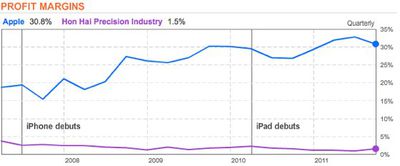

This chart, put together by Bloomberg, shows the slim profit margins that Foxconn deals with to build millions of pieces of consumer electronics for clients like Apple -- which has seen its margins grow dramatically in recent years.

At the time of the iPhone launch in 2007, Apple's profit margins were at 15.4 percent, while Foxconn's was at 2.7. In the most recent quarter, Apple reported 30.8 percent margins -- double what it was 4 years ago -- with Foxconn at a mere 1.5 percent.

Foxconn has continued to grow with the tremendously successful launches of new iPhones and the iPad. The company has sacrificed margin growth so it can get volume and scale, something very important to Apple which puts extraordinary pressure on its suppliers for low prices.

While Foxconn's margins are extremely small in comparison to Apple, they do exceed those of a number of categories, including grocery stores and the global shipping industry.

Top Rated Comments

What is amazing, and everyone on this thread hasn't mentioned, is that Apple has been able to make extremely healthy profits on a large scale. Usually these kinds of profits are only possible in a tiny niche industry that is too small to attract wolves ready to make the same products for much smaller profits.

Apple protects their turf using a lot of tools, the patent suits being only one such. Rather then blast Apple for making healthy profits, one should laude them for doing what most other companies cannot figure out how to do: be innovative with their products, be innovative in setting up cost efficient production strategies, be innovative in marketing to their customers, and being innovative in hundreds (if not thousands) of unique ways.

Remember, Apple shouldn't have been successful with their stores, everyone predicted a huge failure. Remember how Steve Ballmer laughed at the idea Apple could be effective in the phone business. Remember how everyone's tablet up to the iPad flopped terribly. Apple is seeking to break ground in many areas where other's make very thin profits, including the TV industry.

It's almost like there's been a business tenet in place that if you are going to do large scale things in certain business sectors then you will only make razor thin profits. Apple is proving that idea wrong, and in doing so, may actually shock the business industry into rethinking some basic business tenets so that once again companies may start making money like it was the 50s or 60s again.

One more thing: do a search for an article in the New York Times titled Even a Giant Can Learn to Run.

It's about the turn-around at I.B.M. with the new C.E.O., Samuel J. Palmisano, in 2002. That's when the company shed the P.C. business along with other businesses that were not highly profitable. It's been so profitable that Warren E. Buffett, who typically shuns technology stocks, announced he had accumulated $10 billion of I.B.M. shares, a stake of more than 5 percent.

What I found most interesting about Mr. Palmisano is that he built the change at I.B.M. on four questions:

• “Why would someone spend their money with you — so what is unique about you?”

• “Why would somebody work for you?”

• “Why would society allow you to operate in their defined geography — their country?”

• “And why would somebody invest their money with you?”

It sounds obvious, but that's how change starts. Some companies break mental boundaries, and other can follow. There was a time no olympian could break the four-minute mile, however once one man did, it is now being done at high school meets.

Apple can keep their prices and thus their profits high because a huge portion of their customer base has zero interest in buying a Dell or a Nokia thingy, even if it's 10%+ cheaper than Apple's stuff. The demand still strongly exists even at the higher price point.

However if Foxconn tried raising their prices more than just a bit, a whole bunch of other manufacturing companies would gladly jump in with a price in between, and many of Foxconn's customers would jump ship faster than a blur. The taste would be of a poisoned fruit Foxconn would end up eating themselves.

I don't disagree per se. However - they might not actually be able to renegotiate or their hands might have been tied in the first place IF they wanted to sustain their business.

Further - it DOES say something about Apple if (and I say IF) Foxconn workers are exploited. It's not JUST a matter between the employees and Foxconn.

You can't deny that the press just loves to run with stories when someone at Foxconn gets injured, commits suicide, etc. And whether or not it's "fair" to Apple is irrelevant. They get the bad press.

Tim Cook.

They certainly would do bring manufacturing to the States if you would be willing to pay the price. You, the consumer decide what products sell.

I work with a company that purchases components from China. They get quotes from USA companies on a regular basis. China companies bid at 10-15% of what the USA companies bid. Using the US components would cause the final product sale price to jump by 400%. Would you buy an iPad if Apple charged 4 times its current price? I don't think so. They'd be out of business in no time.