers used Apple Pay in 4.9 percent of eligible transactions. As InfoScout points out, simple early adopter curiosity -- Apple Pay was barely a month old at the time -- could have helped in the service's early-on surge in numbers.

InfoScout's survey didn't track in-app payments made on Black Friday through Apple Pay, however, so customers who shopped on mobile devices in apps like Target and Best Buy were not included in the results. 300,000 participants is a large sample size, but given the popularity of mobile and online shopping, there's a good possibility that a large swath of Apple Pay's numbers were subsequently excluded from the poll.

Despite the tepid usage of Apple Pay on Black Friday this year as reported by the survey, Apple has been in full force behind the year-old service. With its launch in new countries like Canada and Australia, the company has continued to educate its customers on Apple Pay's various features with new guided tour videos. Other stores have launched loyalty rewards support and the service is available at more places than ever thanks to Square's $49 NFC and Chip reader.