The 10% drop in Apple's share value following the company's earnings release earlier this week was not entirely the fault of Apple, Fortune suggests, but rather that of overheated analyst predictions.

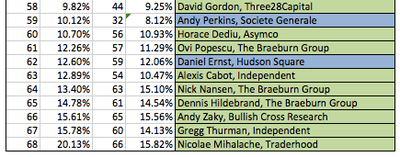

Fortune assessed the accuracy of the predictions made by 68 analysts, and found that revenue figures ranged from $51.7 billion to $65.69 billion against Apple's actual performance of $54.51 billion. It produced a ranking of the analysts by the percentage errors in their predictions for both revenue and earnings per share, as well as overall performance metrics.

The analysts responsible for the sometimes wildly optimistic forecasts were not, said Fortune, doing Apple any favors.

The company didn't have a bad quarter. In fact, it posted its best quarter ever … But the stock market is an expectations game and Apple is expected to blow past analysts' estimates, not miss them.

The Fortune piece wryly observed that 'another way of looking at it is that Apple's analysts did worse than the company this quarter.'

Going forward, Apple has altered the way in which it provides guidance for upcoming quarterly performances. While the company had previously issued single "conservative" guidance estimates for both revenue and earnings that led to the expectation that Apple would always handily beat that number, it is now providing a range of guidance numbers for revenue and other factors.

Apple believes that the range will provide a more realistic idea of where the company expects performance to fall, although it is no longer providing any specific earnings per share guidance and instead allowing analysts to develop their own numbers based on the ranges of revenue, margin, expenses, and tax rate the company expects.

Top Rated Comments

Dear analysts,

Shut the hell up!

Sincerely,

Fortune

It's always the same. In the weeks before the product launch, the rumors start flying. The new product will have a brand new design! It'll be thinner! Lighter! With twice the power! And there will be a price drop! And a spec bump across the line! The whole line-up will be updated! No, replaced! No, this is going to be the start of a brand new product category! Here are some product mockups. Here's what these could look like!

Then the discussion starts flying. "Here's what I'd like to see!" People start predicting entire product lines, including estimated pricing, and start drooling about how awesome it's all going to be.

Then the product announcement happens. It's a new version number with a reasonable spec bump. The form factor is the same as last year's model but the price drops slightly. It's a competitive upgrade, but nothing revolutionary.

And then the complaining starts... What happened to the revolutionary new design? What happened to the brand new product line? We're so disappointed!

Nothing "happened to it". You guys made it all up in the first place. There's no way those expectations could ever have been met.

Every. Single. Time.

Exactly. These analysts set an impossible-to-meet target and then cause the stock to plummet. That's why I hate these m**********rs.

Having worked as an equity research analyst, I can tell you all of the worst offenders shown here are not real analysts and give the profession a bad name.

Traderhood: Seems to be some dodgy forum for people who are long APPL. No idea how they're getting published like they're official.

Gregg Thurman: Independent, says it all. No real clients to answer to so no pressure to get calls right. Almost definitely long AAPL based on his SeekingAlpha posting history and so clearly adds up to being mega-bullish when he can. He also has a thread of MacObserver where he guesses where AAPL will go based on historical trend data - seems legit?! :rolleyes:

Bullish Cross Research: So just a random blog, with the first title I spot being 'Apple $1000: why it's time to buy'. Scanning through, it's more of the same. I seriously don't get how they get treated like they're official!

Braeburn Group: Familiar as repeat offenders every time when it comes to AAPL estimates. Basically a group of people long AAPL (they disclose this) grouping together to write pro-AAPL stuff. Their current price target is 85% above todays stock price.

Alexis Cabot: Again independent, same story.

Asymco: Based on his twitter, looks like he's stopping making estimates. Convenient.

etc. etc.

Overall it's all a bit of a mess. Getting forecasts right is like throwing darts blindfolded. The old status quo was everyone on the buy-side held AAPL and so the sell-side made bullish reports to please their clients. Apple gave conservative estimates which they then of course beat, stock goes up, everyone happy. Basically Apple have now said this will no longer be the case, so hopefully we'll see accuracy improve and ensure the long-AAPL independents can no longer be praised and given media attention when their above consensus estimates come in.