Much of the Apple news in recent days has centered around Apple Pay and what Tim Cook referred to on Monday as a "skirmish" in which several retailers backing a competing mobile payments initiative known as CurrentC have shut down NFC payment functionality in their stores to prevent customer use of Apple Pay, Google Wallet, and other similar services.

Numerous sources have indicated that retailers backing CurrentC are contractually prohibited from accepting alternative forms of mobile payments, and sources told The New York Times that retailers breaking those contracts would "face steep fines."

Merchant Customer Exchange (MCX), the consortium of retailers backing CurrentC, has now published a blog post confirming that retailers working with MCX are indeed required to back CurrentC exclusively. While the group does not directly address whether consortium members could be fined for accepting Apple Pay, it does say members may leave the group without penalty if they so choose.

MCX merchants make their own decisions about what solutions they want to bring to their customers; the choice is theirs. When merchants choose to work with MCX, they choose to do so exclusively and we’re proud of the long list of merchants who have partnered with us. Importantly, if a merchant decides to stop working with MCX, there are no fines.

While the lack of a fine for leaving the consortium means retailers such as CVS and Rite Aid could still pull out of the CurrentC effort and begin accepting Apple Pay, retailers are undoubtedly reluctant to do so as they view CurrentC has a key effort to escape from credit card swipe fees while maintaining the ability to mine customer information. Many have also already invested significant amounts of money in the CurrentC effort, money that would be lost if they stopped working with MCX.

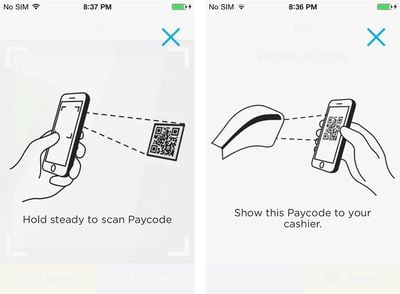

Beyond its arrangements with retailers, MCX also addresses the features of CurrentC in its blog post, highlighting the fact that it will work with any phone, integrate coupons and loyalty cards, support multiple forms of payment including gift cards, credit cards, and checking withdrawals.

Addressing user privacy, MCX highlights CurrentC's privacy dashboard that will allow customers to control what information is shared with retailers and argues that the system's cloud-based storage of sensitive customer information offers more security than on-device storage that could be more easily compromised through hacking or theft.

MCX's CurrentC program is currently in limited testing, and is expected to launch nationwide sometime next year.