As the end of the year approaches, Apple today slightly altered its micro site dedicated to Apple Pay to update the status of several of its partnerships. Retailers that teamed up with Apple and plan to implement Apple Pay support in retail stores and apps in the near future are now listed under sections labeled "Coming soon" instead of "Coming later this year."

The minor change in language suggests that many of Apple's Apple Pay partners will not be able to implement Apple Pay support in the last week of 2014, instead rolling out support in the first months of 2015. Many retailers that have chosen to implement Apple Pay may still be working to train employees, update hardware, and swap out point-of-sale systems, leading to variable launch dates.

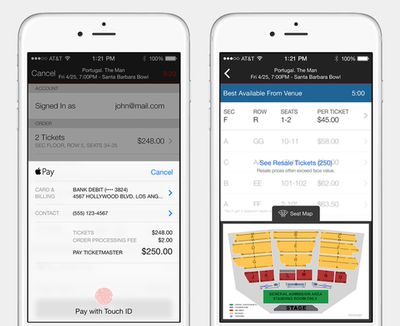

Just in the last few weeks, multiple partners who were initially listed under the "Coming later this year" category managed to implement support before the end of the year deadline, including Walt Disney World, which will begin accepting Apple Pay later this week, and Ticketmaster, which updated its app to support Apple Pay on Monday.

On Apple's site, retail partners listed under the "Coming soon" headings now include ACME, Albertsons, Anthropologie, Free People, and Urban Outfitters. Walt Disney World continues to be listed, as Apple Pay will not be available until December 24. Upcoming app partners include Starbucks, StubHub, and Tickets.com, with Ticketmaster continuing to be listed despite implementing support earlier this week.

Since its October 20 launch, Apple Pay has proven to be popular with iPhone 6 and 6 Plus users. Despite only being available for six weeks, Apple Pay was responsible for 1 percent of digital payment dollars in November, with the most money being spent at Whole Foods, Walgreens, and McDonald's.

Apple Pay is currently limited to the United States, but according to comments from Visa and a recent job posting, Apple has an Apple Pay team in London working on bringing the payments service to new countries in 2015.

Top Rated Comments

----------

When you say luxury, it seems you really mean discipline. The prepaid card forces you to not spend more than you have, but you could do the same with a credit card too. Some of the credit cards actually pay you for borrowing money from them for free. That deal is pretty hard to beat. The prepaid card does just the opposite. You are loaning the bank your money for free.

Target, Kroger, and CVS have NFC terminals that support.

They just insist on denying secure payments, in order to stock piling information on your purchases, for their internal algorithms and such.

It's the only explanation. They have the hardware and software links in place.

It worked, and they disabled it.

http://www.ibtimes.com/cvs-rite-aid-baffle-payments-industry-decisions-block-nfc-apple-pay-1714093

Because storing those one time use tokens does nothing for their internal tracking algorithms.

See below. I'm not 'conspiracy-theory' this is bad, horrible. I've used credit/debit cards for ages, known this, and accept it.

But for a store to intentionally sacrifice their customers security... should be criminal. Or grounds for VISA/MC to terminate agreements.

http://www.theguardian.com/money/2013/jun/08/supermarkets-get-your-data

For Albertsons in particular this is a huge job and it's difficult to implement a change of this scope during the Christmas holidays. If you think of 10-20 terminals including self service and service counter at every store multiplied by the number of stores that's a lot of terminals.

Albertsons will become my grocery store of choice when this is completed. I check in once a month to my local one and chat with the clerks to gauge progress. Probably due for a repeat visit.

And that choice will pay off... NOT

CurrentC hasn't even been formally launched yet and it's already antiquated. QR codes.... really? I'm sure the folks at MCX were excited about developing CurrentC... but I'm guessing they got their teeth kicked in when Apple announced ApplePay.

Now the stores who made the deal with CurrentC have to live with that for a while... or face penalty. I wonder if any of them regret their decision already?

2015 will be the year CurrentC launches. Let them have their experiment. But I'm curious as to how many stores will solely use CurrentC in 2016 and beyond.

As stated above. As part of the MCX consortium developing the Invisiware known as CurrentC (in Private Beta, Area 51?). They choose not to enable secure payments. CurrentC is a payment method based on direct ACH transfers from your bank account tied to loyalty programs that will reduce merchants fees.

If you trust your bank account info to Target, Neiman Marcus, Michaels I have some ocean front property in Arizona I'd like to sell you.

This is also true of MCX merchants, 7-11, Best Buy, Circle K, Conoco, Sears that I have seen personally have NFC enabled terminals but deny ApplePay, Google Wallet. Rite-Aid and CVS are also on the list. Even some merchants that are listed on the Mastercard Nearby App which are contractually obligated to support SoftCard have turned them off.

Is it anti-competitive, yes. Is it aiding and abetting hackers. Yes by expanding their potential profit. Is it exposing them to additional liability if they get hacked. Absolutely. I would love to be on the jury where they explain this. I'd bring popcorn.

I have seen a law firm pursuing a class-action lawsuit. And I hope they are successful. Or CurrentC gets 0 traction and they just turn on NFC. They are supposed to turn on ChipAndPin credit card capability by October of 2015 so hopefully the wait won't be too long. Since Apple Pay is pretty much based on ChipAndPin with a fingerprint replacing the Pin, it should be an automatic feature.