Apple sapphire supplier GT Advanced Technologies' woes continue today with the announcement that it will not appeal the suspension of its stock on the NASDAQ stock exchange. As part of this decision, the company's stock is no longer being traded on the NASDAQ stock market effective today, October 16. This removal was expected and is the result of the company's recent Chapter 11 bankruptcy.

GT Advanced Technologies Inc. today announced that it will not pursue an appeal of the determination by The NASDAQ Stock Market LLC ("NASDAQ") to suspend trading in the Company's common stock based on the Company's voluntary petition for reorganization relief under Chapter 11 of the United States Bankruptcy Code. The Company has been informed that NASDAQ will suspend trading in the Company's common stock effective at the opening of the market on October 16, 2014.

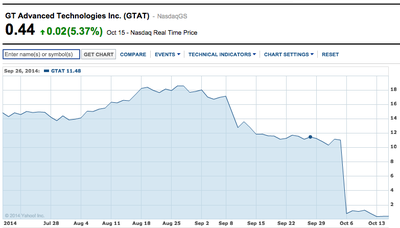

GT's stock plummeted 90 percent following its bankruptcy announcement earlier this month, and has continued to fall since then, closing at just 44 cents per share yesterday. The stock will continue to trade under the symbol GTATQ on the OTC Pink marketplace.

As part of the original deal, Apple made three loan payments to GT totaling $440 million and said it was working with GT to help overcome technical challenges to qualify for the fourth and final prepayment loan of $139 million. Apple also appeared set to delay scheduled repayments on the debt. But under the weight of difficulties that began at least as early as February, GT found itself unable to carry on its business operations and filed for bankruptcy with plans to shut down its sapphire production facilities.

Top Rated Comments

Yesterday, forum member Makosuke and I were discussing the merits of the original deal and (s)he brought up an interesting point. If the info from that discussion is valid then I'm looking at Apple with a sideways glance and asking why?

"One other thing to take into account that I hadn't even realized before: I have no idea what the detailed financials of GTA are, but if you look at their annual financial statements, in 2011 they grossed about $900M with a profit of $175M; in 2012 they grossed $955M with profit of $183M; in 2013, they grossed $298M and came up $82M in the hole--a precipitous 70% decline in gross revenue. Part of their shortfall was due to increase in R&D spending, but there was also a drastic falloff in sales in 2013. Q1 2013 (six months before the Apple deal) was, in fact, pretty much the worst quarter they had ever reported..." - excerpted from Makosuke

Personally, I wouldn't have fallen for GT's song and dance but, if true, it would go a long way towards explaining why Apple had such a draconian contract drawn up. They may have been skeptical as well but considered $500 million an acceptable gamble. Now that I look at, I guess I really can't question Apple's judgement. My pocket and Apple's pocket hold slightly different volumes. Just slightly. :rolleyes: Relative to the potential reward, the risk for Apple wasn't that great.

Carry on. Nothing to see here.:)

Samsung Electronics Co is down 9% since then.

When your stock goes below $1.00 after announcing you're filing for Chapter 11, the fat lady is already singing because this party is over.

Gorilla Glass wins this round but sapphire crystal displays will eventually come to the iPhone, but GTAT won't be the supplier.

Imagine what Apple could have done with the 1/2 billion dollars they threw (away) at GTAT - A U2 world tour sponsored by :apple: