Kantar Worldpanel has released new smartphone operating system market share data for the first quarter of 2015, providing a regional breakdown of Android, iOS, BlackBerry, Windows Phone and other mobile platform adoption in the United States, Australia, United Kingdom, France, Germany, Spain, Italy, China, Japan, Argentina, Brazil and Mexico during the three-month period ending March.

Android continued to have the highest market share among mobile platforms worldwide, as expected, although the continued success of the iPhone 6 and iPhone 6 Plus helped drive iOS adoption higher in the first quarter. Kantar Worldpanel claims that 32.4% of Apple’s new customers in the five big European countries surveyed switched to iOS from Android during the first three months of the year.

The regional breakdown for each platform per country:

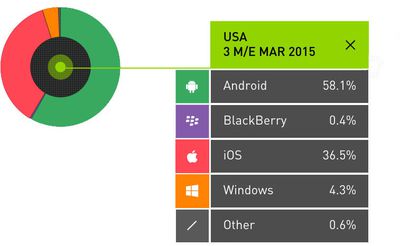

United States:

- Android: 58.1%

- iOS: 36.5%

- Windows Phone: 4.3%

- BlackBerry: 0.4%

Australia:

- Android: 52.3%

- iOS: 38.4%

- Windows Phone: 7.3%

- BlackBerry: 1.6%

United Kingdom:

- Android: 52.9%

- iOS: 38.1%

- Windows Phone: 8%

- BlackBerry: 0.7%

France:

- Android: 64.6%

- iOS: 19.4%

- Windows Phone: 14.1%

- BlackBerry: 1%

Germany:

- Android: 71.3%

- iOS: 18.3%

- Windows Phone: 8.7%

- BlackBerry: 0.8%

Spain:

- Android: 89.9%

- iOS: 7%

- Windows Phone: 2.8%

- BlackBerry: 0.2%

Italy:

- Android: 66.2%

- iOS: 17.5%

- Windows Phone: 14.4%

- BlackBerry: 1.3%

China:

- Android: 72%

- iOS: 26.1%

- Windows Phone: 1.2%

- BlackBerry: 0%

Japan:

- Android: 52.3%

- iOS: 45.1%

- Windows Phone: 0.4%

- BlackBerry: 0.7%

Argentina:

- Android: 81.6%

- iOS: 2.4%

- Windows Phone: 10.7%

- BlackBerry: 1.9%

Brazil:

- Android: 89.6%

- iOS: 3.3%

- Windows Phone: 6.3%

- BlackBerry: 0.2%

Mexico:

- Android: 85.1%

- iOS: 6%

- Windows Phone: 4.7%

- BlackBerry: 2.9%

Last week, Strategy Analytics released global smartphone data that placed Samsung as the world's largest smartphone maker during the first quarter of 2015. Market research firm IDC then followed up with worldwide tablet data for the quarter a day later, revealing that the iPad continues to be the best-selling device in a declining tablet market.

Top Rated Comments

Good Game Apple.

I have an iPad Mini Retina, an nVidia Shield, and an ASUS Vevo NoteTab 8. As far as I know each one is considered a best in class device for the OS they run. I respect them all and use them all.

When I am working, I trust my iPad implicitly. I teach Information Security. I am a student and write papers. My iPad coupled with a clamshell replaced my laptop last year.

When I am playing (experimenting or games) I use the Android. Its Linux base makes it a powerful ally. I am enjoying it as a console replacement. If Steam used Android as its base, my shield devices would be the ultimate for entertainment.

When I am watching movies I like to watch them on the Asus. Most of my movies are iTunes based. I installed iTunes for Windows and watch on it as opposed to my iPad because the screen format matches the video format.

I would not change any of the three of them.

Market share is irrelevant. I have three different devices. And I enjoy them all. Market share does not change their value.

I have an iPhone though. Android is good for games, and I like it for that. Windows is good for compatibility to enterprise systems, it does a great job. But when I need to depend on a system, and get work done...

It's an Apple every time.

So it looks like the average was about a 3% switch to iOS because of the larger phones. And Kantar says 1/3 of those new customers came from Android. So basically about 1% of Apple's total customers came from ex-Android users. Not a huge number. Maybe 300K people in the UK, for instance.

In the countries where high end phones sell best, such as the USA, buyers often spend $200 or less upfront. In some places, almost nothing. But that doesn't necessarily mean they're poor.

Subsidies are a key factor. Even rich countries avoid the iPhone without them. (See Japan example at bottom.)

Rich or poor, people around the world tend to spend $250 or less upfront for a phone. It's not about the total cost over time, it's the upfront layout that matters.

Another factor is that today, a $250-total-price smartphone is often actually a pretty nice device, with large screen and good capabilities. It isn't necessary to spend $650 for a good smartphone any more.

Yes. When the iPhone was first introduced in Japan, it sold extremely poorly. Like most countries without a subsidy, it only got to around 10% of the market.

Then the Japanese carriers started basically giving them away for free with a contract. Instantly iPhone adoption jumped like crazy.