Manipulation of Apple's Stock Price Evident in the Options Market?

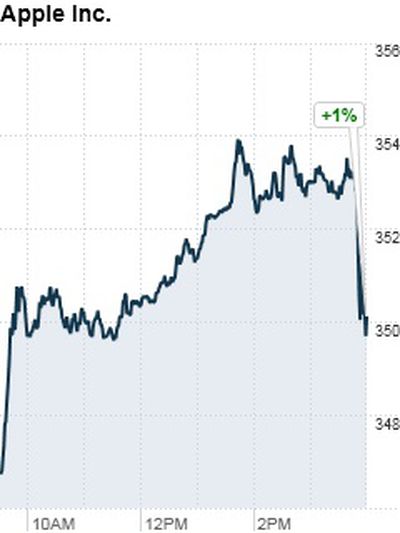

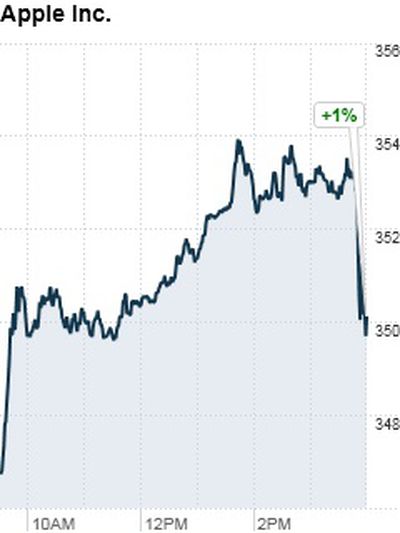

Apple's stock price drop in the closing minutes of trading on April 29th

Fortune reports on an interesting phenomenon being observed in Apple's stock price related to the weekly options market, the trading of rights to purchase stock at a given price at the end of a specified period. According to the report, Apple's stock is consistently seeing suspicious price changes on Fridays as those options are set to expire, activity that makes a significant of traders lose any potential gains as the stock price moves to meet the strike price for that week's options. In many cases, that activity serves to depress the overall stock price, thereby also negatively impacting regular traders as well.

It was 3:48 p.m. on Friday April 29 and traders who had purchased Apple (AAPL) April 29 $350 "calls" -- options that gave them the right to buy Apple shares in blocks of 100 for $350 per share -- were sitting pretty. The stock was trading around $353.50 and those calls were worth more [than] $350 apiece (the difference between the price of the stock and the so-called "strike price" of the option times 100).

Then, in an extraordinary burst of trading -- exacerbated by the rebalancing of the NASDAQ-100 scheduled for the following Monday -- more than 15 million shares changed hands and the stock dropped below the $350 strike price just before the closing bell. Result: The value of those calls disappeared like a puff of smoke.

Fortune went back and charted the daily closing prices for Apple stock over the past eight weeks, comparing the Friday closes to the "max pain" price at which options on both sides of the equation (puts and calls) have the least value in aggregate. Throughout the time period, Apple's stock consistently moved toward the max pain point on each Friday, sometimes over a period of only minutes as trading came to a close for the week.

While the phenomenon is not new and not unique to Apple, the reasons for it are not entirely clear. Some have argued that normal hedging activity is responsible for the drifts in stock price, but scientific studies have shown that such stock price behavior would not be accounted for by simple hedging and is thus indicative of stock price manipulation, which is illegal under U.S. securities law.

Apple is obviously one of the most closely watched stocks these days, and with the second-largest market capitalization in the U.S. markets has the potential to significantly influence trading. And so an apparently consistent manipulation of Apple's stock price makes for an interesting story, even if it is not yet clear who is responsible for the activity and how it is being accomplished.

Popular Stories

Apple's next-generation iPhone 17 Pro and iPhone 17 Pro Max are less than three months away, and there are plenty of rumors about the devices.

Apple is expected to launch the iPhone 17, iPhone 17 Air, iPhone 17 Pro, and iPhone 17 Pro Max in September this year.

Below, we recap key changes rumored for the iPhone 17 Pro models:Aluminum frame: iPhone 17 Pro models are rumored to have an...

The long wait for an Apple Watch Ultra 3 appears to be nearly over, and it is rumored to feature both satellite connectivity and 5G support.

Apple Watch Ultra's existing Night Mode

In his latest Power On newsletter, Bloomberg's Mark Gurman said that the Apple Watch Ultra 3 is on track to launch this year with "significant" new features, including satellite connectivity, which would let you...

The upcoming iPhone 17 Pro and iPhone 17 Pro Max are rumored to have a slightly different MagSafe magnet layout compared to existing iPhone models, and a leaked photo has offered a closer look at the supposed new design.

The leaker Majin Bu today shared a photo of alleged MagSafe magnet arrays for third-party iPhone 17 Pro cases. On existing iPhone models with MagSafe, the magnets form a...

iOS 26 and iPadOS 26 add a smaller yet useful Wi-Fi feature to iPhones and iPads.

As spotted by Creative Strategies analyst Max Weinbach, sign-in details for captive Wi-Fi networks are now synced across iPhones and iPads running iOS 26 and iPadOS 26. For example, while Weinbach was staying at a Hilton hotel, his iPhone prompted him to fill in Wi-Fi details from his iPad that was already...

The iPhone 17 Pro Max will feature the biggest ever battery in an iPhone, according to the Weibo leaker known as "Instant Digital."

In a new post, the leaker listed the battery capacities of the iPhone 11 Pro Max through to the iPhone 16 Pro Max, and added that the iPhone 17 Pro Max will feature a battery capacity of 5,000mAh:

iPhone 11 Pro Max: 3,969mAh

iPhone 12 Pro Max: 3,687mAh...

Apple today seeded the second betas of upcoming iOS 18.6 and iPadOS 18.6 updates to public beta testers, with the betas coming just a day after Apple provided the betas to developers. Apple has also released a second beta of macOS Sequoia 15.6.

Testers who have signed up for beta updates through Apple's beta site can download iOS 18.6 and iPadOS 18.6 from the Settings app on a compatible...

Apple is developing a MacBook with the A18 Pro chip, according to findings in backend code uncovered by MacRumors.

Subscribe to the MacRumors YouTube channel for more videos.

Earlier today, Apple analyst Ming-Chi Kuo reported that Apple is planning to launch a low-cost MacBook powered by an iPhone chip. The machine is expected to feature a 13-inch display, the A18 Pro chip, and color options...