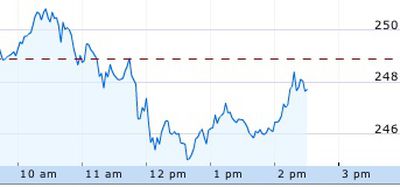

Earlier today, Apple's stock price briefly surpassed $250 per share before being dragged down by an overall market slide precipitated by charges brought by the U.S. Securities and Exchange Commission against Goldman Sachs over alleged subprime mortgage securities fraud.

Apple's stock has since rebounded, but remains below both the $250 threshold and today's opening price of $248.99.

AAPL stock has seen a number of milestones in recent weeks, having surpassed $200 billion in market capitalization in early March, and only days later moving past Wal-Mart to become the third largest U.S. company by market capitalization.

Just yesterday, Fortune released its annual Fortune 500 rankings of U.S. companies by revenue, which saw Apple jump to 56th place from 71st place in last year's survey. The report also ranked Apple as offering the greatest return to shareholders among Fortune 500 companies over the past five years, with an average annual return of 45.6%.

Top Rated Comments

Yee Haw!

And actually today I'm commenting about it, because I didn't actually sell any shares, I just got a loan on my margin account against my AAPL shares. So that is working out good now! (for a while when it dropped to 350, I was slightly on the bad side of that load, but hell, AAPL is going up more than 5% per year to cover that interest!).

I'm selling covered calls on AAPL for OCT - something high up - just to grab a few grand, and if the price comes in, so what, I sell some and pay down the margin loan on the Porsche!

Booyah again

Sold at $82. Didn't buy it back until $187.:rolleyes:

I thought I would bite so you don't continue to talk to yourself!

Lets hear some more predictions.

Some major refreshes this year like the iPad 3 and iPhone 5 which shouldn't be minor upgrades like the iPhone 4s and iPad 2 which could potentially see a lot more people upgrade. Also the potential announcement of the iTV and maybe dividends.

As long as the economy doesn't tank again I can see:

Jan 2013 - $550

Jan 2014 - $650

(pat myself on the back again!)

Gold is a little short of $2000.00, but it's close. DOW 20K for 2014 still on? I guess I have to stick with what I said. Time is a strange thing how it passes.

AAPL is over 450.

Now everyone thinks 600 is possible. Nobody is arguing with me about it.

I almost liked it more when I felt I knew something the suits didn't know. But now they can't miss it.

100 Billion in cash at Apple eh? If Apple has zero growth they will have $200B in cash within 5 years!

I think I'm getting a bit over-confident. The only thing that will mess me up a bit is some mega crash

I think over the last couple of years I have realized that the USD is KING - no matter what. I was thinking the USD would be crashing, it almost has to, but I guess since the entire world of currency is so messed up, the USD is going to remain the monopoly money of choice.

I didn't have my usual AAPL discussion with James's dad this Christmas. I think they are all tired of me being right all the time, and when I ask them how many AAPL shares they bought from my advice over the many many years, the answer is zero. I think they might be happier if I lose my shirt honestly haha.

Quoting myself.

Self you are one smart dude!

Yay!