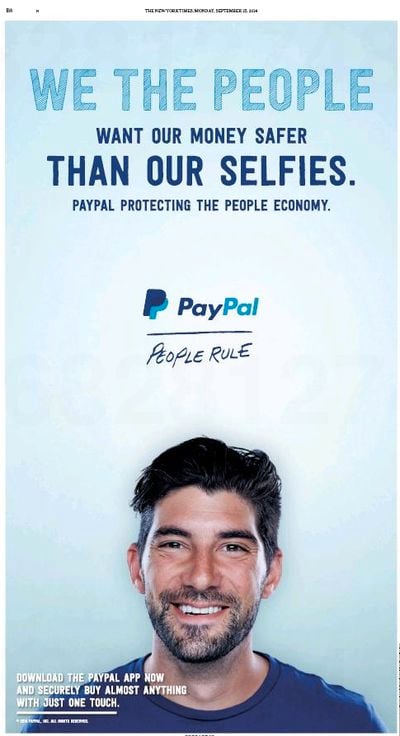

Following the unveiling of Apple Pay last week, PayPal has gone on the offensive, taking out a full page ad in The New York Times that slams Apple for its recent iCloud photo leak while promoting PayPal's own security.

"We the people want our money safer than our selfies," reads the ad first shared by Pando Daily. "PayPal, protecting the people economy."

The ad alludes to a recent attack on celebrity iCloud accounts, which saw hundreds of celebrity photos released on the Internet. Since the attack, Apple has gone to great lengths to point out that the leak was tied to weak usernames and passwords rather than an iCloud security breach, as the incident occurred just before plans to unveil Apple Pay.

The company released a public statement after an investigation, and then Tim Cook did an interview with The Wall Street Journal to let users know about plans to broaden the use of two-factor authentication and to send security emails when a device is restored, iCloud is accessed, or a password change is attempted.

On its Apple Pay website, Apple also goes into detail about the security of the service, pointing towards unique Device Account numbers, the iPhone's Secure Element, and the ability to put a phone in Lost Mode if it goes missing, protecting all information including payment data.

Apple also says that all transactions are private, as the company does not store any details at all. Payment information is also directly stored on a device (within the Secure Element) and not in iCloud, making it inaccessible from a remote location.

Apple doesn't save your transaction information. With Apple Pay, your payments are private. Apple doesn't store the details of your transactions so they can't be tied back to you. Your most recent purchases are kept in Passbook for your convenience, but that's as far as it goes.

It's no surprise that PayPal has launched an ad that subtly attacks Apple as it is facing significant competition from the company. In addition to allowing users to make purchases in retail stores with their iPhones, Apple Pay also lets users buy items in supported apps using a credit card or debit card connected with an iTunes account.

PayPal works in a very similar way, letting users attach a credit or debit card and then make purchases through the service, alleviating the need to enter credit card details. Major credit card companies, banks, and multiple retailers are also already on board with Apple Pay.

App developers have been instructed to use several different payment platforms in their APIs, including Authorize.Net, Chase Paymentech, CyberSource, First Data, Stripe, and TSYS. Noticeably absent is PayPal, though the service's credit card processing subsidiary, Braintree, has pledged support for Apple Pay.

PayPal has had its own security issues in recent months, most recently facing a significant problem with its two-factor authentication system.

Top Rated Comments

Only reason I use PayPal is due to a lack of a decent alternative. PayPal sucks, everybody knows this.

The amount of time Paypal freezes money for "security reviews" and other BS is just too damn high.

The safety of speedy delivery when needed? Not with Paypal when they chose your transaction as one of those they think they need to look at.

Right...

Also, they force me to not use two-factor authentication if I want to use their mobile app.

Back to the drawing board, Paypal.

Glassed Silver:mac