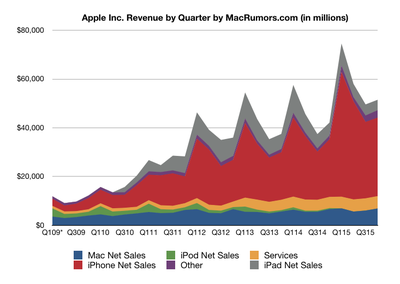

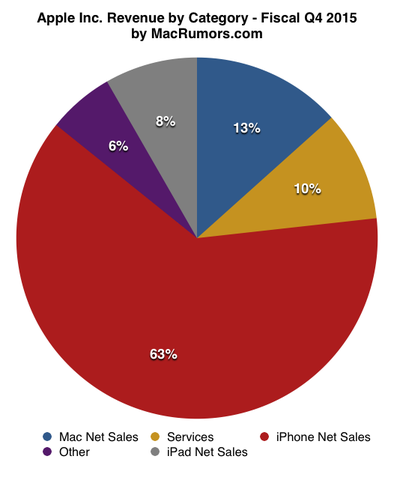

Apple today announced financial results for the third calendar quarter and fourth fiscal quarter of 2015, setting a number of company records. For the quarter, Apple posted revenue of $51.5 billion and net quarterly profit of $11.1 billion, or $1.96 per diluted share, compared to revenue of $42.1 billion and net quarterly profit of $8.5 billion, or $1.42 per diluted share in the year-ago quarter.

Apple today announced financial results for the third calendar quarter and fourth fiscal quarter of 2015, setting a number of company records. For the quarter, Apple posted revenue of $51.5 billion and net quarterly profit of $11.1 billion, or $1.96 per diluted share, compared to revenue of $42.1 billion and net quarterly profit of $8.5 billion, or $1.42 per diluted share in the year-ago quarter.

Gross margin for the quarter was 39.9 percent compared to 38 percent in the year-ago quarter, with international sales accounting for 62 percent of revenue. Apple also declared an upcoming dividend payment of $0.52 per share, payable on November 12 to shareholders of record as of November 9. The company currently holds $205.6 billion in cash and marketable securities.

For the quarter, Apple sold 48 million iPhones, up from 39.2 million in the year-ago quarter. iPad sales were down to 9.9 million from 12.3 million in the fourth quarter of 2014, and Mac sales rose to 5.7 million from 5.5 million.

For the full fiscal year, Apple generated $233.7 billion in sales, a new record for the firm, with $53.4 billion in net income.

“Fiscal 2015 was Apple’s most successful year ever, with revenue growing 28% to nearly $234 billion. This continued success is the result of our commitment to making the best, most innovative products on earth, and it’s a testament to the tremendous execution by our teams,” said Tim Cook, Apple’s CEO. “We are heading into the holidays with our strongest product lineup yet, including iPhone 6s and iPhone 6s Plus, Apple Watch with an expanded lineup of cases and bands, the new iPad Pro and the all-new Apple TV which begins shipping this week.”

Apple's guidance for the first quarter of fiscal 2016 includes expected revenue of $75.5-77.5 billion and gross margin between 39 and 40 percent.

Apple will provide live streaming of its fiscal Q4 2015 financial results conference call at 2:00 PM Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Conference Call and Q&A Highlights are available in reverse chronological order after the jump.

2:58 pm: The call is complete.

2:58 pm: A: We actually solved that problem in 2007, but then had to change it in order to scale in a major way. That is something that we would always in our mind, one day from a customer experience point of view, we would like to make things as easy as possible for the customer. You can already do that with buying on line sort of, but there are many different plans that people buy that they have to come in for. Yes, we would love to have that automated, working with service providers.

2:57 pm: Q: On upgrade program, can you envision a time ever in the US or elsewhere where you would not need to get into an Apple Store to take advantage of the upgrade?

2:57 pm: A: The statement I made in China was about Q4 and 6s was only available in China for two days last quarter. iPhone 6s is the most popular iPhone that we currently sell. In terms of has there been a change? If you look at iPhone 6 today, and add iPhone 6 Plus, and compare that to 5s... we are doing better at that price point than we were previously.

2:56 pm: Q: Comment on mix between 6 and 6s, and whether mix of demand is any different than you saw in 5/5s point, more demand for 6?

2:55 pm: A: Will see what demand is, trying to position inventory for following quarter at the end. Difficult to predict. Re iPhone growth in fiscal Q1, I was making a revenue statement but units should be up as well.

2:55 pm: A: iPhone growth in fiscal Q1, is that statement more reflective of iPhone units or revenues? ASP might get growth even if units are not there? Will you exit in 5-7 week inventory range?

2:54 pm: A: Positive side, positive leverage from higher seasonal volumes. What we've seen over last several quarters is a commodity environment that is favorable, expect it to remain favorable. On other hand, we are launching a lot of new products, launched some in September, some now, and every time we launch new products we make them better, add features, when we launch them, they have higher cost structures than the ones they've replaced. We have great track record to reduce those cost structures, there is a head wind to gross margin. What's different, is FX impact that we've mentioned before. It remains a very significant headwind, as I mentioned earlier to Toni, we're dealing with that through hedging, cost realignments, etc. Clearly be a sequential headwind.

2:53 pm: Q: Gross margin dynamics going from September to December? FX and other headwinds that would imply Gross Margin going down in December?

2:52 pm: A: This isn't exactly what you're asking but this will give you some color. We don't look at it in the aggregate, we look at detail. By iPhone model, by country, what percent is going to a first iPhone buyer? If you look at China as an example, it's over 50% of people who bought a 6 and 6 Plus were buying their first iPhone. As you move down the line, that number goes up. 5s generally is higher in most countries.

2:51 pm: A: We've made a number of price changes over fiscal 2015, what we've seen in a number of these markets is that iPhone sales have been very resilient. That's shown in our growth rates. Most recently we've adjusted some prices around the world for the launch of the 6s and 6s Plus. We feel very positive about sales trends around the world but it's a bit early to tell. Obviously when we increase prices around the world, it's normal to see some impact on sales rates. We've been very encouraged by the response.

2:50 pm: Q: You've had to make adjustments to pricing in various regions, what has been the response to demand in some of these regions like Japan, India, parts of Europe where local prices have gone up?

2:50 pm: A: I don't know the answer.

2:50 pm: Q: Roughly what percent of iPhone shipments come to shipments to installed base vs new user shipments?

2:50 pm: These are things that we're very focused on. The first time buyer number is surprisingly strong. Keep in mind, we have a good history, once people buy one Apple product, they have a great experience and begin to look at other Apple products.

2:49 pm: A: In terms of 2016 vs 2015, regarding new customers, it's hard to predict. I'm very happy with how we're doing, better than we've ever been doing. I know there's a fixation on upgrade rate. When I look at the upgrade rate, I feel good that it's a low number. That means 69% of the people out there, prior to the iPhone 6 and 6 Plus that haven't bothered to upgrade just yet. That's a large number .That's an opportunity. Do I think it has anything to do with consistency? Part of it is. I believe the iPhone upgrade plans that are out there, it seems to me only the future will tell, but it's going to act as a catalyst to accelerate some of those upgrades. That's not something that we'll see this quarter or next quarter, but beginning a year from now or so. It begins to be, you've seen the plans, they look and act more like a subscription than a purchase. That's great for the customer, many want to upgrade on a frequent basis and they can do this simply. In terms of new, I don't know if we'll have more new or not, that's always our objective. We want to add a lot more people to the ecosystem and certainly if you look at the emerging markets, nobody is asking about iPad on the call, if you look at iPad as an example, in China 68% of people that purchased an iPad, it was the first tablet they've owned. 40% of those had never owned any Apple product.

2:47 pm: A: Android... what this means is that customers who purchased an iPhone last quarter AND replaced a smartphone, 30% of those switched from an Android device. Some switchers on top of that from other operating systems but Android is the largest one by far. That's what that means. That number is the largest that we've ever recorded since we began measuring it 3 or so years ago. It's a huge number, we're very proud of that number.

2:46 pm: Q: Two sources of iPhone demand, selling to current customers and new customers. Indicated a third of the base has moved to the 6 line. 33% is not that big a number, would have thought it would be bigger than that. Is there more of a consistency to upgrading than the street perceives? Clarity on switcher number, 30% of iPhone shipments in quarter went to Android switchers? Could you have more switchers in 2016 than 2015?

2:45 pm: That said, I don't think it's growing as fast as it was but I don't think Apple's results are largely dependent on minor changes in growth. I think other things contribute to it much more. Not saying we'll never have an issue with the economy, but thinking the area it's currently operating in, it's hard to tell a difference at the consumer level for us. If you look at our daily and weekly numbers, you can't tell. We're investing in China for the decades ahead, and as we look at it, our own view is that China will be Apple's top market in the world and that's not just for sales, that's also for developer community. Growing faster than any other community in the world. Ecosystem there is very strong.

2:43 pm: A: China, we grew 87% on Greater China. Market grew 4%. Take Market minus iPhone, it actually contracted slightly. We grew without market growing. iPhone 6 was number one selling smartphone in mainland China last quarter and iPhone 6 Plus was number 3. We did fairly well. Economic question which I know there's been a lot of attention on, frankly if I were to shut off my web and shut off the TV and just look at how many customers are coming in our stores regardless of buying, how many people are coming online and looking at sales trends, I wouldn't know there was any economic issue in China.

2:42 pm: Q: China, big growth on iPhone, where are you in the market place and penetration from a smartphone sales point? China Mobile given huge potential to grow from LTE

2:41 pm: A: From a product point of view, we've actually been continuing to change and improve iOS for some time, with every release there are more enterprise features. Continuation of that cadence perhaps with a little more intensity. From go to market POV, we're working with IBM and Cisco, working with 75 mobility partners that are principally in the US. That's expanding quickly to international as well. Many of these companies have, in some cases very large sales forces. In addition to direct sales force, and huge worldwide indirect channel that many customers buy from and count on buying some services from. I do not envision Apple having a large enterprise sales force, we'll clearly continue adding some people more on the engineering side, but I don't envision having a large direct sales force.

2:40 pm: Q: Relatively small sales force internally, important driver of growth. How do you attack enterprise market going forward? Shift and focus products? Adequately attack it?

2:39 pm: We do that in countries where FX movements are particularly extreme. We cover that through pricing, and finally we are putting in place a number of cost initiatives that will allow us to deal with FX situation. Very strong guidance for first quarter, beyond the first quarter we won't guide so we'll see over the course of the year.

2:39 pm: A: What's going to happen in practice, we have this portfolio of hedge contracts that over time provides protection to margin and results. Over time it diminishes. That protection will come off, assuming that the dollar stays at current levels. There are some currencies that we cannot economically hedge so those are excluded, but I think, my conclusion is that the guidance we're providing for the first quarter, 39-40% GM is an incredible level of guidance given the FX headwinds. We will continue to hedge, we will continue to provide some level of protection to FX movements. In some cases, we have realigned prices particularly when we launch new products.

2:37 pm: Q: Reported gains from currency hedging in 2015 were significant, several billion to the company, how do we think about this notion of currency hedges effectively rolling off and being replaced with hedges that are likely to have less of an impact? How do we think about that impacting P&L on a go-forward basis with Q1 and qualitatively or directionally over the course of the year? What have you undertaken or plan to to mitigate those concerns?

2:37 pm: A: We don't guide beyond December, I do think the macro things I spoke about earlier, upgrade programs, Android switcher rate, iPhone momentum in emerging markets and LTE penetration in these markets, these trends are not one quarter things. They're longer term things. My same response applies. We'll do quite good in iPhone, will grow this quarter as we put in our guidance. When you start with a number in low 30's in terms of percentage of installed base that's upgraded, iPhone 6 and 6 Plus, that number is still likely to leave a lot of headroom beyond December. That's how I look at that, in terms of your first comment... our forecasting doesn't work like you articulate. I recognize that people can have their own models and so forth, but to make it clear, I'm not agreeing with your point.

2:35 pm: Q: Q1 will benefit at least on a year-over-year basis from 3 more weeks of sales in China and more initial launch days that only 2 of them were in the September quarter and remainder will be in December quarter. So I guess the investor concern is December is a structurally advantaged quarter in the sense of benefitting from both of those tailwinds on a YoY basis. Look out beyond December, wouldn't that point to notably lower seasonal growth in March? How do we think about the factors affecting unit growth beyond the December quarter?

2:34 pm: A: I would think about it as being... some clearly offered in market prior to this cycle. They became much more pervasive and communicated much wider with September announcements. I would expect to begin seeing this somewhere around a year from now.

2:33 pm: Q: Is this something that has a more measurable impact on the business 2-3 quarters down the road?

2:33 pm: Luca: Transaction on the iPhone upgrade program is a purchase, not a lease. Recognize revenue up front. Deduct cost to do interest free financing and deferred value of upgrade option for the customer, it's a popular program in US store but in scheme of things it's a small percentage of worldwide sales. Negligible impact on ASP.

2:33 pm: A: We do think the broader upgrade program, not just ours in Retail (that is relatively small compared to total iPhone sales) but broader thing from carriers offering these plans, if you look at them in the aggregate, we think it would have a positive impact on replacement cycle. We do like that it creates a market for an iPhone at a different price point as well that is a better product than that customer may be currently buying. Will further help from an ecosystem point of view. Not to be underestimated. Seems like from a rollout point of view, you will see these plans offered in a signifiant way in the US already but these plans are being offered in some derivation in over a dozen countries in the world. Not as pervasive as they are in the US but it seems like we're on the front end of a fairly major trend in the industry.

2:31 pm: Q: You briefly touched on reducing the time between upgrades, how do you think about the iPhone upgrade cycle compressing over the next few years? Talk a little about when that's going to be rolled out internationally? Luca, mentioned accounting changes related to iPhone upgrade program, any idea with how many S upgrades were linked to upgrade program?

2:30 pm: A: App Store is growing over 20%. 25% last quarter. We feel very good about that, become a sizable business. Would point out that these upgrade programs in the market, where they sort of begin to look like a subscription business how they operate. We think that in the aggregate, they may reduce upgrade cycles and also be the iPhone that has been sold to someone else... hits a price point that we're not hitting today. Could help further fuel the services revenue which we did quite well on last quarter.

2:29 pm: Q: If you look at large services companies, Facebook, Google, largely driven by activity of Apple users. Is there more for Apple to do to participate in that?

2:29 pm: A: Constant currency growth rates... our guidance is 8-11 percent. 700 basis point FX headwind in Q1. Growth is actually quite good underneath that, a problem that everyone's struggling with. Here's what I see on growth. iPhone will grow in Q1. We base that on what we're seeing from a switcher point of view. Recorded highest rate on record for Android switchers last quarter at 30%. We look at the number of people that have upgraded that were in the installed base prior to iPhone 6 and 6 Plus, and that number is in the low 30 percentages. We have a very open field in front of us. Our performance in emerging markets, although it's quite good and our revenue is good, our market share is low. And the LTE penetration in these markets is quite low. Also, if I zoom out and look at China, as I said before, we see an enormous change in China over the next several years. If you look back 5 years, China's middle class had 50 million in it. Look ahead, it will have 10 times that number in it. I feel like we're reasonably well positioned in China, I'm sure we can do better, but I think we can do fairly well there. It's not the only market that we're working on, I was really impressed with our progress in Vietnam and Indonesia and India among others. From currency POV, weak global economy, we don't overly focus on this. My view is it's a transitional kind of thing, we invest for the long term so we're investing for Apple's future. In addition to those, Apple TV is off to a great start. Apple Watch is just getting going. App Store hit a new record again last quarter and the growth seems really great there. Happy with early days of Apple Music, moving from free trial to music business. Finally, Enterprise business is not to be underestimated. I doubt many people knew we had $25b enterprise business that we've quietly built in not too many years. Our penetration is low but we have significant actions going on to really deepen that. Everywhere I look, I see significant opportunity.

2:25 pm: Q: In light of December quarter revenue guidance for low-single digit revenue growth. How do you get comfortable being on the edge of being ex-growth for the first time in a decade?

2:25 pm: Q&A with analysts is beginning.

2:23 pm: Fifth accelerated share repurchase program completed in July, an additional 10 million shares. $143 billion in $200 billion program.

2:23 pm: Returned over $17 billion to investors. $3 billion in dividends, and $14 billion to repurchase almost 122 million Apple shares on the open market.

2:23 pm: Issued more debt in Australian dollars, Euros and British Pounds. $56 billion in total term debt at the end of the quarter.

2:22 pm: Relative to iPhone upgrade program, we will be reducing revenue at time of sale for cost associated with the program, and deferring some earnings for each iPhone sold.

2:21 pm: Going over new items like Apple iPhone Purchase Program.

2:19 pm: Excited about potential for iPad Pro in enterprise.

2:18 pm: 55 apps in IBM MobileFirst for iOS catalog. Inside IBM, Macs are gaining tremendous traction. 30,000 Macs within the company, with 1,900 more each week. Each Mac is saving $270 vs a traditional PC thanks to reduced support cost and higher residual value.

2:18 pm: New strategic partnership with Cisco. iOS mobile users with great performance advantage over mobile platforms. IBM released new MobileFirst apps across a number of sectors.

2:17 pm: In segments of tablet market where Apple competes, Apple has 73% share of US market for tablets priced above $200. IDC says iPad has 74% share of US commercial tablet market.

2:17 pm: iPad customer metrics remain extremely positive. ChangeWave says 97% consumer satisfaction rate for iPad Air 2, 70% of tablet purchasers plan to purchase an iPad. 95% satisfaction for corporate buyers.

2:15 pm: More favorable mix, gross margin improves on lower than expected costs even with strong FX headwinds.

2:14 pm: Going over earnings, gross margin, etc.

2:13 pm: CFO Luca Maestri on the call now.

2:12 pm: Enterprise markets accounted for $25 billion in revenue over the last 12 months, up 40% over the prior year.

2:12 pm: Cook is going over Apple News, Apple Pay, and other services.

2:10 pm: Will be available to eligible Amex customer in Canada and Australia this year, and Spain, Singapore and Hong Kong in 2016.

2:10 pm: We're partnering with American Express to bring Apple Pay to customers in key global markets.

2:09 pm: iOS 9 is set to be downloaded by more users than any previous Apple OS release. 61% of eligible devices are using it.

2:08 pm: We think apps represent the future for TV.

2:08 pm: Started taking orders for new Apple TV.

2:07 pm: Revenue in Greater China nearly doubled year-over-year.

2:06 pm: 13,000 apps on the Watch app store, including 1,300 native apps.

2:06 pm: App Store set new all-time quarterly records for total customers and overall revenue. Helped fuel $5.1 billion in services revenue, also an all-time record. Sales of Apple Watch were up sequentially and were ahead of expectations.

2:06 pm: Exited the quarter with demand for new iPhones exceeding the supply. Making good progress with manufacturing ramp. Sold 5.7 million Macs, defying negative trend in global personal computer market.

2:05 pm: Established a new launch record for iPhone 6s and 6s Plus.

2:05 pm: Ending on a high note with record-breaking September quarter.

2:04 pm: Protecting the environment, equality and human rights, and privacy.

2:04 pm: Completed 15 acquisitions.

2:04 pm: Apple Watch, and very early innings of this promising part of our business. $53 billion in net income, earnings per share up 43%. $50 billion returned to shareholders.

2:04 pm: New units records and increasing global market share for both iPhone and Mac. Crossed 100 billion cumulative downloads from the App Store. Added Apple Pay in US and UK, Apple Music in 100 countries, and Apple News in US.

2:03 pm: 300 million devices sold.

2:03 pm: Our growth in one year was greater than revenue of 90% of companies in Fortune 500.

2:03 pm: Completed fiscal year... revenue of $234 billion, up 28% and $51 billion over 2014. Largest absolute revenue growth ever.

2:02 pm: Today we're reporting a very strong finish to a record-breaking year.

2:02 pm: CEO Tim Cook speaking first.

2:01 pm: The earnings call is beginning.

1:45 pm: Conference call begins in roughly 15 minutes.