Less than one week before Apple's third quarter fiscal results are released on July 21 at 2:00 PM Pacific, multiple research firms and analysts have released earnings previews for the three-month period ending June 30. The consensus is that Apple will report another quarterly earnings beat based on stronger than expected iPhone sales and continued year-over-year growth in China.

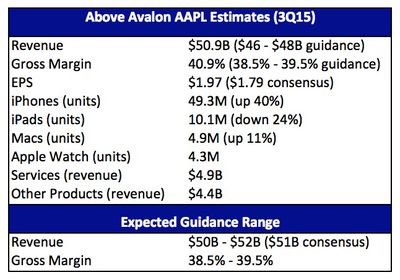

Apple provided third quarter guidance of revenue between $46 billion and $48 billion, gross margin between 38.5% and 39.5%, operating expenses between $5.65 billion and $5.75 billion and other expenses of $350 million, while the consensus among analysts was an EPS of $1.79. Apple is expected to beat both that guidance, which is purposefully conservative, and street expectations.

Wall Street and Silicon Valley analyst Neil Cybart published his 3Q15 earnings preview on Above Avalon, predicting Apple earned $50.9 billion revenue, with a gross margin of 40.9% and $1.97 earnings per share (EPS), based on sales of 49.3 million iPhones, 10.1 million iPads, 4.9 million Macs, 4.3 million Apple Watches and $9.3 billion from other products and services.

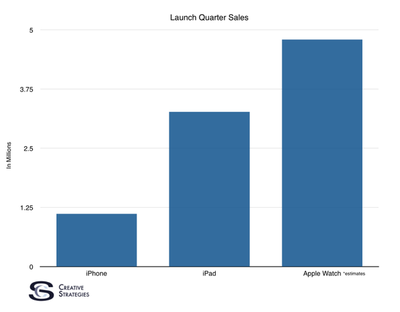

Creative Strategies principal analyst Ben Bajarin estimates that Apple Watch worldwide sales were 4.7 million during the June quarter, topping the roughly 1.1 million iPhones and 3.3 million iPads sold in their respective launch quarters. Bajarin's estimate is based on supply chain output tracked by his market research firm, and is 400,000 units higher than Above Avalon's estimate.

Apple has not publicly disclosed any official Apple Watch sales figures to date, and will be grouping the wrist-worn device under its "Other Products" category in quarterly earnings reports. The combined category includes sales of iPod, Apple TV, Beats Electronics and Apple-branded and third-party accessories, which will inevitably lead to predictions about how many Apple Watches make up the total units sold.

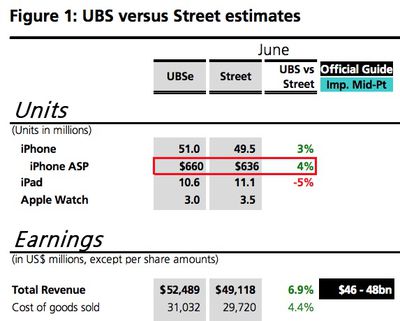

Investment banking company UBS also forecasts that Apple will have above-consensus earnings results based on a higher iPhone average selling price (ASP) estimate of $660 vs $636. The firm predicts Apple will report $52.5 billion revenue, with a gross margin of 40.9% and $2.00 EPS, based on sales of 51 million iPhones, 10.6 million iPads and 3 million Apple Watches.

RBC Capital Markets is more conservative with its estimates, expecting that Apple will report $49.3 billion revenue, with a gross margin of 39.3% and $1.78 EPS, based on sales of 46.5 million iPhones, 11.3 million iPads and 4.6 million Macs. The firm did not estimate Apple Watch sales and expects scrutiny from investors in regards to Apple's iPhone unit sales globally, but particularly in China.

MacRumors will provide live coverage of Apple's third quarter results on July 21.