As Intuit's Quicken options for Mac users continue to falter in the wake of a stripped-down Quicken Essentials release and the company's ongoing efforts to make the more fully-functional Quicken 2007 compatible with OS X Lion, other personal finance software firms have attempted to step into the void.

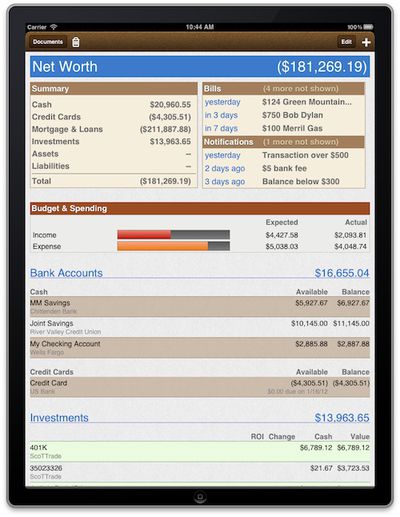

One of the more successful companies has been IGG Software with its iBank software, which is available as both a Mac application and a companion iPhone app. IGG Software has been teasing a few tidbits about its work on an iPad application over the past few months, and as noted in a new blog post today, the company appears to be making significant progress in moving toward the release of iBank Access for iPad. The forthcoming app will serve double duty as either a companion app to iBank for Mac or as a standalone personal finance app.

Among the most significant features of iBank Access is "Direct Access", IGG's new service that will provide users with significantly more options for automatically importing account data from their financial institutions.

After you enter valid credentials to log in to the bank’s website, you are given a list of accounts that you have at that financial institution – with the option of choosing which accounts you actually want in iBank. For example, many folks might have a checking, savings and even credit card all at the same bank and in the last screen you would be given the option to choose which of these you might not want to import. Most users will link all of the accounts. When the accounts are created, iBank imports available historical transactions associated with each account and even does some automatic categorization.

Here is where the beauty of our new aggregation system really begins to shine. Each time you launch the app, it goes out and fetches any new transactions. Unlike iBank for Mac, however, there is no separate window that appears where you have to manually verify which transactions to import. The new transactions just automatically appear conveniently marked.

In an effort to learn more about iBank Access and IGG's broader iBank efforts, MacRumors spoke with IGG's chief architect James Gillespie, a nearly 15-year veteran of Intuit who joined his brother Ian's company in 2008 to oversee iBank and other projects.

With the change to Direct Access for automatic syncing of information from over 5,000 financial institutions, iBank Access represents a paradigm shift for IGG in that it will require a small monthly fee ("in the range of a fancy cup of coffee") in order for users to take advantage of the service. Users who choose to manually import their transactions will not need to pay the monthly fee, but IGG believes that many will find the service worthwhile. Gillespie says:

Internally, people who have used it are very excited and love the experience. We plan on offering some sort of free trial so that everyone who wants to, can try it out. If people like it, then great - they can sign up, if they don't, then that is fine too. This is not something we are pushing for everyone, just for the people that want to import from their banks and not go through the Mac.

The new Direct Access capabilities will also eventually be making their way to iBank for Mac, increasing by tenfold the number of financial institutions able to feed data directly into iBank. For those users who prefer the existing OFX import solution, it will remain available.

Gillespie also notes that IGG is working on iCloud compatibility for its iBank products. MobileMe's iDisk service has been a popular method for iBank users to keep their data in sync, and IGG will continue to support iDisk syncing until Apple discontinues the service at the end of June. The transition to iCloud will be a relatively straightforward coming from iDisk, but will enable IGG to make further enhancements to syncing capabilities down the road.

We also asked Gillespie about the impact of the Mac App Store on iBank sales. iBank has been available in the Apple's marketplace for Mac software essentially from day one, and Gillespie notes that it has become the second-largest distribution channel for iBank, behind the boxed software and ahead of IGG's own download store. But sales have been increasing across the board, suggesting that Mac App Store sales are not cannibalizing other distribution channels and may indeed be helping to bring increased visibility for the company.

Finally, Gillespie shared details on some of IGG's recent hires, which have included two former Intuit employees who were core members of the team that led Mac software development and TurboTax for iPad development during their time there. With IGG providing them with a new home focused solely on Mac and iOS applications, the company believes that it has the right team in place to continue challenging Intuit in the personal finance software market.

iBank Access for iPad is still under development and IGG has not yet promised a release date, but the company is intending for it to launch sometime this summer.

Top Rated Comments

Although Mint.com certainly does offer a lot of convenient and useful features (their graphs are actually nicely done) their service isn't truly free and people are fooling themselves if they believe otherwise.

For agreeing to use Mint.com's services, at a minimum, you're agreeing to let them data-mine all your spending habits (https://www.mint.com/how-it-works/security/policy/), and target you with advertisements; sorry but that is a HUGE deal breaker for me, and I value my financial privacy way too much to agree to that invasive nonsense. I also suspect I'm not the only one that feels this way.

Also there are still some legit security concerns lingering around (see here (http://www.jasonowens.com/mint-com-in-2010-is-it-safe/) and here (http://www.usatoday.com/money/perfi/columnist/krantz/2011-02-22-financial-software-safety_N.htm)) regarding granting Mint.com access to your banking accounts via their online interface.

Personally speaking, it may not be perfect, but overall iBank has been great, and I'm happy to support a product that's clearly committed to the Mac platform and offers a solid application that addresses the vast majority of my personal finance tracking needs.

And for all those that don't want to pay a dime for anything, ultimately they get what they "pay" for.

If for no other reason (although there are several)..... the above is why I won't use Mint. Intuit can KMA.

iBank is a full featured stand alone program. You can enter your transactions manually instead of waiting for them to post to be added to your financial snapshot.

Personally, and this is just me on a soapbox here, I've never understood what the point is of using current bank balances as a way of taking a snapshot of your real time financial standing. If you don't enter your own transactions and reconcile your bank statement off of that at the end of each month how do you sniff out fraudulent charges or recognize when your cash is artificially inflated because checks haven't cleared or charges have not yet posted to your account?

I've been using iBank since 2008. It's simply gotten better and better. It is now rock solid, and its data entry, reporting and analysis functions are better than anything I've used before. I was a Quicken user since 1990, and did nor relish the thought of moving my data to another app. I actually used to love Quicken, although it did not handle transfers between accounts well at all.

iBank have actually cracked this transfer problem.

This year, I have been wildly busy and have not had time to keep my accounts up to date. Now US tax time approaches, and I needed to get my accounts up to speed. I entered a years worth of data (through direct access and QFX files), and I'm back on track. That took 4-5 hours. I used to spend that each month..

My son uses mint.com and seems to like it. I think that it's great that we have some real options for Mac users. We don't actually need Intuit anymore for personal accounting.

I'm quite sure that the reason this software was created and developed was for the purpose of selling it to users. So like I said....

I don't think too many people are going to buy/use this app, therefore I predict a flop. Side note:

American's having negative net worth is not the root of why America is in the financial mess it's in. I'm not paid to teach on here, but for the sake of filling in the apparent gap in your knowledge, the financial mess was caused by certain key factors: increased foreclosure rates, increased unemployment, unpaid debt owed to financial institutions, and other financial instability. All negative net worth means is that you have debt; it doesn't say anything about wether or not you're paying it off.. and tens of millions of people have negative net worth without having contributed to the financial mess.

The thing I am really waiting for is iCloud sync support.