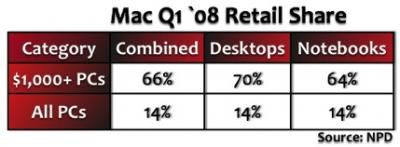

eWeek first reported on an interesting breakdown of Apple's retail marketshare. According to numbers from the NPD Group, Apple's Q1 2008 retail (brick and mortar) reached 14%. Note that by limiting it to retail, they've excluded online sales and institutional/enterprise sales.

More surprising, however, is if you limit the data to computers priced above $1,000, Apple represents 66% of all retail computer sales.

Apple's success above $1,000 defies some of the conventional retail thinking about PCs, where the emphasis is on lower pricing and greater features. "Consumers don't care about features," Stephen asserted. "People see a value proposition in an offering that gives them a great experience."

As with all statistics, it's difficult to take these raw numbers at face value. Instead, the most revealing finding is how quickly this market share has been increasing. Fortune reports that Apple's $1,000+ January 2006 marketshare was only 18%. Their share grew to 57% by September 2007 and finally to 66% in the 1st quarter of this year. These numbers confirm Apple's reporting of large year-over-year growth of Mac sales during their financial results.

One long term question becomes whether or not the saturation of their target market ($1,000+ computers) will limit Apple's future growth. If more customers aren't attracted to this high-end market over time, Apple's Mac sales growth will necessarily stall. Meanwhile, up until now, Apple has been resistant to compete in the low margin market. Apple's only sub-$1,000 offering, the Mac mini, has been rumored to be just hanging on to life.

This phenomenon could explain Apple's willingness to experiment in seemingly niche markets that were not previously satisfied by Apple's offerings. A product like the MacBook Air might be able to further expand their already-large marketshare amongst customers in the $1,000+ market. If Apple's success continues, however, there will be no where else to look but to the sub $1000 market for additional customers.