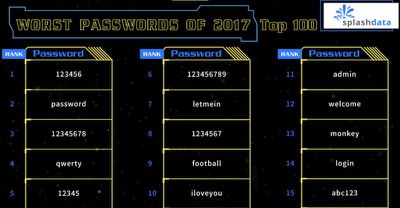

SplashData today published its annual list of the worst passwords of the year, using data pulled from over five million passwords that were leaked across 2017 by hackers.

Despite many well-publicized major data leaks in 2016 and 2017, many people continue to use weak passwords that are easily guessed. "123456" and "Password," for example, were the two most popular passwords SplashData came across, as they have been for several years running.

Other passwords in the top 10 of the worst passwords list included "12345678," "qwerty," "12345," "123456789," "letmein," "1234567," "football," and "iloveyou." "Monkey," "123123," and "starwars" also made the list this year, as new easily guessable passwords people have adopted. Passwords made up of a single word or consecutive number string are dangerous because they're so easy to guess.

"Unfortunately, while the newest episode may be a fantastic addition to the Star Wars franchise, 'starwars' is a dangerous password to use," said Morgan Slain, CEO of SplashData, Inc. "Hackers are using common terms from pop culture and sports to break into accounts online because they know many people are using those easy-to-remember words."

With data breaches from major companies so common, a strong password that consists of multiple random words or multiple numbers, letters, and characters is essential, and it's also important not to use the same password for more than one account.

Safari has built-in password generating features, and passwords can also be stored in the Keychain and accessed on all of your iOS and Mac devices. Password management apps like 1Password, LastPass, or SplashID can also make remembering and managing multiple passwords simple.

SplashData publishes its annual list to encourage people to use stronger passwords. This year, the company's data came primarily from North America and Western Europe, culled from data leaks. Yahoo data and data from adult websites was not included.

In 2017, there were several major data leaks from companies that included Verizon, Saks Fifth Avenue, Deloitte, and Uber, along with a huge Equifax breach that exposed the personal information of millions of people.

Today marks the fourth anniversary of Apple last updating the Mac Pro.

Today marks the fourth anniversary of Apple last updating the Mac Pro.

Note: MacRumors is an affiliate partner with some of these vendors. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.

Note: MacRumors is an affiliate partner with some of these vendors. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.