In the latest installment of its "iEconomy" series, The New York Times takes a look at how Apple minimizes its corporate tax burden, taking advantage of a number of legal maneuvers and loopholes around the world. Apple's strategies are of course fully legal and used by many other corporations, but with a spotlight on Apple as it has rapidly risen to become the world's most valuable publicly-traded company with record-setting profits, it has obviously attracted much attention about how it handles its money.

Apple, for instance, was among the first tech companies to designate overseas salespeople in high-tax countries in a manner that allowed them to sell on behalf of low-tax subsidiaries on other continents, sidestepping income taxes, according to former executives. Apple was a pioneer of an accounting technique known as the “Double Irish With a Dutch Sandwich,” which reduces taxes by routing profits through Irish subsidiaries and the Netherlands and then to the Caribbean. Today, that tactic is used by hundreds of other corporations — some of which directly imitated Apple’s methods, say accountants at those companies.

Among the tactics used by Apple:

- Setting up subsidiaries in low-tax locations such as Nevada, Ireland, Netherlands, Luxembourg, and the British Virgin Islands, routing as much revenue as possible through these locations. By routing much of its U.S. revenue through its Braeburn Capital subsidiary in tax-free Reno, Nevada, Apple is able to avoid California's corporate tax rate of 8.84%, while also reducing its tax burden on money earned in other states.

- Apple's iTunes S.à r.l. subsidiary in Luxembourg consists mainly of a mailbox and a few dozen employees, but records $1 billion per year in revenue as the entity responsible for all iTunes Store transactions throughout Europe, Africa, and the Middle East. With the iTunes Store offering strictly downloadable goods, Apple is able to take advantage of favorable tax treatment available in Luxembourg as part of the country's efforts to attract businesses.

- Apple has substantial operations in Ireland, but the report notes that one of the main benefits of locating there is that Apple is able to internally transfer its patent royalty earnings to a subsidiary there, with the money being subjected to a 12.5% tax rate rather than the 35% tax rate found in the United States. More than one-third of Apple's worldwide revenue is booked through its Irish subsidiaries.

- Apple records 70% of its revenue overseas, even though much of the product value would normally be considered to derive from their design, which occurs in the United States.

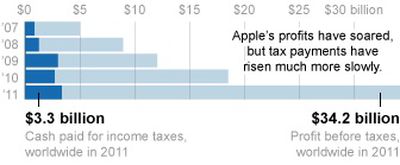

Overall, Apple paid $3.3 billion in corporate taxes in 2011 on earnings of $34.2 billion in profits, an effective tax rate of 9.8%, which is considered low by corporate standards. But with the company's tactics relying on a complex and disjointed system of tax laws throughout the world, it is difficult for the United States to single-handedly require Apple to book more of its revenue in its home country, which currently has the highest corporate tax rates in the world when federal and average state rates are included.

Apple has provided an official response to The New York Times, highlighting its role in job creation in the United States, the tax payments it does make, and its charitable giving. The company also notes that its business practices are in full compliance with all laws and accounting rules.

Update: As noted by Forbes, The New York Times is reporting an incorrect calculation of Apple's effective tax rate for 2011 of 9.8%, simply reusing numbers released several weeks earlier by the Greenlining Institute. Forbes points out that Apple's $3.3 billion in taxes paid during 2011 come from its quarterly estimated tax payments made during the year, but that federal tax guidelines instruct taxpayers to base their calculations on the previous year's earnings.

Consequently, Apple's 2011 quarterly tax payments are actually based on 2010's earnings, with the correct amount of tax for 2011 not being settled until Apple files its final taxes in 2012. And given Apple's strong growth rate, the incorrect assumption that Apple's 2011 tax payments were based on 2011's earnings grossly understates Apple's tax rate.

As outlined in his previous piece debunking the Greenlining Institute's claim, Tim Worstall notes that Apple reports its effective tax rate in its annual 10-K filings with the Securities and Exchange Commission, and that rate came in at 24.2% for 2011, much more in line with industry norms.