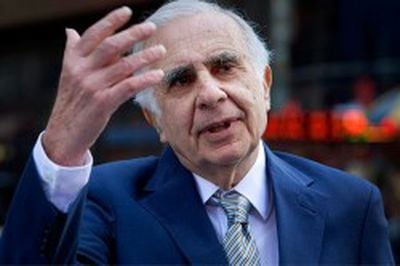

Activist investor Carl Icahn has just tweeted that his investment firm has acquired an additional $500 million in Apple stock over the past two weeks, pushing his stake to over $3 billion. Calling continued investment in Apple a "no brainer" at current prices, Icahn also continues to believe that Apple needs to significantly increase its stock buyback program. A more in-depth letter from Icahn on the topic will be forthcoming.

Activist investor Carl Icahn has just tweeted that his investment firm has acquired an additional $500 million in Apple stock over the past two weeks, pushing his stake to over $3 billion. Calling continued investment in Apple a "no brainer" at current prices, Icahn also continues to believe that Apple needs to significantly increase its stock buyback program. A more in-depth letter from Icahn on the topic will be forthcoming.

Having purchased $500 million more $AAPL shares in the last two weeks, our investment has crossed the $3 billion mark yesterday. — Carl Icahn (@Carl_C_Icahn) January 22, 2014

For its part, Apple management has stated that it is continually evaluating its buyback program and that it plans to announce any changes to the program during the first half of this year.

Update: Icahn appeared on CNBC today to shed more light on his Apple position.

Icahn: Apple is a culture with a great ecosystem; what bothers me a hell of a lot is that billions of dollars is just sitting there. • $AAPL — CNBC Newsroom (@CNBCnow) January 22, 2014

.@Carl_C_Icahn telling @ScottWapnerCNBC: I'm criticizing $AAPL board, not the management. @CNBCFastMoney — Shannan Siemens (@ShannanSiemens) January 22, 2014

Carl Icahn LIVE on @CNBC: "There's no one on Apple's board that is a finance guy." • $AAPL — CNBC Newsroom (@CNBCnow) January 22, 2014

Carl Icahn LIVE on CNBC: I'm actually better off if Apple does nothing. I plan on buying more of Apple's stock. • $AAPL — CNBC (@CNBC) January 22, 2014

Top Rated Comments

When you buy shares in a public company, you are buying a piece of that company's earnings. Buybacks concentrate earnings on fewer shares. If a company with 100M shares earned $100M, the earnings per share (EPS) is $1.00. If they take 50M shares off the market through a buyback, EPS will rise to $2.00. If companies do nothing about the number of shares outstanding, over time the opposite will happen, as they grant shares and stock options to executives. This is called dilution. In part, buybacks are a strategy to reverse dilution.

So just to be clear about a couple of things: First, Apple is under no "pressure" do anything, so the headline of this article is fundamentally misleading. Second, the buyback that Icahn is proposing represents less than the amount of free cash Apple will generate in one year. So even if Apple accepted the proposal, they'd still end up the year with more than the $150B cash hoard that they are sitting on today.

Finally, Icahn is fundamentally correct. When a company generates cash far in excess of their ability to reinvest it in growing the company, then they need to find other ways to benefit stockholders. The two ways are dividends and buybacks. Apple is already doing both, so the only question is whether either or both will be increased. Last I heard from Apple, they were preparing to announcing something this month. It might come next week, at the earnings announcement.

Look up the practice known as Greenmail, this guy was a pioneer of the practice and ruined thousands of lives in the process of doing absolutely nothing of value.