In an extensive research report on the smartphone industry released this morning, RBC Capital Markets reveals a "new world order" in which smartphones embracing the convergence of communication, computing, and content are becoming the "next wave" of computing. Based on this evidence, RBC sees smartphones, led by Apple, Research in Motion and Palm, taking a larger share of mobile phone sales than previously predicted, and even capturing users, revenue and market share from other markets such as the PC, TV, media player, digital camera, gaming, and navigation markets previously considered discrete market segments.

RBC sees the possibility for 4-5 smartphone "leaders", each carving out a fairly distinct market segment on which to focus. The model sees Apple as having staked out the "media-centric" segment and Research in Motion having grabbed the "productivity-centric" segment, and proposes three other segments that may yet arise: "PIM-centric" focused on personal organization, "cloud-centric" based on data-heavy users taking advantage of web-based e-mail, social networking and other web-based services, and a "specialized" market for devices that excel in one specific area such as e-books, gaming, or navigation.

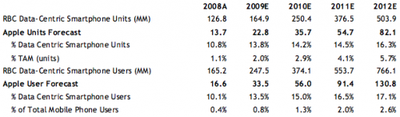

The report views Apple's installed base of 100+ million iPod users and 300+ million iTunes users as natural leverage for expanding market share, and sees the company continuing to introduce innovations that will further expand the addressable market. Apple's existing smartphone unit market share of 10.8% is expected to grow to 16.3% in 2012, but that growth would occur alongside expected growth of the smartphone share of the overall mobile market from ~10% to 35% over that time. The result is that Apple's overall mobile market share would grow from 1.1% in 2008 to 5.7% in 2012 on unit growth from 13.7 million in 2008 to 82.1 million in 2012.

Based on the total market analysis, RBC has raised its target price for Apple's stock to $250 from a previous target of $190.

We view the iPhone as a 10-year platform, with significant growth and share gains ahead. Our outlook reflects continued share gains in domestic and international markets, driven by distribution expansion, innovations in user experience, and additional iPhone SKUs. Apple's iTunes/iTunes Store/device ecosystem remains a significant source of competitive advantage.

Besides Apple, RBC also sees Research in Motion continuing to succeed with its BlackBerry line of smartphones and Palm possessing the "secret sauce" of management, integration and innovation to leverage its new webOS operating system for future market gains.