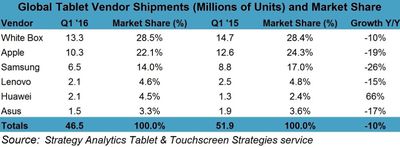

The latest data from research firms IDC and Strategy Analytics reveals that iPad market share declined for the ninth consecutive quarter as the worldwide tablet market continues to slow. Apple now has between 22.1 and 25.9-percent market share among tablet vendors, down from between 24.3 and 27.2-percent in the year-ago quarter.

Apple reported iPad sales of 10.3 million during the March quarter earlier this week, compared to 12.62 million in the year-ago quarter. IDC and Strategy Analytics data shows Samsung trailing in second with 6 to 6.5 million tablets shipped, amounting to 14.0 to 15.2-percent market share during the first three months of 2016.

IDC data shows that Amazon experienced explosive 5421.7-percent year-over-year growth, with its market share rising from just 0.1-percent to 5.7-percent on the strength of new low-cost Fire tablets. The research firm noted that it did not count the Fire HD 6 in its Q1 2015 numbers. Strategy Analytics did not share Amazon data.

Lenovo and Huawei rounded out the top five in both datasets, with both vendors having shipped between 2.1 and 2.2 million tablets during the quarter. Their respective market shares ranged between 4.5-percent and 5.5-percent, amounting to only a slight variation between the IDC and Strategy Analytics data.

Global tablet shipments reached between 39.6 and 46.5 million during the quarter, the latter of which is the lowest total since the third quarter of 2012, according to Strategy Analytics. Nevertheless, IDC noted that convertible 2-in-1 tablets continue to experience growth, with quarterly shipments totaling 4.9 million.

"Microsoft arguably created the market for detachable tablets with the launch of their Surface line of products," said Jitesh Ubrani, senior research analyst with IDC's Worldwide Quarterly Mobile Device Trackers. "With the PC industry in decline, the detachable market stands to benefit as consumers and enterprises seek to replace their aging PCs with detachables.

Apple's recent foray into this segment has garnered them an impressive lead in the short term, although continued long-term success may prove challenging as a higher entry price point staves off consumers and iOS has yet to prove its enterprise-readiness, leaving plenty of room for Microsoft and their hardware partners to reestablish themselves."

IDC and Strategy Analytics shared smartphone and smartwatch data earlier this week.

Top Rated Comments

At the end of the day, Apple's iPad is being handicapped by its own superb hardware coupled with its utter lack of innovation in software, meaning there isn't much incentive to upgrade. Newer iPads don't really do anything new, only faster. The new strategy of increasing prices on everything from cases to the iPads themselves is only going to hurt sales more (as it rightly should). I guess Apple has decided they're better off trying to wring as much money out of the few people who are buying new iPads rather than innovating to drive more people to buy the product. Not a good strategy long term.