Apple's growth in the overall worldwide smartphone market continues to slow as it loses ground to smaller Chinese vendors releasing more affordable devices, even as the smartphone market itself grows substantially.

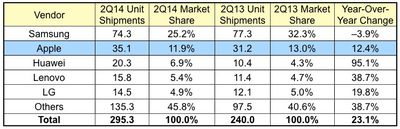

According to IDC's latest estimates, worldwide smartphone sales for the second quarter of 2014 grew 23.1 percent year-over year as smartphones continue to replace feature phones, with a record quarter of 295.3 million shipments.

Apple shipped 35.1 million iPhones during the quarter, up from 31.2 million during Q2 2013, for a share of 11.9 percent, a slight drop from its 13 percent share in the year-ago quarter. The company's growth was at just 12.4 percent.

Samsung, the vendor that has long held the top spot with the most smartphone shipments, fared even worse during the quarter, with estimated shipments of 74.3 million for a 25.2 percent share of the market, down from 32.3 percent in Q2 2013, and overall growth of -3.9 percent.

Smaller Chinese vendors like Huawei and Lenovo continue to see significant growth, with Huawei shipping 20.3 million smartphones during the quarter for a 6.9 percent share and growth of 95.1 percent, while Lenovo shipped 15.8 million smartphones for 5.4 percent market share and growth of 38.7 percent.

Despite a challenging quarter for Samsung, and to a lesser extent Apple, the strong market demand boosted results for most smartphone vendors. Emerging markets supported by local vendors are continuing to act as the main catalyst for smartphone growth. Among the top vendors in the market, a wide range of Chinese OEMs more than outpaced the market in 2Q14. By far the most impressive was Huawei, nearly doubling its shipments from a year ago, followed by another strong performance from Lenovo.

As noted by IDC, Apple's second quarter is typically its seasonal low of the year due to its release schedule. Apple may see significant growth later in 2014 as it gears up to release the iPhone 6, meeting consumer demand for a larger-screened device for the first time.

Apple has also made efforts towards releasing low-cost devices in BRIC (Brazil, Russia, India, China) markets that are ripe for growth, but it is difficult for the company to keep up with the myriad low-cost devices coming from manufacturers like Lenovo and Huawei in those markets.